Following a difficulty plunge to 1.49% to the 169 EH/s area two weeks ago, Bitcoin (BTC) has seen its hashrate jump by over 15% ever since, as the network hashrate hovers over 200 exahash per second (EH/s).

On March 3, Bitcoin’s difficulty dropped by 1.49% after six consecutive upward difficulty adjustments. At press time, the network’s mining difficulty is 27.55 trillion as processing power improves.

That said, Bitcoin has now increased by over 15% since the difficulty adjustment and 29% since its hashrate touched 169 EH/s in early March. As mentioned earlier, Bitcoin’s processing power hovers over the 200 EH/s range at 218.11 EH/s. The next mining difficulty adjustment is set to occur in the next four days, with analysts predicting a 1.03% rise.

Meanwhile, a three-day hashrate distribution data shows that Foundry USA has recorded the lost mining activity in the last 72 hours. The American-based mining pool boasts a dedicated mining capacity of 42.42 EH/s, which translates to 21.19% of the current hashrate.

Coming in second place in the last three days is F2pool with 30.93 EH/s dedicated to mining BTC, which translates to 15.45% is the current global hashrate. Current reports show that 11 known mining pools are dedicating SHA256 hash power towards the BTC network.

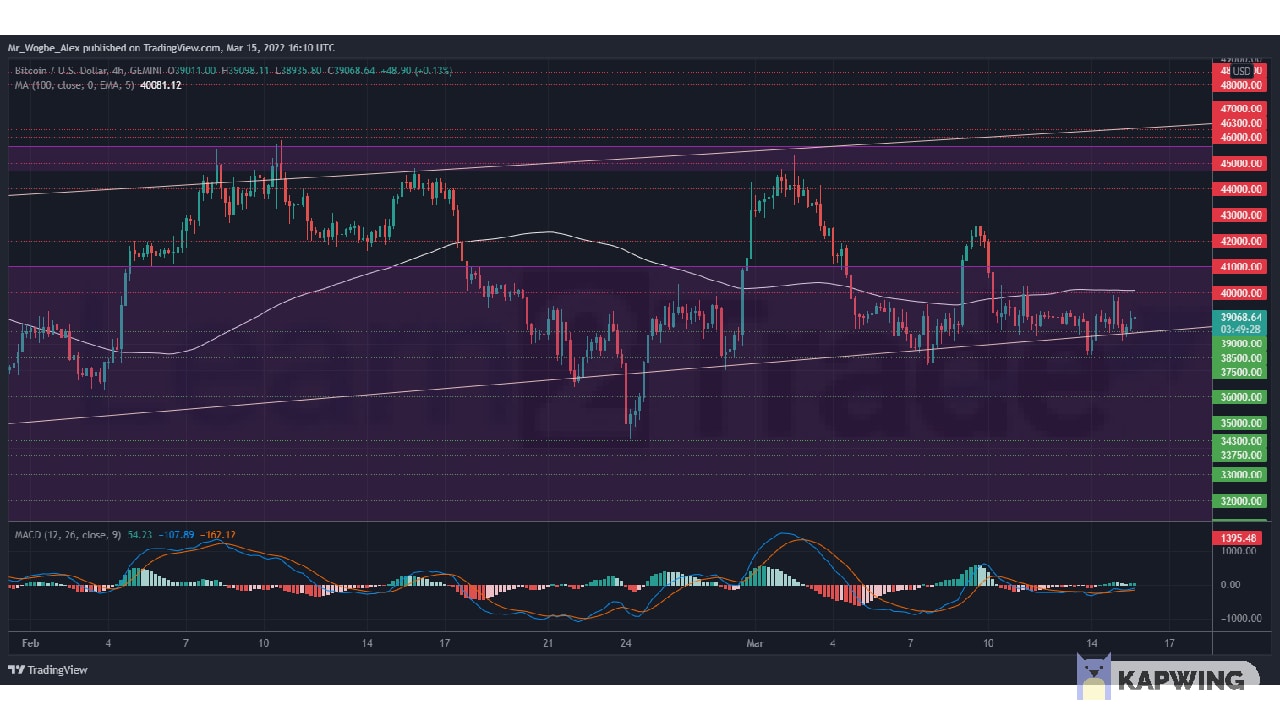

Key Bitcoin Levels to Watch — March 15

Bitcoin continues to show an aggressive refusal to sustain a slip below the $38,000 support as it clings to my multi-week-long ascending trendline. The key level for bulls to beat in the near term is the $40,000 top, where the 4-hour 100 EMA resides. The primary cryptocurrency recorded a goodish bounce off the trendline earlier today and has maintained a mild bullish tone ever since.

However, trading volume, and thus market momentum, appears to be on the low side as market participants move to the sidelines ahead of the two-day US Fed policy meeting commencing tomorrow. That said, traders will likely take cues from the event for near-term trading bias.

Meanwhile, my resistance levels are at $40,000, $41,000, and $42,000, and my key support levels are at $38,500, $37,500, and $36,000.

Total Market Capitalization: $1.74 trillion

Bitcoin Market Capitalization: $743.5 billion

Bitcoin Dominance: 42.6%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.