Bitcoin (BTC) continues to battle with an aggressive bearish sentiment, as the benchmark cryptocurrency refreshed its $29,000 low in the Asian session yesterday.

On-chain analytics provider Glassnode recently published a report that shows that BTC has traded lower for eight consecutive weeks so far, labeling it the longest “continuous string of red weekly candles in [BTC] history.”

The on-chain analytics platform revealed that during the recent market sell-off, the Bitcoin options implied volatility recorded a massive surge. Glassnode explained:

“Short-dated at-the-money options saw IV more than double, from 50% to 110%, whilst 6-month dated option IV jumped to 75%. This is a break higher from what has been a long period of very low implied IV levels.”

Amid a raging bearish sentiment, the Bitcoin put options are said to retain solid preference into the end of Q2 2022. Over the last two weeks, the BTC put/call option ratio for open interest surged by 20%, from 50% to 70%. Glassnode suggests that this could be an indication that investors are getting ready to hedge further downside risks.

By the end of Q2, the market will see solid out options with strike prices of $25,000, $20,000, and $15,000. However, the longer-term options (end of 2022) paint a significantly bullish projection for BTC. Glassnode revealed:

“There is a clear preference for call options with a concentration around strike prices of $70k to $100k. Furthermore, the dominant put option strike prices are at $25k and $30k, which are at higher price levels than the mid-year.”

Key Bitcoin Levels to Watch — May 24

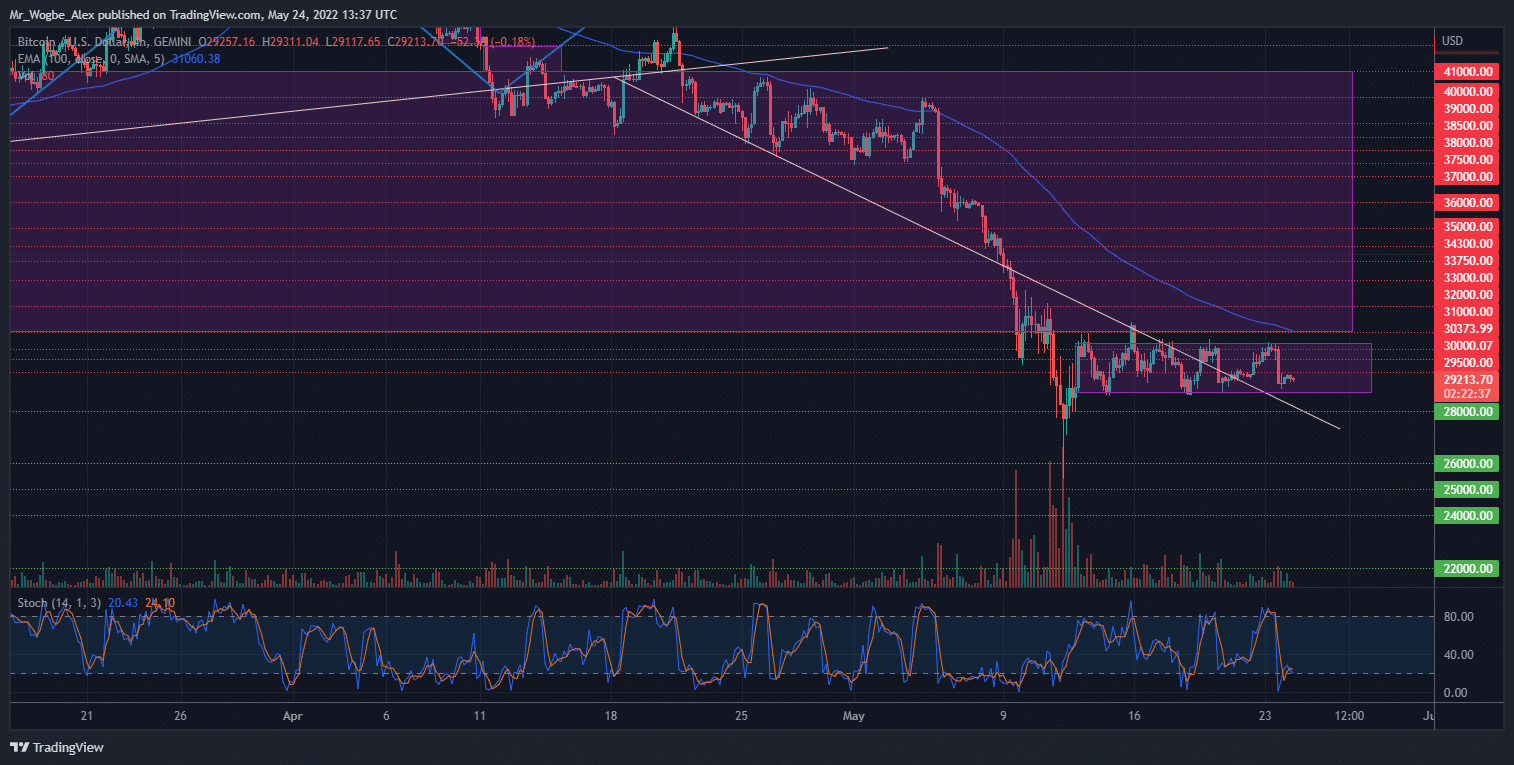

Bitcoin has again confirmed its range-bound channel between $30,600 and $28,700 after a sharp rejection from the former yesterday. BTC suffered a 5.8% dump after tapping the $30,626 channel top yesterday.

This would be the third-consecutive rejection from that top, forming a triple top for BTC. That said, we could witness a bearish continuation to the $28,700 base over the coming hours amid a depressed trading volume. A fall to this mark could finally propel BTC into the $31,000 pivot zone and higher over the coming days.

However, a breach of the stated bottom could be fatal for the flagship cryptocurrency, as it could send it spiraling towards 2020 lows.

Meanwhile, my resistance levels are at $30,000, $30,600, and $31,000, and my key support levels are at $29,000, $28,700, and $28,000.

Total Market Capitalization: $1.25 trillion

Bitcoin Market Capitalization: $555.8 billion

Bitcoin Dominance: 44.3%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.