Latest on-chain reports from Glassnode show that cryptocurrency investors withdrew Bitcoin (BTC) at the most aggressive rate ever recorded in June, with exchange outflows topping 151,000 BTC worth over $3 billion.

Notably, the number of active addresses has plunged by 13% since November 2021, following the commencement of the bear cycle. As of July 4, the number of active addresses hovered around 870,000.

Meanwhile, Bitcoin recorded a 1.41% difficulty adjustment drop on July 7, bringing its cumulative difficulty drop to 6.8% since May 25. For those unaware, the Bitcoin mining difficulty is used to measure the difficulty of verifying transactions on a block in the blockchain by miners. Currently, the majority of mid-level miners are on the brink of shutting down their operations.

Mining difficulty adjustments are highly correlated to changes in mining hashrate—the amount of computing power expended during mining. At press time, the Bitcoin network hashrate has dropped by roughly 3.6% since June 11.

That said, the persisting drop in mining difficulty and BTC hashrate suggests that several miners have called it quits due to challenging operational conditions and declines in miners’ revenue. Glassnode statistics show that Bitcoin miners have dropped by over 70% since their peak in 2010.

Key Bitcoin Levels to Watch — July 7

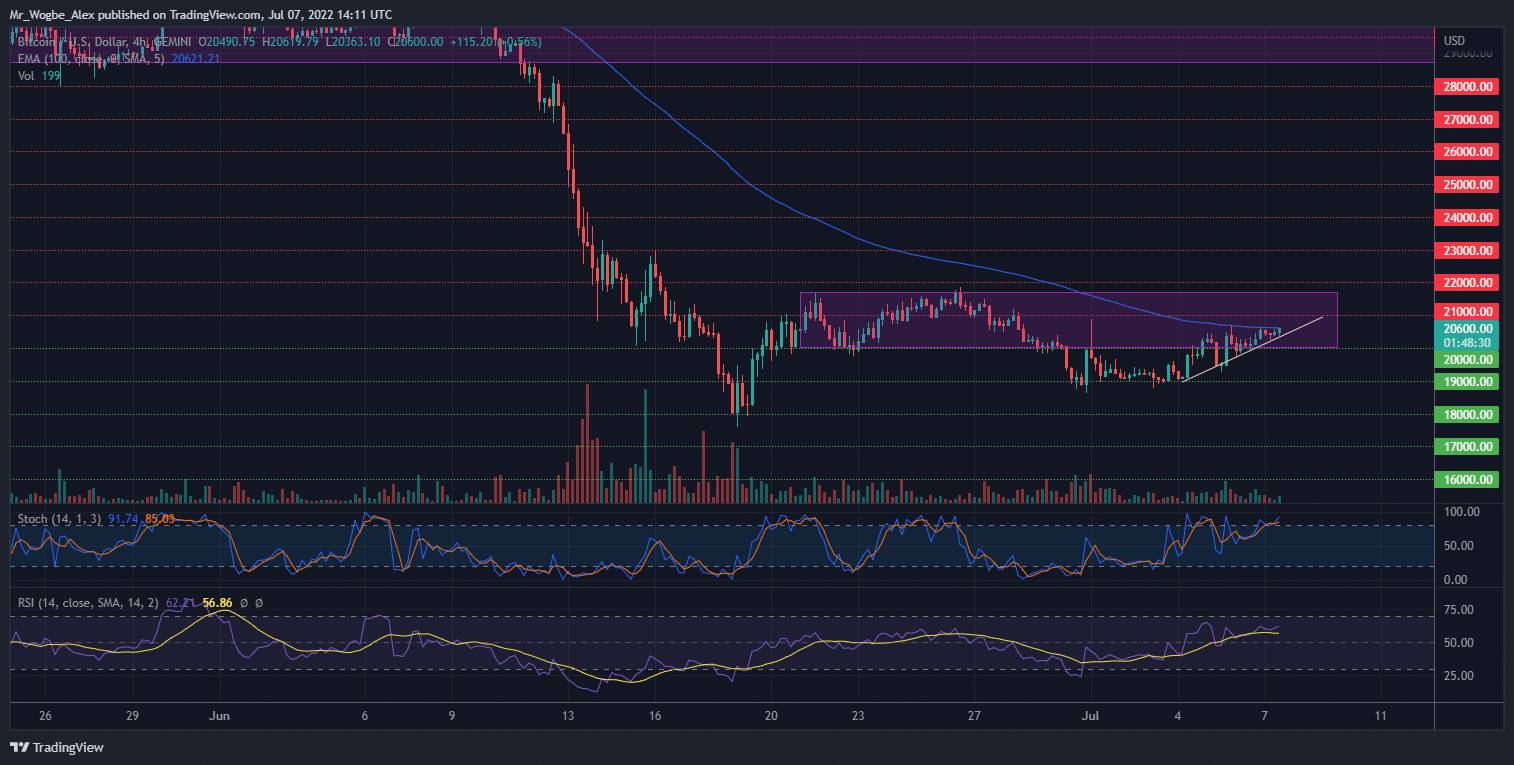

Bitcoin has entered a mildly-aggressive bullish trend as it fights to test the $21,000 mark. The recently formed bullish bias is highlighted by the trendline on my 4-hour chart on TradingView. That said, the primary cryptocurrency faces some headwinds resurfacing above the $20,500 level due to active resistance from the 100-day EMA around that level.

Regardless, BTC has shown great strength returning above the $20,000 mark this week. I foresee sustenance of this bias over the week and into the weekend after the US non-farm payroll and unemployment rate announcements tomorrow. In the meantime, we could record small corrections to the $20,000 figure to ease overbought conditions.

Meanwhile, my resistance levels are at $21,000, $22,000, and $23,000, and my key support levels are at $20,000, $19,000, and $18,000.

Total Market Capitalization: $930.8 billion

Bitcoin Market Capitalization: $394.7 billion

Bitcoin Dominance: 42.4%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.