Bitcoin (BTC) suffered a >8% crash on Tuesday, despite previously recording a successful network upgrade. The primary cryptocurrency bottomed at the $59,000 low earlier today, effectively erasing all the gains recorded in November. Additionally, BTC has dropped by 11.75% over the last seven days from a record high of $69,000 on November 10.

Meanwhile, the world’s-largest altcoin Ethereum also suffered a significant loss today and has dropped by 11.8% towards $4,200.

Many analysts have expressed their bafflement as there seems to be no news driving the declines. However, the bearish correction appears to emanate from profit-taking across the market, following the recent bull rally.

Commenting on the rattling development, chief operating officer at Singapore-based Stack Funds Matthew Dibb noted that:

“There is a lack of news, and this is some pure selling of spot and some additions of short selling. Outside of this, there is no significant news.”

Interestingly, Bitcoin has more than doubled its value since June, thanks to increased mainstream adoption of cryptos and the recent launch of futures-based BTC exchange-traded funds (ETFs) in the US.

Also, Bitcoin’s network recorded a significant upgrade, dubbed Taproot, last Sunday. The upgrade allows the network to facilitate and execute more complex transactions, thereby increasing the potential use cases of BTC and making it a little competitive with Ethereum and other Smart Contract-processing blockchains.

Key Bitcoin Levels to Watch — November 16

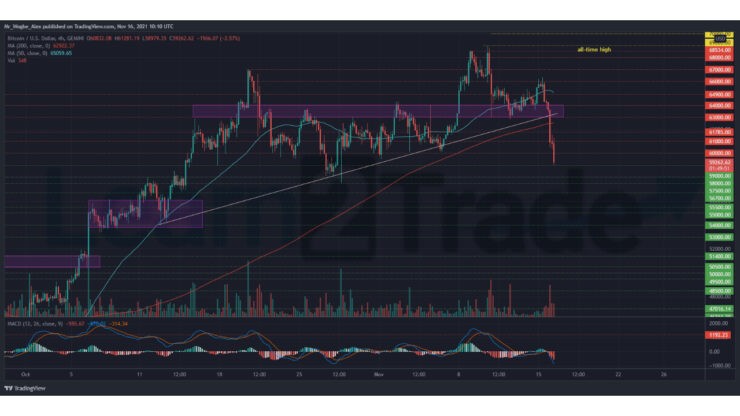

Bitcoin made a sharp U-turn beginning yesterday from the $66,340 top to the $64,000 – $63,000 pivot area. Considering the historical potency of this support area, I expected to see a rebound to the $64,900 resistance.

However, bears had other plans and drove prices significantly lower within a short period. While the bearish pressure has eased currently, I expect to see a continuation to the $58,000 area followed by a slow and steady bullish retrace to the $63,000 pivot zone.

Meanwhile, my resistance levels are at $61,000, $61,785, and $63,000, and my key support levels are at $59,000, $58,000, and $57,500.

Total Market Capitalization: $2.61 trillion

Bitcoin Market Capitalization: $1.13 trillion

Bitcoin Dominance: 43.1%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.