On-chain analytics platform Glassnode suggested in a recent report that Bitcoin (BTC) has hit its lowest level in the ongoing bearish cycle as network activity plummets on a lack of new users.

Glassnode asserted that June was Bitcoin’s worst trying month in over ten years, adding that the benchmark cryptocurrency is near its bottom as “market tourists” have been squeezed out of the market. However, the on-chain statistics provider clarified that the bearish cycle could persist and exhibit different properties from older cycles due to external macroeconomic factors.

BTC just eased off its worst quarter since 2011, following its crash to the $17,580 low in mid-June. Despite a rebound from this low, the primary cryptocurrency still ended the month under the $20,000 mark. The Glassnode report detailed:

“Prices traded down -37.9% over the last 30-days, competing only with the 2011 bear market, for the crown of [the] worst month on record.”

The analytics company believes that market tourists—who typically show up in “time of plenty” and bolster network activity—have fled the scene. It explained:

“Almost the entire suite of on-chain activity metrics indicate that the number and activity of network users are approaching the deepest historical bear market territory. The Bitcoin network is approaching a state where almost all speculative entities and market tourists have been completely purged from the asset.”

Key Bitcoin Levels to Watch — July 5

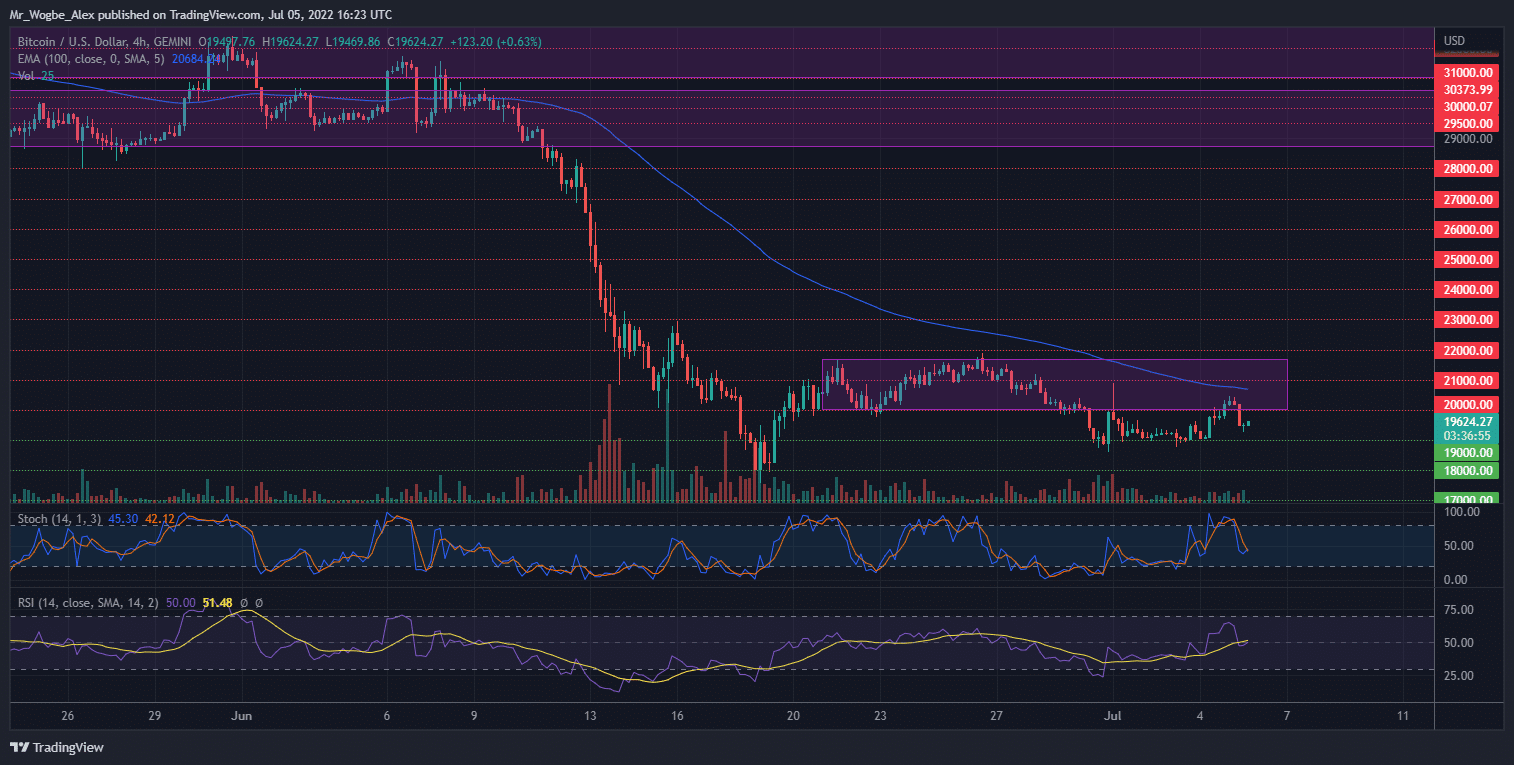

As projected in my last analysis, Bitcoin attempted a push towards the $21,000 resistance but failed halfway, stumbling to the mid-$19,000 area. We could see the benchmark cryptocurrency return to the $19,000 round figure in the coming hours, where the next price direction should emerge.

Regardless, my previous analysis of BTC remaining under the $21,000 mark in the coming days remains. However, we should witness several bullish attempts in the coming days ahead of the US non-farm payrolls.

Meanwhile, my resistance levels are at $20,000, $21,000, and $22,000, and my key support levels are at $19,000, $18,000, and $17,000.

Total Market Capitalization: $885 billion

Bitcoin Market Capitalization: $374.2 billion

Bitcoin Dominance: 42.2%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.