On-chain reports show that Bitcoin (BTC) investors continue accumulating more coins despite the persistent downtrend.

The benchmark cryptocurrency currently trades over 50% lower from its all-time high of $69,000. Many analysts argue that the recent increased BTC accumulation could be an early pointer to an imminent bull run.

The latest report from on-chain analytics provider Glassnode suggests that the number of wallets accumulating BTC has jumped over 600,000 for the first time in Bitcoin history. This lifetime record shows that investors are heavily taking advantage of the massive price gap in BTC to strengthen their token base.

The report also suggests that the number of long-term BTC holders is on a steady rise, which should lay the foundation for a massive surge in the coming weeks.

Bitcoin has a stronger long-term investor base compared to most other cryptocurrencies, as BTC holders continue to exhibit solid confidence in the cryptocurrency irrespective of the prevailing market sentiment.

Day from TheBlockCrypto shows that at least 61% of BTC investors have held their tokens for over a year, while another 33% have held their BTC tokens between one and twelve months. Finally, only 6% of BTC holders have been holding their coins for less than a month.

Key Bitcoin Levels to Watch — June 9

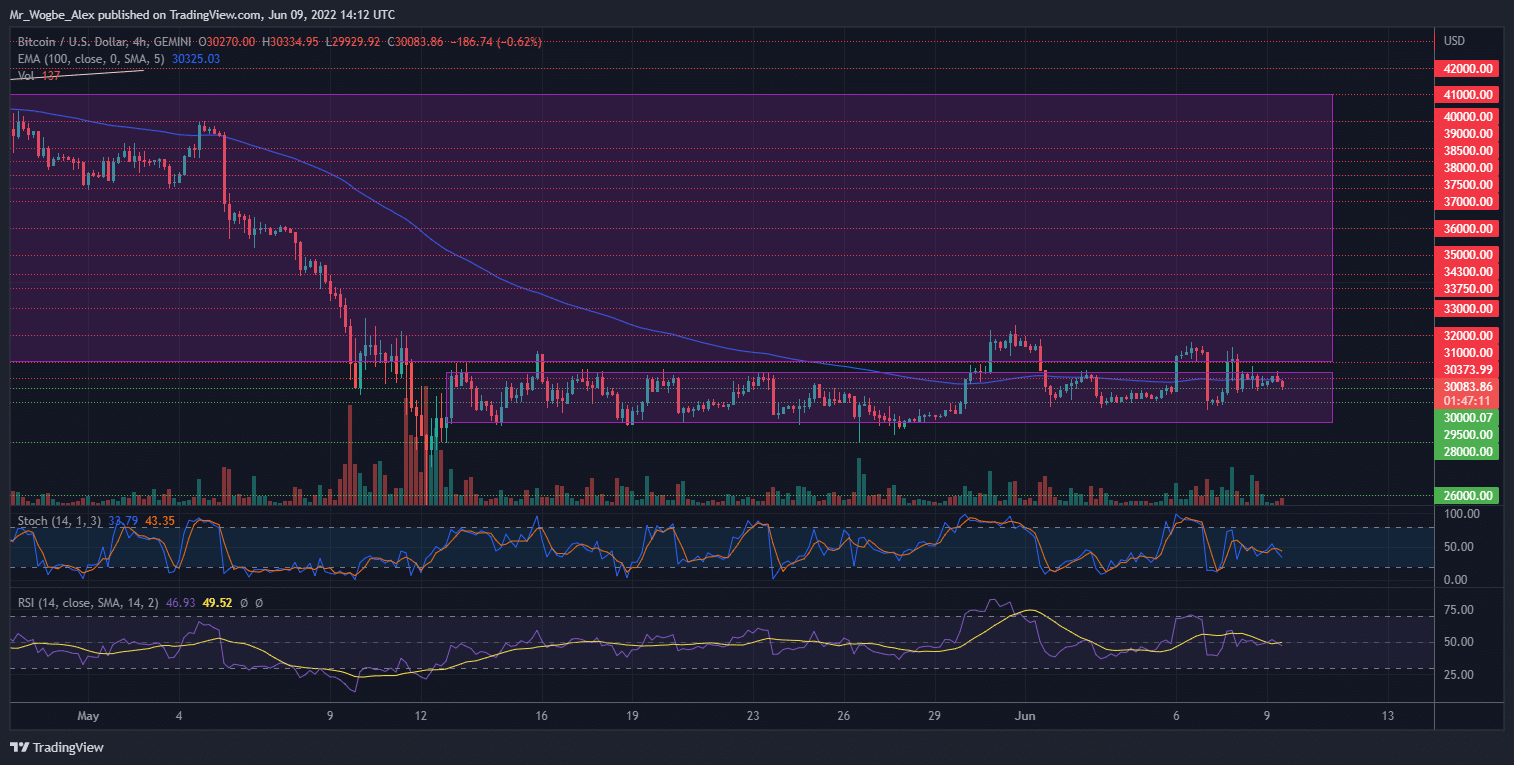

Bitcoin had another quiet trading session on Thursday as the price holds firmly above the $30,000 support line. This prolonged lack of upward momentum could trigger exhaustion for BTC, pushing it to the $28,700 pivot base in the coming days.

Except we see a sustained bullish push above the $32,000 barrier, the possibility for a breach below the pivot base continues to strengthen the more BTC price does nothing. We should see some momentum in the market tomorrow with the release of the US CPI data for May.

Meanwhile, my resistance levels are at $30,400, $30,300, and $31,000, and my key support levels are at $29,500, $29,000, and $28,000.

Total Market Capitalization: $1.24 trillion

Bitcoin Market Capitalization: $575.3 billion

Bitcoin Dominance: 46.4%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.