Bitcoin (BTC) re-emerged above the $50,000 barrier today as millions of dollars worth of short positions got liquidated. Data from TradingView showed that the benchmark cryptocurrency touched the $50,400 level, its highest mark since August 23.

BTC/USD finally mustered the strength to leave its lower trading range of the past weeks following an overnight rally. Analysts peg the $51,000 mark as the level to beat for a continuation of the 2021 bull run. However, due to the heavy resistance at that level, bulls have failed to secure a footing near that level despite two trials within the last two months.

Meanwhile, reports show that the recent rally cleared several short trades. Sellers have lost close to half a billion dollars over the past 24 hours.

Historically, September is a “boring” month for Bitcoin. However, with the 6% rally seen in the past 24 hours, BTC has recorded its best September performance on record.

That said, prominent on-chain analyst Plan B notes that the “worst-case scenario” for the primary cryptocurrency this month is $43,000. The analyst’s $47,000 monthly close prediction for August was correct. Furthermore, Plan B notes that the minimum close for August is $68,000.

Key Bitcoin Levels to Watch — September 2

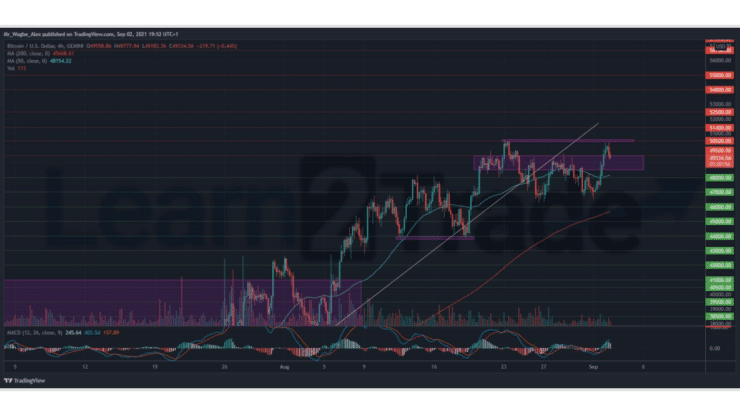

Following its recent boom near the $50,500 resistance, BTC has fallen to the edge of the $49,500 – $48,500 pivot zone, as it trades at $49,500. Bulls need to defend this pivot point over the coming hours to cement its footing around the $50,000 psychological level.

Trading conditions are far from overstretched situations indicating that bulls have enough room to push towards the pivotal $51,000 mark. Failure to hold above this pivot level could undo the gains of the previous bull and push prices towards $45,000.

Meanwhile, our resistance levels are at $50,000, $50,500, and $51,000, and our key support levels are at $48,500, $47,000, and $46,000.

Total Market Capitalization: $2.22 trillion

Bitcoin Market Capitalization: $927.6 billion

Bitcoin Dominance: 41.8%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.