Recent reports show that China accounts for 21% of the total global Bitcoin (BTC) hash power output despite an all-out ban on cryptocurrency operations in the country last year.

The report from the Cambridge Bitcoin Electricity Consumption Index (CBECI) revealed that China was the second-largest Bitcoin hash power provider as of January this year after the Chinese government launched an offensive against the local crypto industry months ago.

The CBECI report noted that China provided 21.1% of the total global BTC hashrate in early 2022 behind the US, which accounted for 37.8% of the total hash rate as of January.

Before the ban, China was the largest single provider of Bitcoin hashing power, with the local hashrate at over 75% in 2019. That said, the hashrate slumped to zero between July and August 2021 after the Chinese government’s aggressive clampdown on the crypto mining industry. However, by September, the country’s hashrate had surged to 22.3% and has remained above the 18% mark since then.

Commenting on the findings, CBECI project lead Alexander Neumueller explained that the data shows that Bitcoin mining is still ongoing in the Asian nation, noting:

“Our data empirically confirms the claims of industry insiders that Bitcoin mining is still ongoing within the country. Although mining in China is far from its former heights, the country still seems to host about one-fifth of the total hash rate.”

Key Bitcoin Levels to Watch — May 17

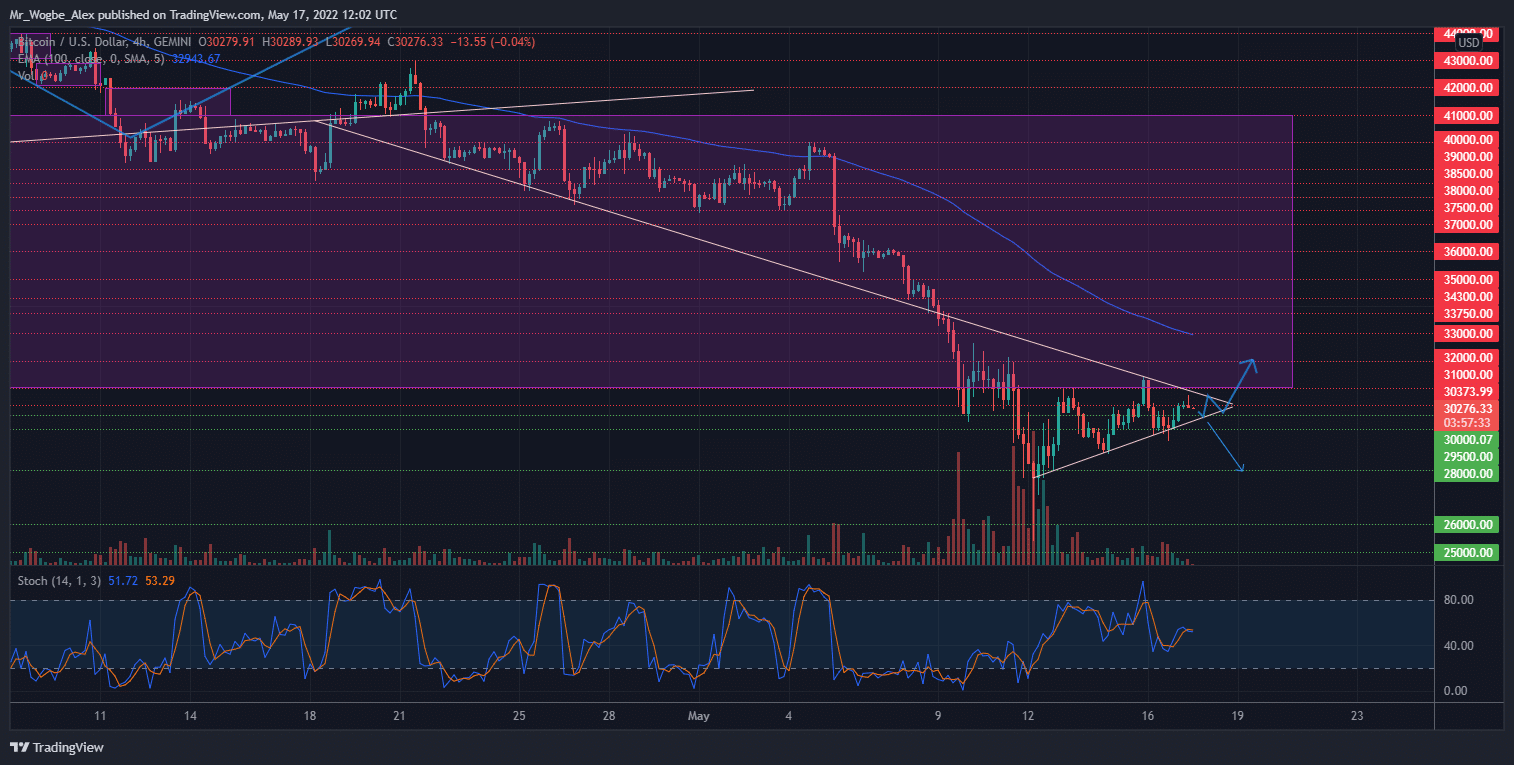

Bitcoin continues to hold along the $30,000 psychological mark despite attempts by bears to send prices lower. This is a good sign for bulls as it suggests that the market could record a bullish wave that would send it to the $33,000 level in the near term. A move in this direction should rescue BTC and the broader market from the brewing crypto winter.

However, the possibility of rejection from the $31,000 pivot bottom still exists and could refresh a slump to the $28,000 support area. With the market shifting focus from the LUNA situation, a crypto recovery could erupt soon. However, with the increasingly aggressive central bank outlooks, riskier assets could continue to stumble into Q3.

Meanwhile, my resistance levels are at $31,000, $32,000, and $33,000, and my key support levels are at $29,000, $28,000, and $27,000.

Total Market Capitalization: $1.30 trillion

Bitcoin Market Capitalization: $577.3 billion

Bitcoin Dominance: 44.2%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.