In its recently released Q2 earnings report, Tesla revealed that it sold a large portion of its Bitcoin (BTC) holding and converted it to USD. In its report the behemoth electric vehicle manufacturer explained:

“As of the end of Q2, we have converted approximately 75% of our bitcoin purchases into fiat currency. Conversions in Q2 added $936M of cash to our balance sheet.”

Tesla’s Q2 report showed a net digital asset holding of $218 million, a sizable 82.6% drop from the $1.26 billion reported in the last quarter. The EV manufacturer also revealed that its W2 year-on-year (YoY) operating income suffered significantly from the Bitcoin impairment.

That said, the Elon Musk-owned company’s statement of cash flow showed proceeds of $936 million from digital asset sales.

In early 2021, Tesla announced that it added $1.5 billion worth of Bitcoin to its balance sheet. Although it never formally disclosed the total number of BTC owned since the purchase, Musk hinted last July that his company held 42,000 Bitcoins.

At some point early last year, the company began accepting BTC as payment for its merchandise. However, it ended the practice a few months later, citing environmental concerns.

By October, Tesla told the SEC that it was considering resuming the practice after most of Bitcoin’s environmental worries were addressed. However, to date, Tesla has yet to make good on its promise.

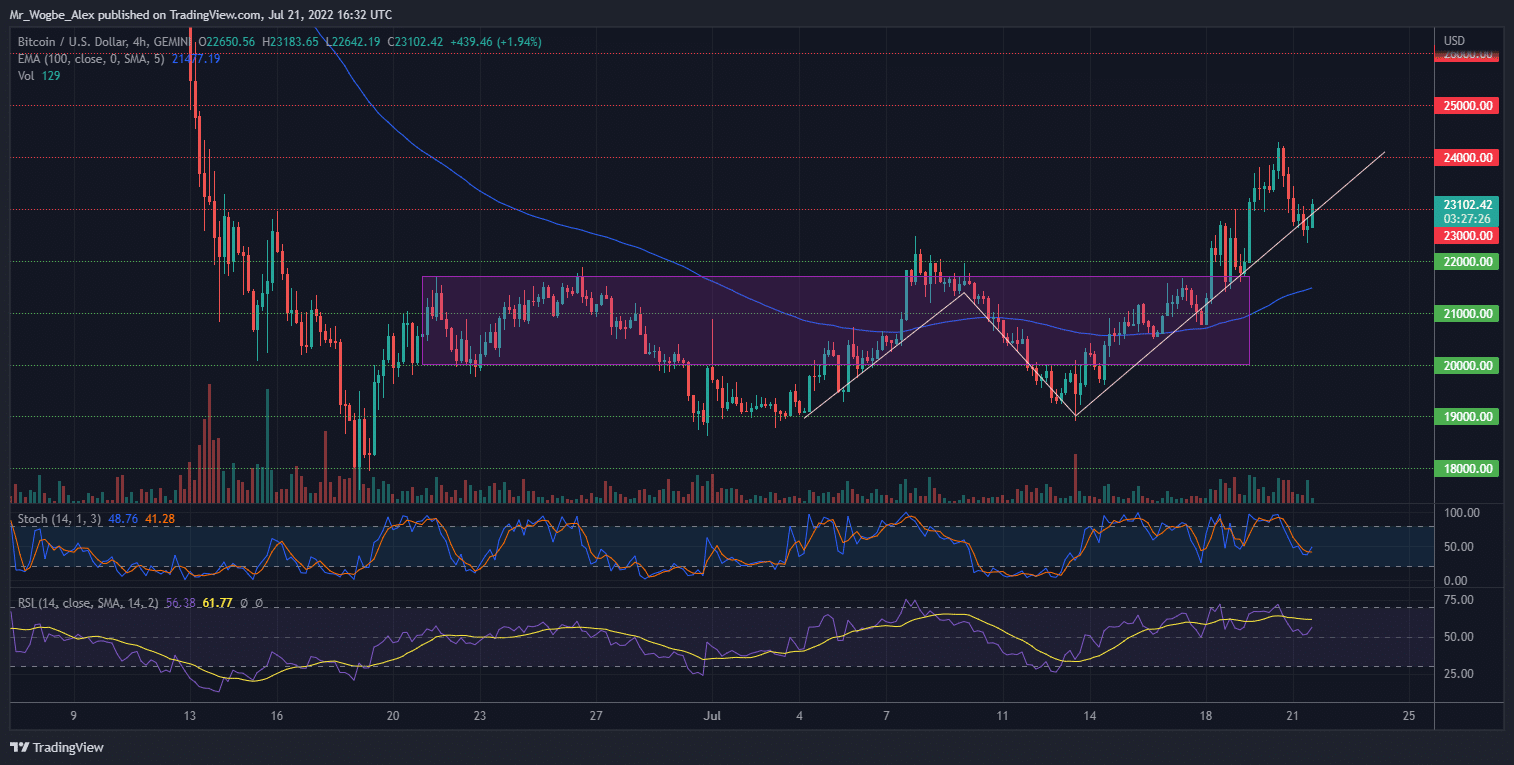

Key Bitcoin Levels to Watch — July 21

Bitcoin bulls appear to have been reinvigorated in the past few days, despite popular expectations of further crashes. At press time, the benchmark cryptocurrency clings to the $23,000 mark, holding on to my 4-hour trendline.

The cryptocurrency seems to be preparing for another leg-up in the coming days, as bulls target a retest of the $24,000 top. A successful retest of this level could open the doors to a $25,000 price for BTC in July. With a clear economic docket in the coming days, the flagship cryptocurrency stands the chance of pushing its way to the mentioned top, especially with the stochastic indicator projecting a bullish turn.

Meanwhile, my resistance levels are at $24,000, $25,000, and $26,000, and my key support levels are at $22,000, $21,000, and $20,000.

Total Market Capitalization: $1.04 trillion

Bitcoin Market Capitalization: $439.6 billion

Bitcoin Dominance: 42%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.