Last Thursday, Jacobi Asset Management announced that it plans to launch the first Bitcoin exchange-traded-fund (ETF) in Europe on the Euronext exchange. This comes despite the raging volatility currently getting recorded in the crypto market, signaling notable confidence in the market.

The digital asset management company noted that its Bitcoin ETF would begin trading on Euronext Amsterdam this month under the ticker symbol ‘BCOIN.’

Commenting on the project, Jacobi CEO, Jamie Khurshid, noted:

“The Jacobi Bitcoin ETF will enable investors to access the underlying performance of this exciting asset class via a well-established and trusted investment structure.”

In June, Bitcoin (BTC) tapped its lowest point in 2022 at $17,580, plummeting below the $20,000 mark for the first time since December 2020. The benchmark cryptocurrency is down by over 70% since it hit its highest point on record of $69,000 in November 2021.

Altcoins have not been spared in the mayhem either, with most altcoins recording worse declines than Bitcoin as investors dump their digital assets for safe-haven assets like Stablecoins, gold, and the dollar amid worsening inflation and more aggressive monetary policies by central banks.

Last month, ProShares revealed plans to launch an ETF for shorting Bitcoin (betting on a possible drop in price in the future). Meanwhile, the US Securities and Exchange Commission (SEC) turned down an ETF conversion request from Grayscale, the world’s largest digital asset manager. Grayscale took the Commission to court, making good on its threat to do so if the regulator failed to grant its request.

Key Bitcoin Levels to Watch — July 3

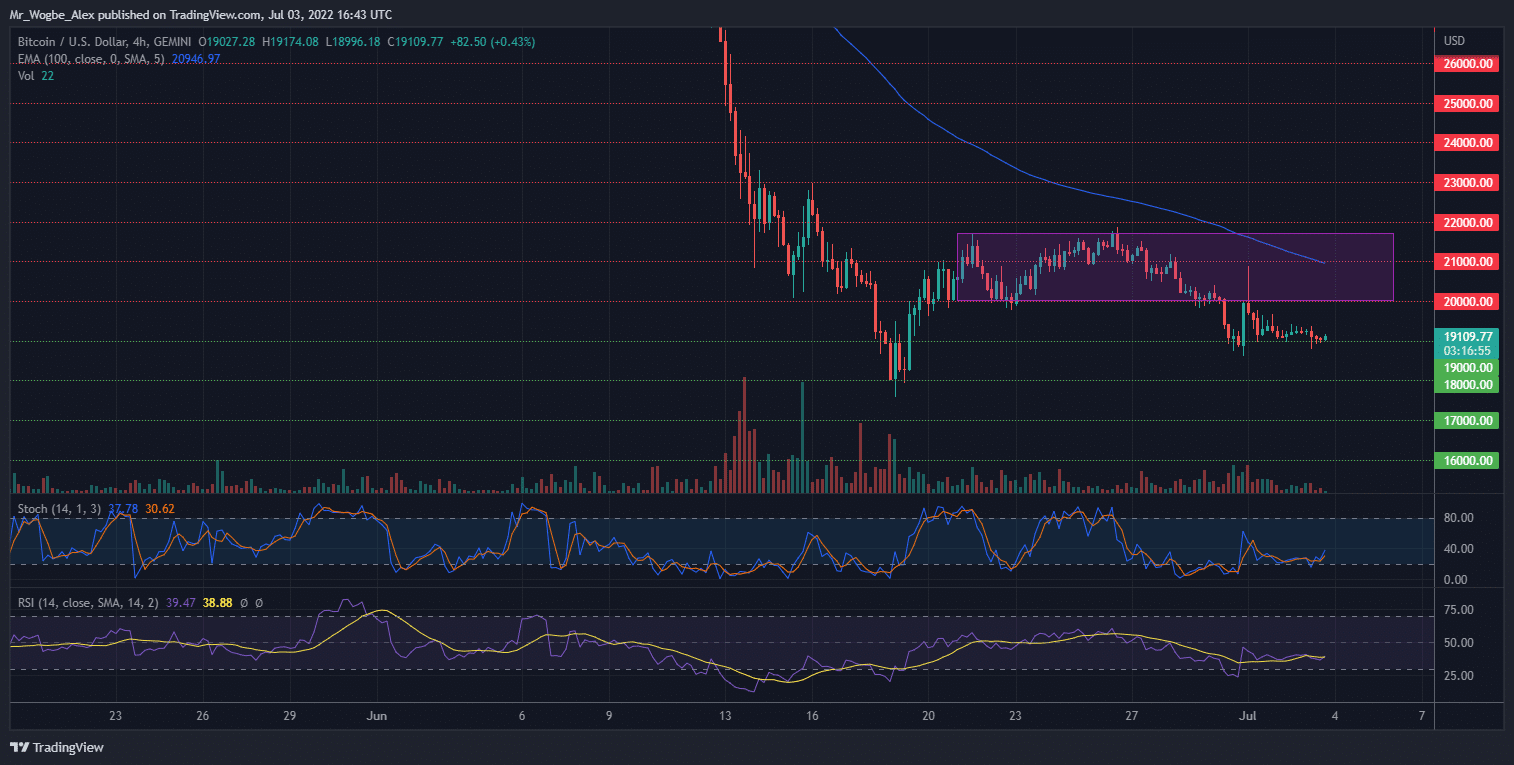

Bitcoin held the $19,000 level through the weekend as we prepare for the first week in the second half of 2022. Notably, the benchmark cryptocurrency broke into the $21,700 – $20,000 consolidation area last Friday but failed to hold the surge and returned to the $19,000 mark.

The prolonged defense of the $19,000 base suggests we could see a bullish attempt at $21,000 this week. However, the broader sentiment remains bearish, meaning a sustained bullish bounce above $21,000 is unlikely.

Meanwhile, my resistance levels are at $20,000, $21,000, and $22,000, and my key support levels are at $18,000, $17,500, and $17,000.

Total Market Capitalization: $865.4 billion

Bitcoin Market Capitalization: $365.3 billion

Bitcoin Dominance: 42.2%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.