Bitcoin (BTC), and the broader crypto market, suffered a horrendous meltdown on Monday, shedding over 10% off its value amid expectations of an even more aggressive Federal Reserve rate hike prospect as inflation rages.

The benchmark cryptocurrency slumped to the $20,800 low in the Asian session on Tuesday but pared back some of its losses in the London session. Other cryptocurrencies, like Ethereum, suffered an even worse predicament, with the largest altcoin nearing the $1,000 round figure.

Cryptocurrencies have borne the major brunt of the recent risk flight as central banks around the world tighten their monetary policy to combat rising inflation, siphoning liquidity from global markets. As a result, investors remained on the sidelines amid uncertainty over the extent of the prevailing dip.

Commenting on the recent development, the CEO of Unocoin crypto exchange, Sathvik Vishwanath, explained: “There were some buyers waiting for an opportunity to buy on dips, and that’s why Bitcoin has come off its lows.” He added that the hands-off investor approach might be temporary, as retail investors remain jittery about liquidity.

This week’s market crash was exacerbated by the halting of withdrawals and swaps by top crypto lending platform Celsius, sparking liquidity fears. This issue comes only a month after the historic Terra-induced market fallout.

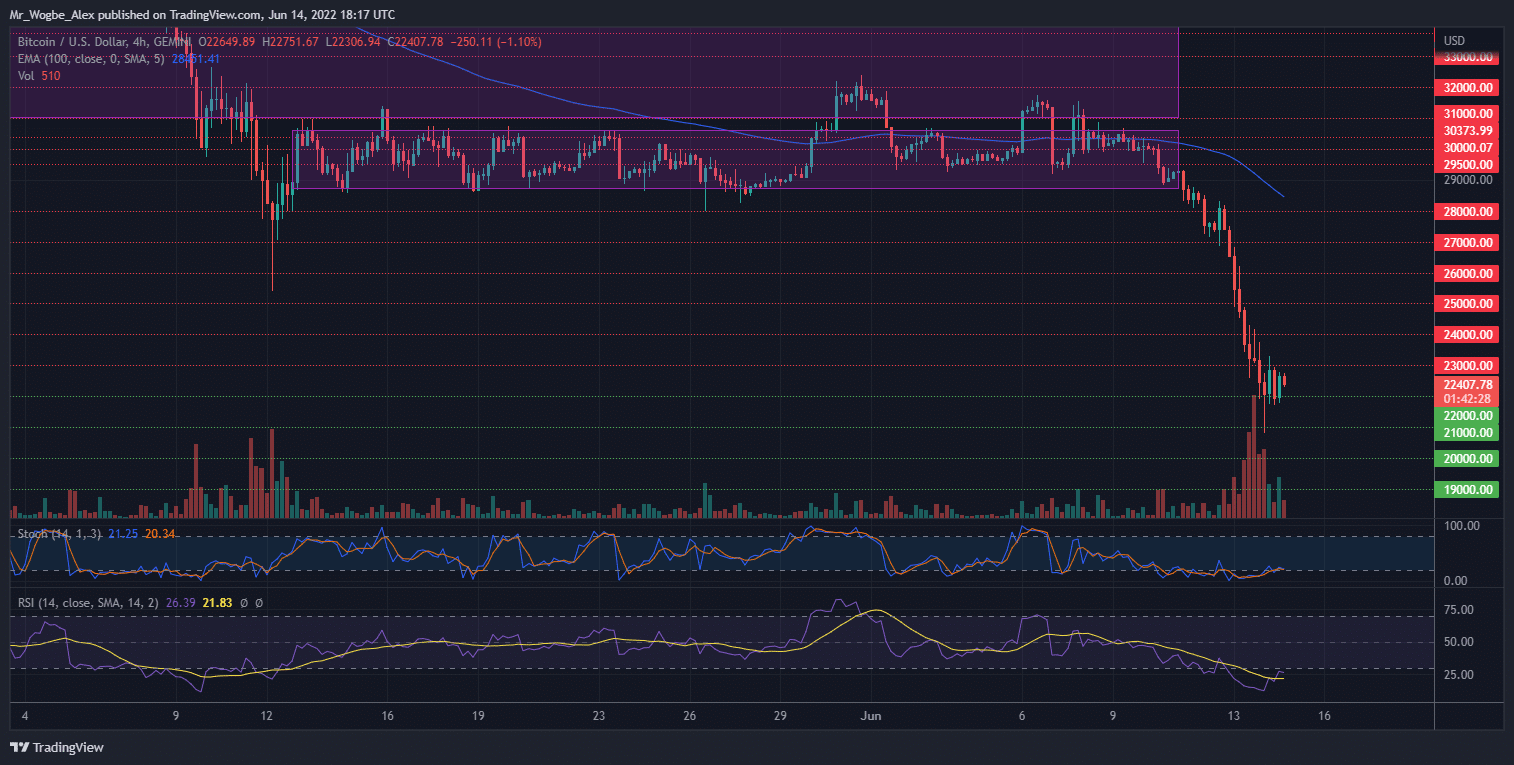

Key Bitcoin Levels to Watch — June 14

Bitcoin cannot seem to catch a break as bears deal another devastating blow to the benchmark cryptocurrency. BTC slumped to the $20,800 low in the Asian session today, triggering massive liquidations across the market.

The price appears to have stabilized above the $22,000 mark as the flagship cryptocurrency eases out of overheated conditions. This should give buyers a window to push the price towards $25,000 – $26,000 over the coming days. However, with many investors choosing to remain on the sidelines, we could see an extended bearish restriction under $24,000 followed by a possible push to $20,000.

Meanwhile, my resistance levels are at $23,000, $24,000, and $25,000, and my key support levels are at $22,000, $21,000, and $20,000.

Total Market Capitalization: $940.8 billion

Bitcoin Market Capitalization: $423.9 billion

Bitcoin Dominance: 45%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.