Bitcoin (BTC) has reacted positively, surprisingly, to the US Federal Reserve’s recent rate hike, as the benchmark cryptocurrency tapped $41,470.

The US Fed raised its interest rate to 0.50%, its first rate hike in four years. The Fed’s decision comes after the Bank of England (BoE) raised rates by 25 basis points (bps) along with market expectations.

The benchmark cryptocurrency currently trades at the $41,100 area on Gemini, after paring all the losses realized immediately after the rate hike announcement.

That said, the Fed is under intense pressure to keep consumer prices in stable conditions as inflation continues to climb.

Risk-related assets like Bitcoin enjoyed a wealth of stimulus from the central bank’s aggressive pandemic-era easing measures. However, the apex bank alongside many other central banks is now tapering support to stabilize inflation.

At yesterday’s press conference, Fed Chair Jerome Powell noted that the financial institution would cut down its balance sheet at the upcoming Federal Open Market Committee (FOMC). However, the Fed has yet to give a timeline.

Powell noted that the Fed was aware of the risks of a persistent climb in inflation, adding that the institution plans to “steadily” raise interest rates throughout 2022, indicating an ultra-hawkish stance.

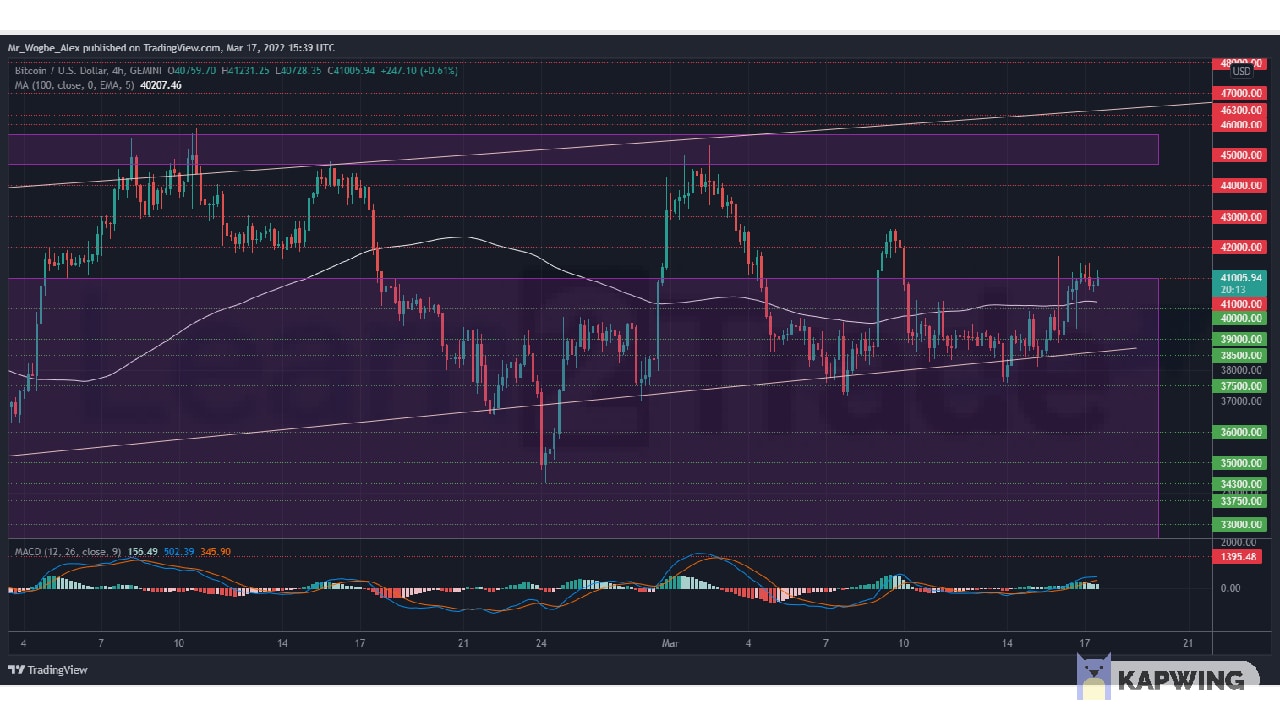

Key Bitcoin Levels to Watch — March 17

BTC has fought its way back to the $41,000 pivot top, as the flagship cryptocurrency becomes bullish again with a cross above the 4-hour 100 EMA. This move brings the cryptocurrency a step closer to securing the $50,000 target for March.

That said, BTC should break the $41,000 pivot top over the weekend, where buyers should foster more bullish momentum. However, we could see a minor correction to the $40,000 area in the near term. Regardless, the prevailing sentiment remains strongly bullish and should remain so in the medium term.

Meanwhile, my resistance levels are at $40,100, $42,000, and $43,000, and my key support levels are at $40,000, $39,000, and $38,500.

Total Market Capitalization: $1.83 trillion

Bitcoin Market Capitalization: $757.7 billion

Bitcoin Dominance: 42.4%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.