While Bitcoin (BTC) continues to struggle below the $50,000 mark, reports show that the network has recorded significant transaction volume.

On-chain analytics provider Glassnode recently revealed that the weekly transaction volume on the BTC network has surged to a record high, while the number of token holders steadily recovers. According to the report, the average weekly transaction volume peaked at a record high of over $8 billion. The report showed that this figure is 50% higher than the previous record.

Worthy of notice, though, is that this figure does not emanate directly from regular transfers. Also, additional data showed that the Entity Adjusted Transfer Volume in USD fails to reflect a similar increase as the previously mentioned figure.

That said, the most likely reason behind this difference is that the spike emanated from internal transfers, which the mempool supports.

Meanwhile, Glassnode revealed that the number of Bitcoin holders increases steadily following the recent crash. Reports show that retail investors gravitate towards the market during significant price pumps and flee when it slumps. As a result, the total number of BTC wallets holding one or below one BTC dipped following the mid-May correction.

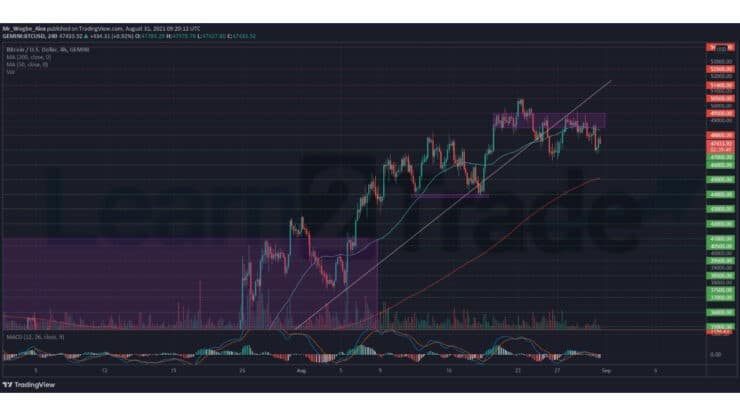

Key Bitcoin Levels to Watch — August 31

BTCUSD suffered a sharp overnight dip as bulls failed to reclaim the $49,000 level. The benchmark cryptocurrency bottomed at $46,700 before posting a rebound towards the $48,000 mark.

However, bulls remain lacking in strength to follow up rebounds as price stalls below $48,000. If bulls continue with this weak action, we could see a bearish reemergence to the lower-$46,000 area. That said, a break above the $48,000 mark in the near term could stall a bearish move and help bulls gather strength to push the price higher.

Meanwhile, our resistance levels are at $48,000, $49,500, and $50,500, and our key support levels are at $47,000, $46,000, and $45,000.

Total Market Capitalization: $2.09 trillion

Bitcoin Market Capitalization: $893 billion

Bitcoin Dominance: 42.7%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.