The cryptocurrency market suffered another bearish blow in the last 24 hours, as Bitcoin (BTC) dropped below the $29,000 low again and Ethereum below the $2,000 mark. The renewed bearish sentiment comes amid a sharp decline in the stock market, as stock indexes fall to yearly lows.

Wall Street suffered a negative trading session yesterday, as the S&P 500 (SPX), Dow Jones Industrial Average (US30), and Nasdaq Composite (IXIC) all recorded massive declines with -4.04%, -3.84%, and -4.73%, respectively.

Target stocks suffered the most losses yesterday following a 24.93% drop. This crash came after the company announced that its logistics had been disrupted by higher freight, wage, and fuel costs.

Due to the increasing correlation between Bitcoin and the stock markets, the benchmark cryptocurrency recorded a 5.73% drop, tapping the $28,600 low. This was the cryptocurrency’s first breach below the $29,000 mark since the Terra-induced crash last week.

However, the cryptocurrency appears to be on a recovery path from yesterday’s drop as it trades at $29,400 or +2.7%. Regardless, many experts still believe more declines await Bitcoin ahead.

Finally, most altcoins also took a plunge due to the inter-crypto correction. Ultimately, yesterday’s decline swept $84.5 billion (6.5%)off the valuation of the total market.

Key Bitcoin Levels to Watch — May 19

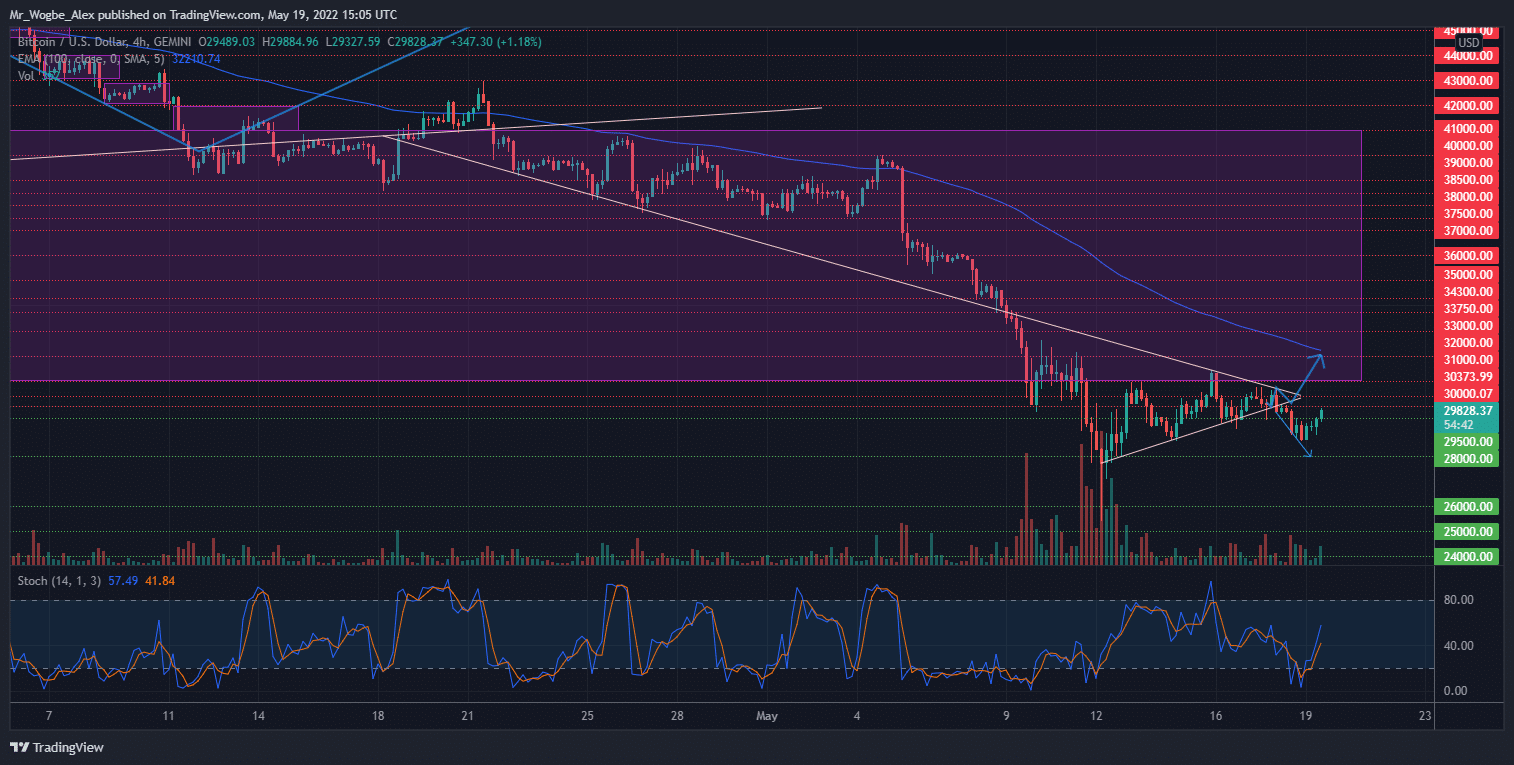

After slipping below the $29,000 support yesterday, Bitcoin rebounded near the $30,000 mark on Thursday amid a positive open to the stock market. The primary barrier BTC needs to scale to put some momentum behind it is the $31,000 pivot base.

That said, I expect to see a momentum continuation in the near term as bulls hunt the $31,000 barrier. A sustained push above the $31,000 level should spark a rally towards the $33,000, putting more lines and technical support behind it.

Meanwhile, my resistance levels are at $30,000, $31,000, and $32,000, and my key support levels are at $29,000, $28,000, and $27,000.

Total Market Capitalization: $1.26 trillion

Bitcoin Market Capitalization: $566.5 billion

Bitcoin Dominance: 44.8%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.