As the cryptocurrency market and most of the equities market continues to plummet, the Bitcoin (BTC) Fear and Greed Index has slumped to alarmingly low levels. At press time, the Index has dropped to levels not seen since January, when the benchmark cryptocurrency traded at around $33,000.

So far, May has not turned out to be what many investors expected. Bitcoin jumped to the $40,000 area on May 4, following favorable comments from the FOMC meeting after the Fed noted that it would raise its rates by 0.50% instead of the expected 0.75%.

However, Bitcoin’s rally was short-lived as the benchmark cryptocurrency has rapidly slumped to the $34,000 region, a few points away from its yearly low.

Not surprisingly, this bearish turnaround was reflected in the overall market sentiment, as indicated by the Bitcoin Fear and Greed Index. While BTC has been in “fear” territory since April, the recent aggressive bearish push has sent it to “extreme fear” conditions. At press time, the Index is at a fear level of 18, not far from January lows.

Interestingly, on-chain analytics platform CryptoQuant recently revealed that this bearish rally has spooked whales into dumping their holdings, an uncommon sight. The platform detailed that whales are dumping at a higher rate than retail investors, sparking worries in the crypto community.

Key Bitcoin Levels to Watch — May 8

Bitcoin cannot seem to catch a break from the rain of bearish blows as the benchmark cryptocurrency slumped to the $34,300 low.

The bearish momentum comes as investors flee risky assets, like Bitcoin, for their safe-haven counterparts. This investor migration can be seen in the increased offloading of holding by BTC whales, according to a CryptoQuant report.

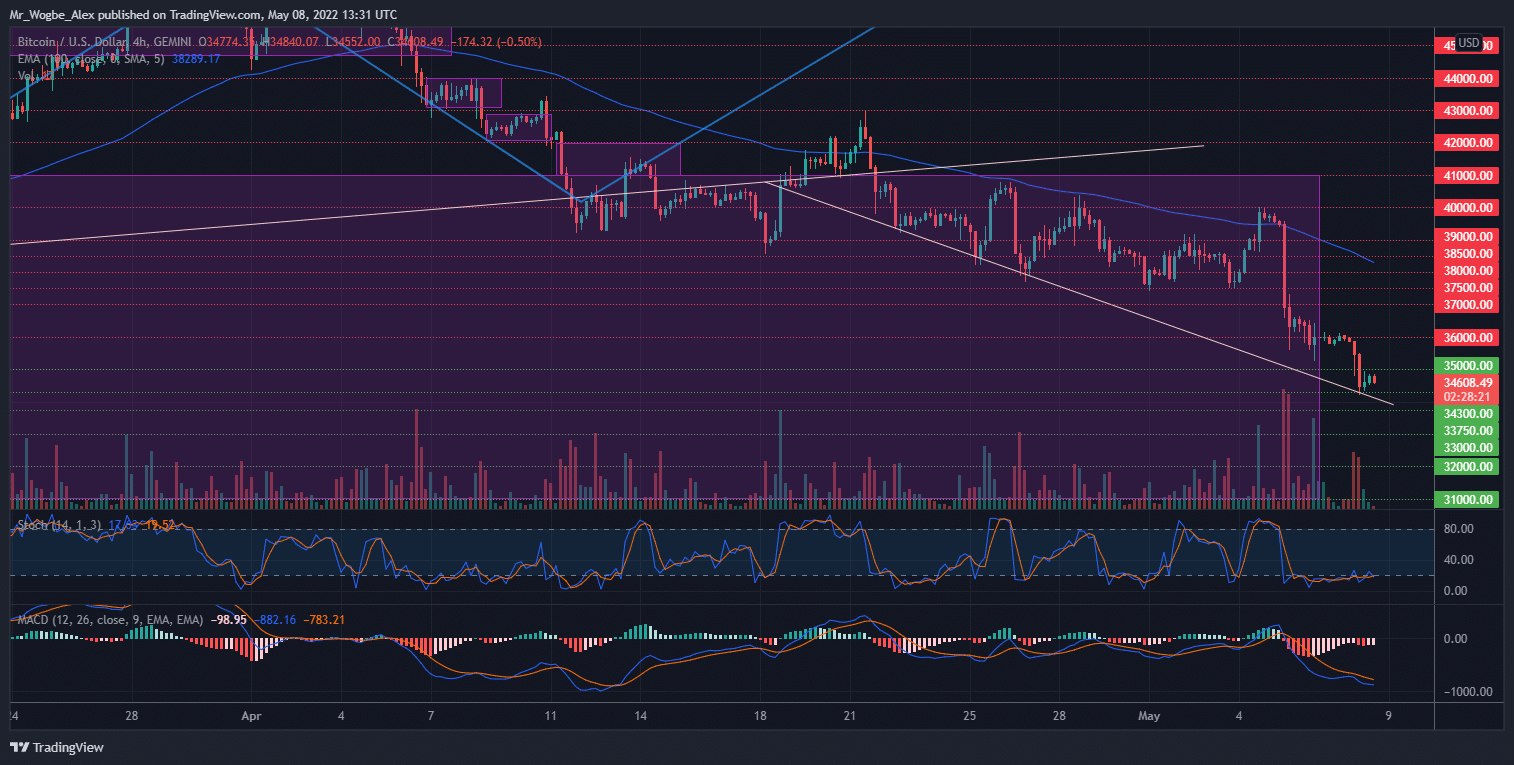

That said, a bearish push to the sub-$34,000 region in the coming days is increasingly likely, as bulls lose all foothold. This decline would align with my descending trendline on the 4-hour chart.

Meanwhile, my resistance levels are at $36,000, $37,000, and $38,000, and my key support levels are at $34,000, $33,000, and $32,000.

Total Market Capitalization: $1.58 trillion

Bitcoin Market Capitalization: $654.8 billion

Bitcoin Dominance: 41.5%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.