According to results from a recent Bitcoin (BTC) survey conducted by Forrester Consulting on behalf of crypto exchange AAX, sizable populations in developing economies top the trend in Bitcoin awareness and adoption.

The survey detailed that 74% of consumers in markets within Africa, Latin America, the Middle East, and Southeast Asia were aware of Bitcoin, while 52% of respondents agreed to notice the increasing use of BTC in their country in the past year.

Notably, 91% of surveyed subjects believe Bitcoin could empower a digital future, especially when it comes to serving as a preferred payment solution.

The result suggested that despite the recent crash and volatility, Bitcoin remains a necessity in emerging markets as it serves as a digital transaction gap.

According to the survey, other factors necessitating the use of Bitcoin in developing economies include helping users achieve financial independence, dissatisfaction with traditional financial services, and the need for a reliable cross-border payment system.

According to Ben Caselin, head of Research and Strategy at AAX, many users in emerging markets use BTC because it “offers an alternative to the banking system that is easier to access, more secure, and protected from government intervention.” Caselin further explained:

“We believe this study really shows us the potential of Bitcoin to power a different, fairer, and more inclusive financial system for everyone – not simply an investment vehicle for institutions and a wealthy minority.”

Key Bitcoin Levels to Watch — July 19

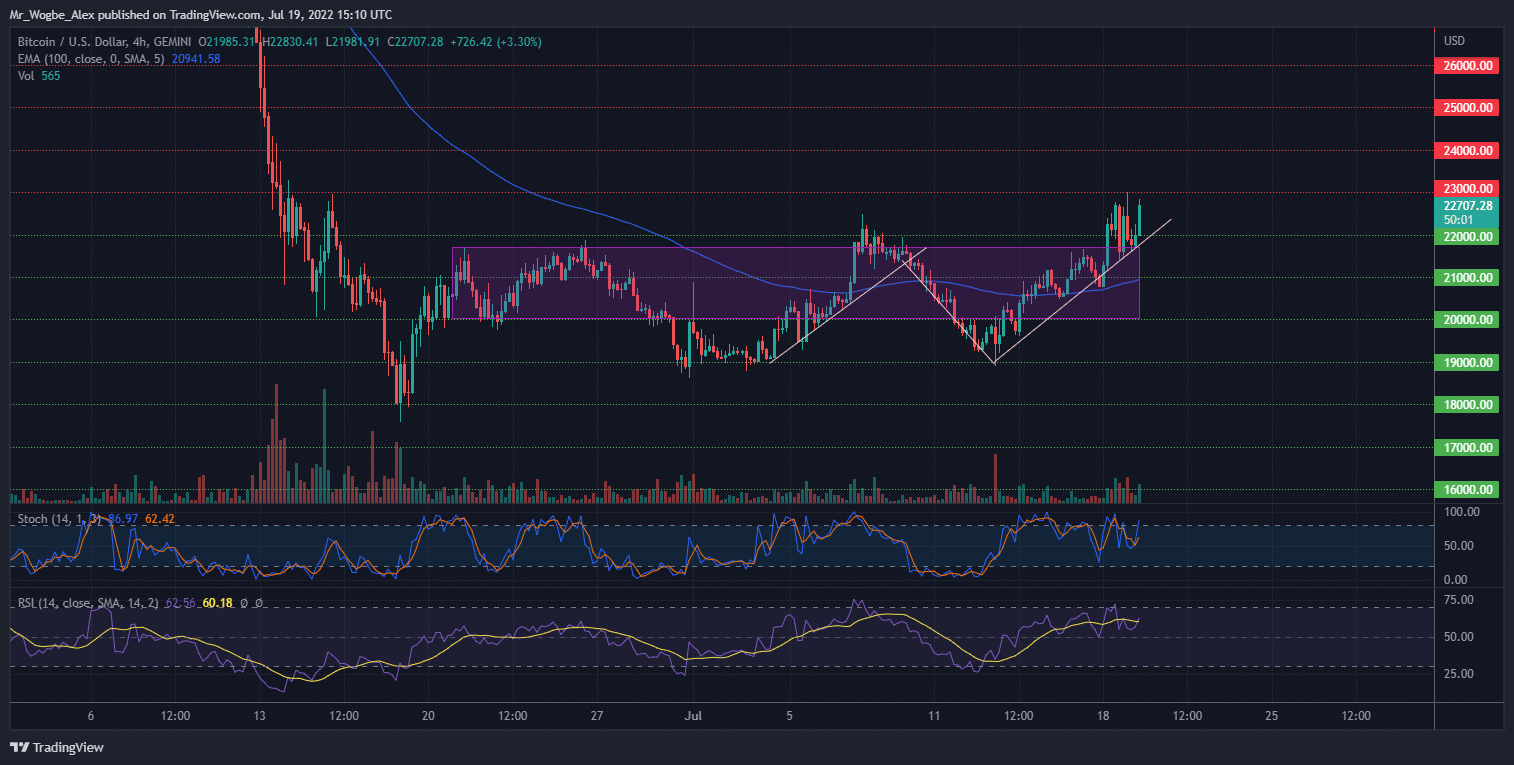

Over the past week, Bitcoin has regained a significant bullish momentum as the benchmark cryptocurrency flags a new monthly high of $23,000. After tapping this high in the early Asian session today, BTC recorded a sharp correction to the $21,700 mark (the top of my previous range). However, this decline did not last long, as the cryptocurrency is back at the edge of $23,000.

With the newly acquired bullish momentum, BTC is likely to chart new highs not seen since early June in the coming days, barring unexpected external factors. On the flip side, a decline from the current level is unlikely to get by the $22,000 support, prompting some caution on short bets.

Meanwhile, my resistance levels are at $23,000, $24,000, and $25,000, and my key support levels are at $22,000, $21,000, and $20,000.

Total Market Capitalization: $1.01 trillion

Bitcoin Market Capitalization: $424.9 billion

Bitcoin Dominance: 41.2%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.