While many environmentalists worry over the energy consumption rate of Bitcoin (BTC), new reports reveal that the network has consumed more power this year than the whole of 2020.

The new, report curated by Bloomberg, noted that “the network reportedly consumed about 67TWh of electricity in 2020, and its total consumption has already surpassed this in 2021.” The report predicted that Bitcoin could consume 91 TWh of electricity, higher than the yearly electricity consumption of Pakistan, by the end of the year. Other forecasts peg this number at 95 TWh.

However, Bloomberg noted that this projection is subject to fluctuations. The recent clampdown on BTC mining in China took a heavy toll on the network’s hash power. This clampdown pushed BTC hash power from a high of 141 TWh in May to 68 TWh in June.

Increased electricity consumption is a common occurrence whenever the price of BTC surges. Bitcoin mining, the most energy-intensive activity on the network, rewards miners who consume the most energy with new coins. That said, the report highlights that mining becomes a more profitable venture as BTC price increases, which causes the network to consume more energy.

Key Bitcoin Levels to Watch — September 19

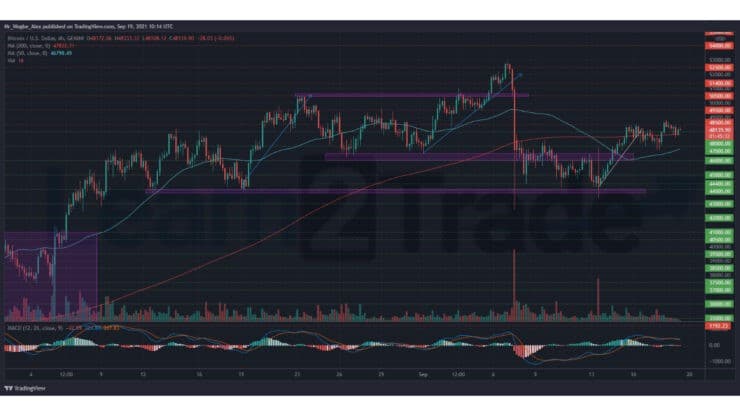

The primary cryptocurrency recently suffered a sharp rejection near the $49,000 line, following a healthy bullish move from the $46,700 low. As we mentioned in an older analysis, a break towards the $48,000 area could help BTC negate the recent formation of a bearish golden cross. This projection has come to fruition as the golden cross pattern takes a bullish turn with BTC above $48,000.

That said, the flagship cryptocurrency retains its bullish outlook despite the recent correction, as the 200 SMA restricts any further declines. We expect a bullish continuation over the coming hours and days towards $50,000, as buyers get moralized once again.

Meanwhile, our resistance levels are at $48,500, $49,500, and $50,000, and our key support levels are at $47,600, $47,000, and $46,000.

Total Market Capitalization: $2.31 trillion

Bitcoin Market Capitalization: $900 billion

Bitcoin Dominance: 42.3%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.