Bitcoin (BTC) and the broader crypto market have undergone a roller coaster ride in the past 24 hours, leading to the liquidation of over $215 million within the same period.

The benchmark cryptocurrency recorded a sharp price surge above the $42,000 mark yesterday following the leak and eventual signing of the highly-anticipated digital asset executive order by US President Joe Biden.

The document release appears to have gone down well with the market, as it only highlighted worries already factored into the market and nothing else.

However, the benchmark cryptocurrency took a sharp turn late yesterday, as it plunged to the $39,000 mark. In dollar terms, the flagship cryptocurrency shed over $3,500, or -8% within the last 24 hours.

With BTC being the bellwether of the broader market, the altcoin market followed suit with severe plunges as the total crypto market shed over $93 billion. As mentioned earlier, it also triggered a liquidation of about $215 million, most of which were leveraged long positions.

Bitcoin positions alone recorded $80 million worth of liquidation, 37.2% of the total liquidation, while Ethereum positions accounted for $52 million of all liquidation, according to Coinglass.

Key Bitcoin Levels to Watch — March 10

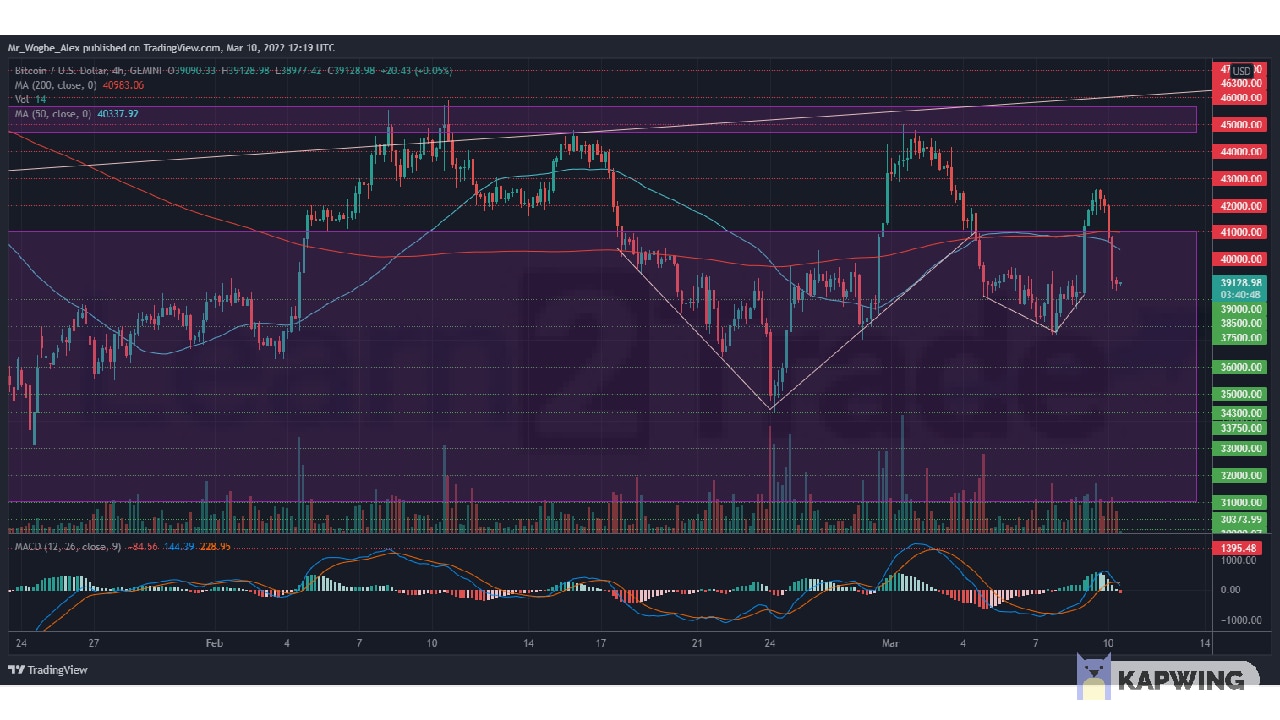

After its executive order-induced rally to the $42,590 top yesterday, BTC surprisingly switched sentiments again, as bears took control and drove the market down to the $39,000 support. So far, this support level has proven immovable as traders await a major US data release today.

If the data fails to have the negative effect analysts forecast it would have on BTC, we could see a sharp rebound again to the $41,000 level over the coming days, followed by a steady recovery to the $45,000 level.

That said, market momentum and sentiment will get clearer in the coming hours following the US inflation data release.

Meanwhile, my resistance levels are at $40,000, $41,000, and $42,000, and my key support levels are at $39,000, $38,500, and $38,000.

Total Market Capitalization: $1.74 trillion

Bitcoin Market Capitalization: $742 billion

Bitcoin Dominance: 42.5%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.