The United States Securities and Exchange Commission (SEC) has, yet again, rejected the spot Bitcoin (BTC) exchange-traded fund (ETF) presented by VanEck. This decision comes after several weeks of delayed approval on the product by the SEC.

VanEck has presented several spot BTC ETFs to the watchdog over the past several years but has had no success in courting their approval.

This comes after the SEC approved two futures-backed Bitcoin ETFs in October, one of which was VanEck’s Strategy ETF. Following this approval, many spectators believed that the Commission had become more open-minded to a spot BTC ETF. However, this has not been the case.

The SEC rejected the VanEck ETF filing last Friday and announced that it could not list its shares on the CBOE BZX Exchange.

The official document from the financial regulator read that:

“This order disapproves the proposed rule change. The Commission concludes that BZX has not met its burden under the Exchange Act.”

Also, the Commission noted that BZX and VanEck failed to address any of the previous hurdles preventing the approval of older ETFs, noting that they were “designed to prevent fraudulent and manipulative acts and practices” and “to protect investors and the public interest.”

Meanwhile, SEC Chairman Gary Gensler recently noted that a futures-based ETF is a safer option for investors, adding that this is why only such funds have scaled approval in the US.

Key Bitcoin Levels to Watch — November 14

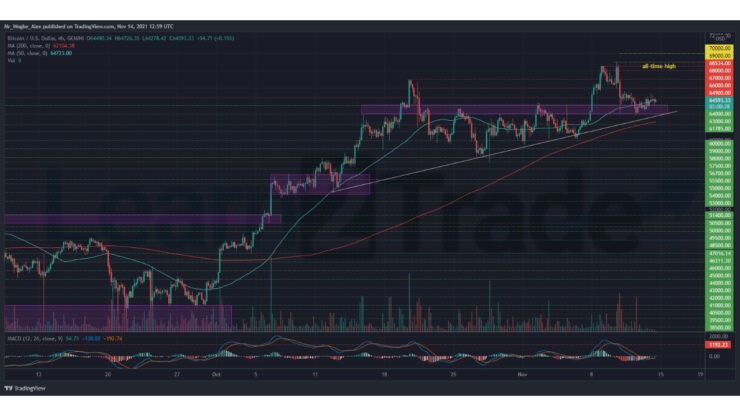

BTC regained a mild bullish tone on Sunday following a drop to the $63,000 pivot zone on the VanEck spot BTC ETF rejection by the SEC. The benchmark cryptocurrency now confirms the $63,000 level as the base of the current trend as bulls prepare to drive the price higher soon.

BTC has also completed a full retracement from above 1192.23 (overbought conditions) on my 4-hour MACD chart, further bolstering the possibility of a sharp bullish move in the near term. That said, our benchmark cryptocurrency needs a candle-close above the $65,000 mark to kickstart another bull run.

Meanwhile, my resistance levels are at $65,000, $66,000, and $67,000, and my key support levels are at $64,000, $63,000, and $62,000.

Total Market Capitalization: $2.83 trillion

Bitcoin Market Capitalization: $1.21 trillion

Bitcoin Dominance: 43.1%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.