MicroStrategy CEO Michael Saylor recently argued that the long-term prospects of Bitcoin (BTC) remain intact, regardless of whatever occurs in the near term. Saylor noted that Bitcoin’s near-term volatility is irrelevant considering the fundamentals backing the leading cryptocurrency.

Speaking at an interview with The Block last week, the MicroStrategy boss noted:

“Bitcoin is the most certain thing in a very uncertain world, it’s more certain than the other 19,000 cryptocurrencies, it’s more certain than any stock, it’s more certain than owning property anywhere in the world.”

Saylor believes that investors who have only spent at least $100 on BTC can speak about the cryptocurrency but argued that they probably “shouldn’t have anything to say about it.”

Owning one of the largest Bitcoin wallets—holding 129,218 BTC—MicroStrategy and its CEO have become leading BTC proponents since the company began adding BTC to its balance sheet in August 2020.

The company’s most recent BTC purchase was revealed in an April 5 filing, where it acquired 4,167 coins worth $190.5 million at the time.

The company has an average Bitcoin acquisition price of $30,700. MicroStrategy’s holding is in the red with the primary cryptocurrency currently trading around $29,700 on Sunday. However, Saylor asserted that the company has no plans of selling, even if BTC loses 95% of its value.

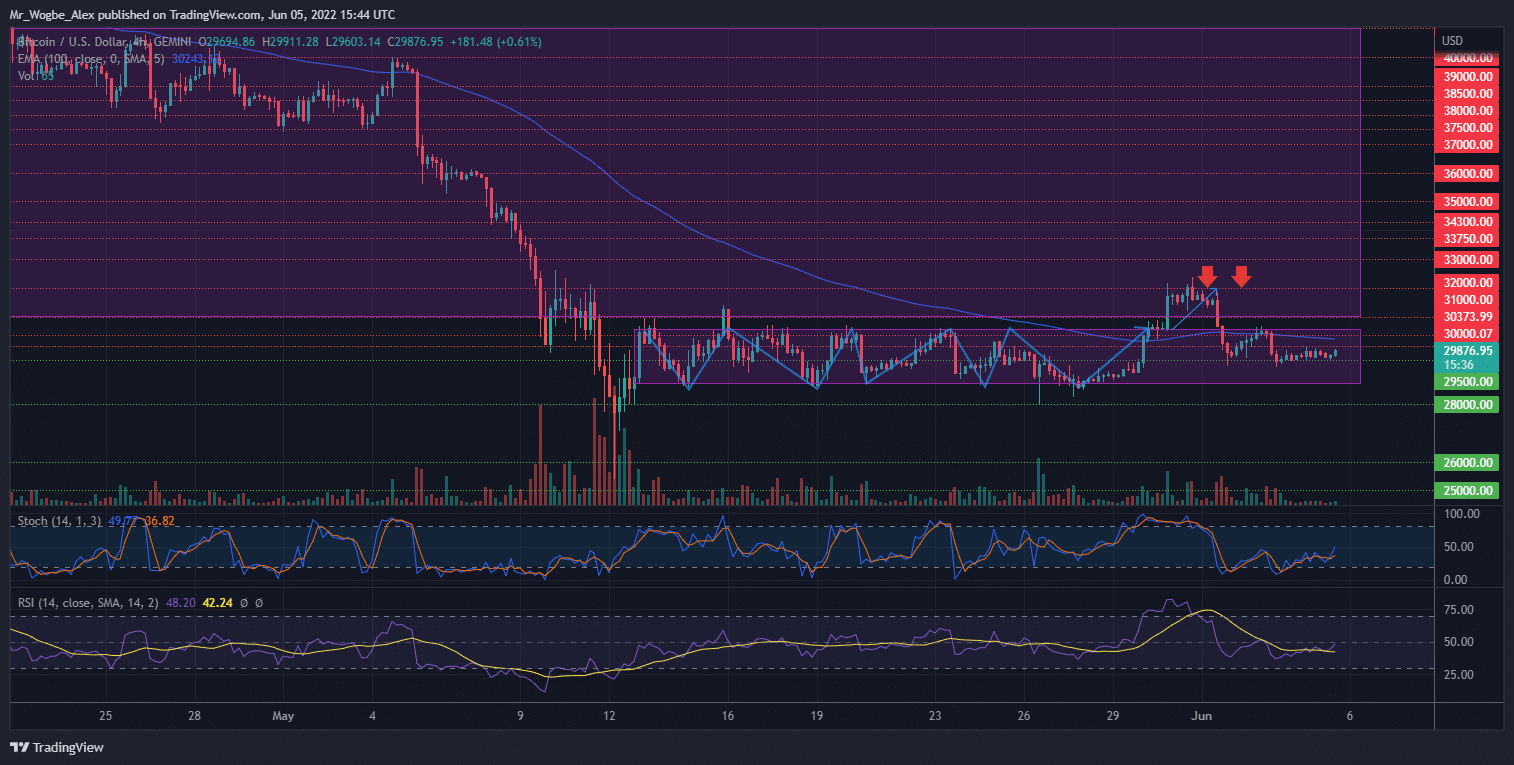

Key Bitcoin Levels to Watch — June 5

Bitcoin has managed to hold within a tight range between $30,000 and $29,500 as it records its first bullish candle in over two months, ending its nine-week bearish streak.

We should record a volatile price dynamic in the coming hours following the opening of the Asian market. I expect to see a volatile reaction to the $31,000 top by Monday, where additional bullish impetus could materialize. Regardless, the possibility of a bearish resumption towards $28,700 remains on the cards in the meantime.

Meanwhile, my resistance levels are at $30,000, $31,000, and $32,000, and my key support levels are at $29,000, $28,700, and $28,000.

Total Market Capitalization: $1.23 trillion

Bitcoin Market Capitalization: $568 billion

Bitcoin Dominance: 46.1%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.