New reports show that Bitcoin (BTC) suffered most of its selling volume since April in the US session. Active traders in the US session are majorly responsible for the selling pressure seen in the market, while Asian traders are responsible for the opposite. According to the report, Asian session traders mostly pump the digital currency more than any other session.

Data from Arcane Research analysts shows that the cumulative year-to-date (YTD) return on BTC in the US trading session dropped significantly from 4.22% at the beginning of April to -32.55% in May.

The data suggests that US session traders mostly dumped their Bitcoins, sparking significant pressure in the market, responsible for being the main trigger of the sell-off recorded in April.

Asian cryptocurrency holders have refused to follow in a similar footpath as their American counterparts, despite the persisting selling pressure. Also, European session traders have maintained a stable trading practice, with returns flowing steadily.

While this trading pattern might not mean much in terms of market dynamics, it serves as a pointer to market sentiment and behavior during the day.

At press time, Bitcoin has lost over 6% in the last 24 hours and currently trades around $29,500 ahead of the US market open.

Key Bitcoin Levels to Watch — June 7

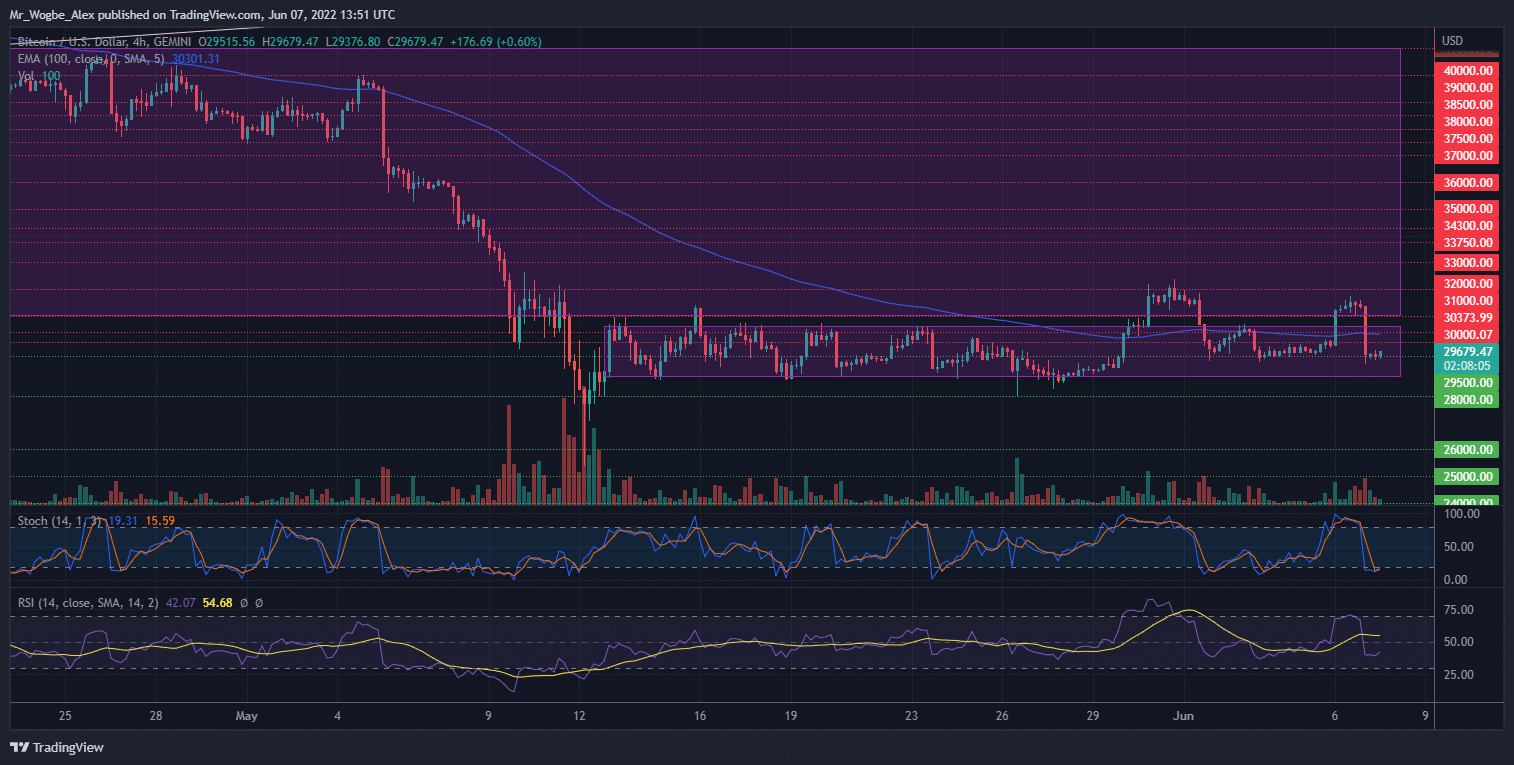

Bitcoin has suffered another false breakout near $32,000, triggering a market-wide liquidation as it fell by over 6%. The cryptocurrency has since regained stability under $30,000, as it returned its month-long range between $30,300 and $28,700.

Notably, the 4-hour stochastic indicator shows that the bearish slowdown occurred as BTC hit sub-neutral levels. This suggests that we could record a mild recovery towards $30,300 in the coming hours. Regardless, the possibility of another bearish wave remains present ahead of critical market data releases.

Meanwhile, my resistance levels are at $30,000, $30,300, and $31,000, and my key support levels are at $29,500, $29,000, and $28,000.

Total Market Capitalization: $1.23 trillion

Bitcoin Market Capitalization: $569.9 billion

Bitcoin Dominance: 46.4%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.