Bitcoin (BTC) suffered a 5.5% 24-hour slump on Thursday, erasing every gain accrued since Monday. This slump came as investors braced for additional monetary tightening by the US Federal Reserve.

The benchmark cryptocurrency tapped the $29,300 low from the $32,000 top yesterday but has since rebounded towards the $30,000 mark.

As mentioned earlier, the slump was prompted by the US Fed’s positioning, as it officially began tapering its $8.9 trillion balance sheet on Wednesday to combat inflation. The move also triggered sell-offs in other risk-related assets. On Wednesday, the Nasdaq 100–Bitcoin’s closest stock parallel—dropped by 0.74%.

Another factor that worked against the crypto market and risk assets was US Treasury Secretary Janet Yellen’s admission to being wrong in her comments about inflation being transitory.

The US Fed began tapering its balance sheet by $47.5 billion a month, per its announcement at its May 4 meeting. The move poses a bearish threat to BTC as it indicates lower liquidity conditions on the market, meaning lesser inflow into Bitcoin.

The US Fed introduces balance sheet reduction when other measures, like interest rate hikes, fail to curtail inflation. Balance sheet reduction is only activated when the risk of inflation to the economy reaches critical levels.

Key Bitcoin Levels to Watch — June 2

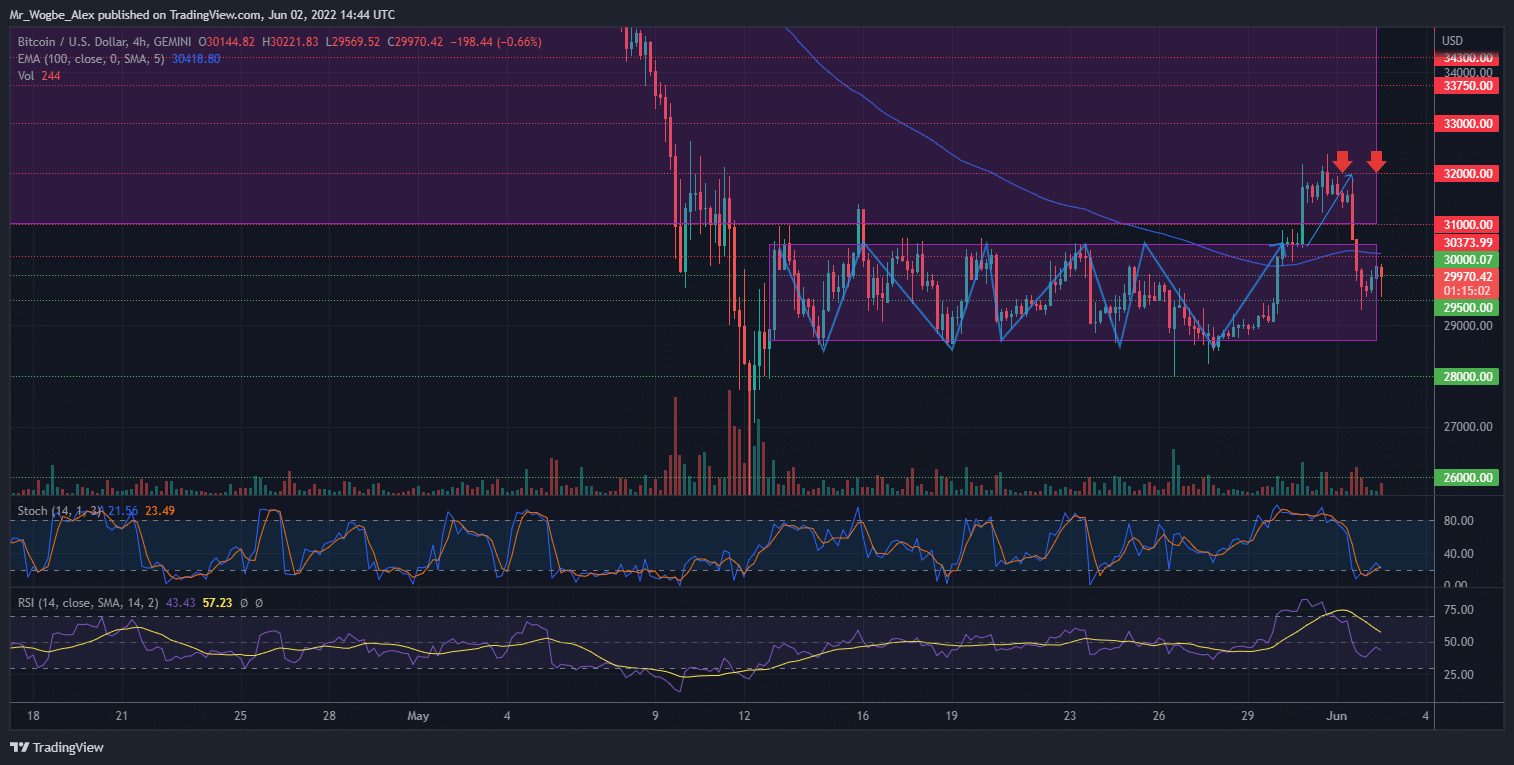

As mentioned earlier, the fall recorded in BTC over the last 24 hours has erased most of the gains gathered this week. However, there is good reason to believe that the price drop was simply a rejection from the $32,000 resistance line and not a bearish resumption.

That said, BTC should attempt a bullish comeback in the coming hours and days to the $32,000 level, where we could record a bullish continuation. This sentiment is backed by the 4-hour stochastic indicator, which paints a bullish picture for BTC in the near term.

Regardless, the overall bias remains bearish until we see a return above $41,000 (pivot top), warranting some caution around bullish bets.

Meanwhile, my resistance levels are at $31,000, $32,000, and $33,000, and my key support levels are at $29,500, $29,000, and $28,000.

Total Market Capitalization: $1.25 trillion

Bitcoin Market Capitalization: $576.2 billion

Bitcoin Dominance: 46.1%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.