Bitcoin (BTC) has dropped by an additional 21% over the last two weeks with miners suffering a serious backlash from the crash. Now, a recent report from Bloomberg shows that several loans backed by mining rigs are in distress.

CFO and co-founder of Luxor technologies, Ethan Vera, estimated that about $4 billion worth of mining rigs-backed loans is in distress. Vera explained to Bloomberg’s David Pan in an interview noting: “They are nervous about their loan books, especially those with a high collateral ratio.”

Based on current exchange rates of $21,000, statistics from asicminervalue.com claims only 14 SHA256-based mining machines can profit in current conditions, with electricity costing about $0.05 per kilowatt-hour (kWh). The report also noted that top mining machines made by Bitmain and Microbt raise realize between $2 to $4.50 daily at an electrical cost of $0.05 per kWh.

The report further noted that miners are frantically dumping their BTC to gather enough to offset operational costs, revealing that Core Scientific Inc. sold over 2,000 BTC in May to settle overhead expenses.

Commenting on the miner’s predicament, the head of lending at Galaxy Digital, Luka Jankovic, noted: “Bitcoin miners, broadly speaking, are feeling pain.” He added: “A lot of operations have become net IRR negative at these levels. Machine values have plummeted and are still in price discovery mode, which is compounded by volatile energy prices and limited supply for rack space.”

Key Bitcoin Levels to Watch — June 28

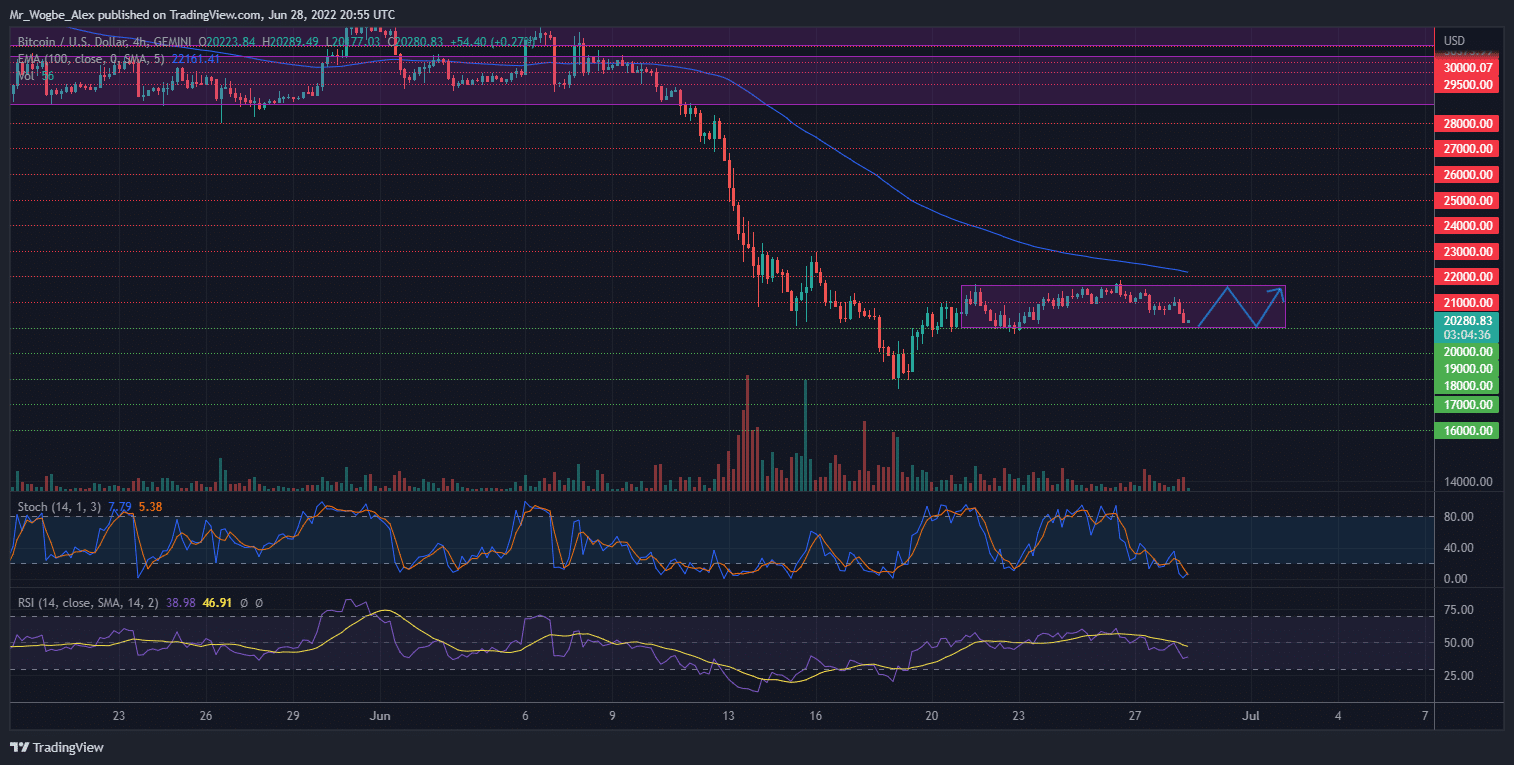

A clear sideways pattern has emerged on my 4-hour chart for Bitcoin, as the benchmark cryptocurrency slumped to the $20,000 psychological base again.

BTC now trades dangerously in oversold territories, requiring a bullish ease-off in the coming days, according to the stochastic indicator. This supports the choppy theory as the primary cryptocurrency would rebound to the $21,700 range top. Nonetheless, erratic price actions are not out of the picture, making a bearish extension possible.

Meanwhile, my resistance levels are at $21,000, $22,000, and $23,000, and my key support levels are at $20,000, $19,000, and $18,000.

Total Market Capitalization: $915.7 billion

Bitcoin Market Capitalization: $387.1 billion

Bitcoin Dominance: 42.2%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.