Recent reports show that the supply of Bitcoin (BTC) on cryptocurrency exchanges has depleted significantly over the last few days. CryptoQuant reported that the total supply of coins on exchanges today has dropped to 2.32 million BTC, the lowest amount in over three years.

The total number of BTC on trading platforms in March 2019 was 2.73 million coins. Also, the day after the infamous “Black Thursday” on March 10, 2020, crypto exchanges held a little over three million BTC, according to data from CryptoQuant.

Over the last few weeks, crypto prices have plummeted, surprisingly, alongside the exchange balance. Data shows that as of today, Coinbase holds the highest number of BTC with 853,530 BTC, according to Bituniverse.

After Coinbase is Binance with the second-highest Bitcoin balance holding 340,000 BTC, according to the Bituniverse metric. The platform also revealed that Binance holds 3.59 million ETH and 1.24 million Tether.

Behind Coinbase’s $44.5 billion asset holding and the stockpiles of Binance comes Huobi with a $16.12 billion crypto reserve. The metric reported that Huobi held 160,000 BTC and 2.13 million Ethereum.

A low crypto balance on trading platforms is seen as a bullish sign, as it indicates that investors and traders are unwilling to part with their stash.

Key Bitcoin Levels to Watch — March 13

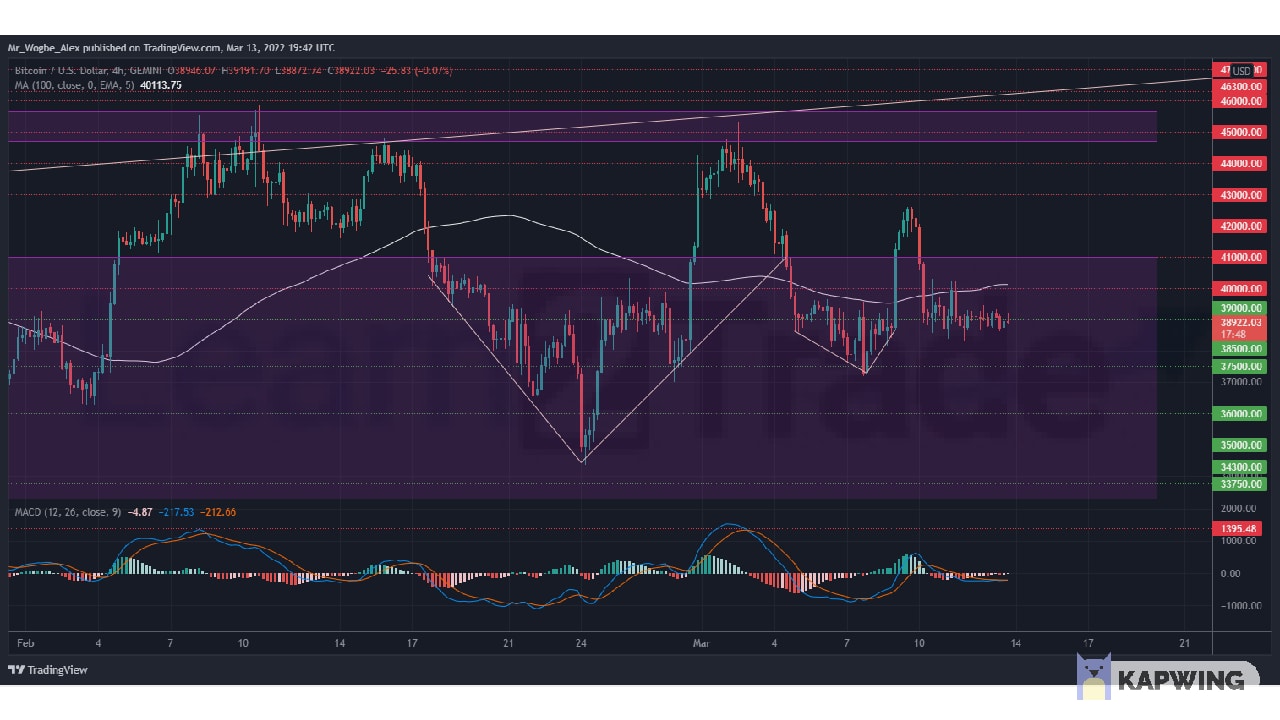

BTC remained restricted around $39,000 through the weekend as the benchmark cryptocurrency whipsawed between $38,500 and $39,400. This trading activity comes following an attempt at the $40,000 psychological mark on Friday, which was swiftly met by sellers who kept the price on a backfoot behind the $39,000 line.

That said, the crucial near-term level to beat is the $40,000 resistance where my 4-hour 100 EMA resides. Until we record a jump above that line, the appropriate sentiment to view BTC with is bearish.

Meanwhile, my resistance levels are at $40,000, $41,000, and $42,000, and my key support levels are at $38,500, $37,500, and $36,000.

Total Market Capitalization: $1.74 trillion

Bitcoin Market Capitalization: $740.6 billion

Bitcoin Dominance: 42.5%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.