As the price of Bitcoin (BTC) remains under bearish pressure, strategists at behemoth financial institution JP Morgan Chase & Co. have revealed that the cost of minting new Bitcoins has declined by almost 50% in the past month.

In a note published by the Nikolaos Panigirtzoglou-led strategy department at JPM yesterday, the Bitcoin production cost currently hovers around $13,000, a notable fall from $24,000 recorded at the beginning of June. The strategists highlighted in the report that this decline in production cost could afflict the value of the benchmark cryptocurrency.

The Panigirtzoglou-led department further explained in the note that the decline in production cost is likely due to a drop in electricity use according to statistics from the Cambridge Bitcoin Electricity Consumption Index.

The JPM strategists explained that the drop in electricity use is a ploy by BTC miners to remain profitable by using only energy-efficient mining rigs instead of a mass migration of less efficient miners. However, this strategy could create a massive stumbling block against any meaningful price gains for Bitcoin. The strategists explained:

“While clearly helping miners’ profitability and potentially reducing pressures on miners to sell Bitcoin holdings to raise liquidity or for deleveraging, the decline in the production cost might be perceived as negative for the Bitcoin price outlook going forward. The production cost is perceived by some market participants as the lower bound of the Bitcoin’s price range in a bear market.”

Key Bitcoin Levels to Watch — July 14

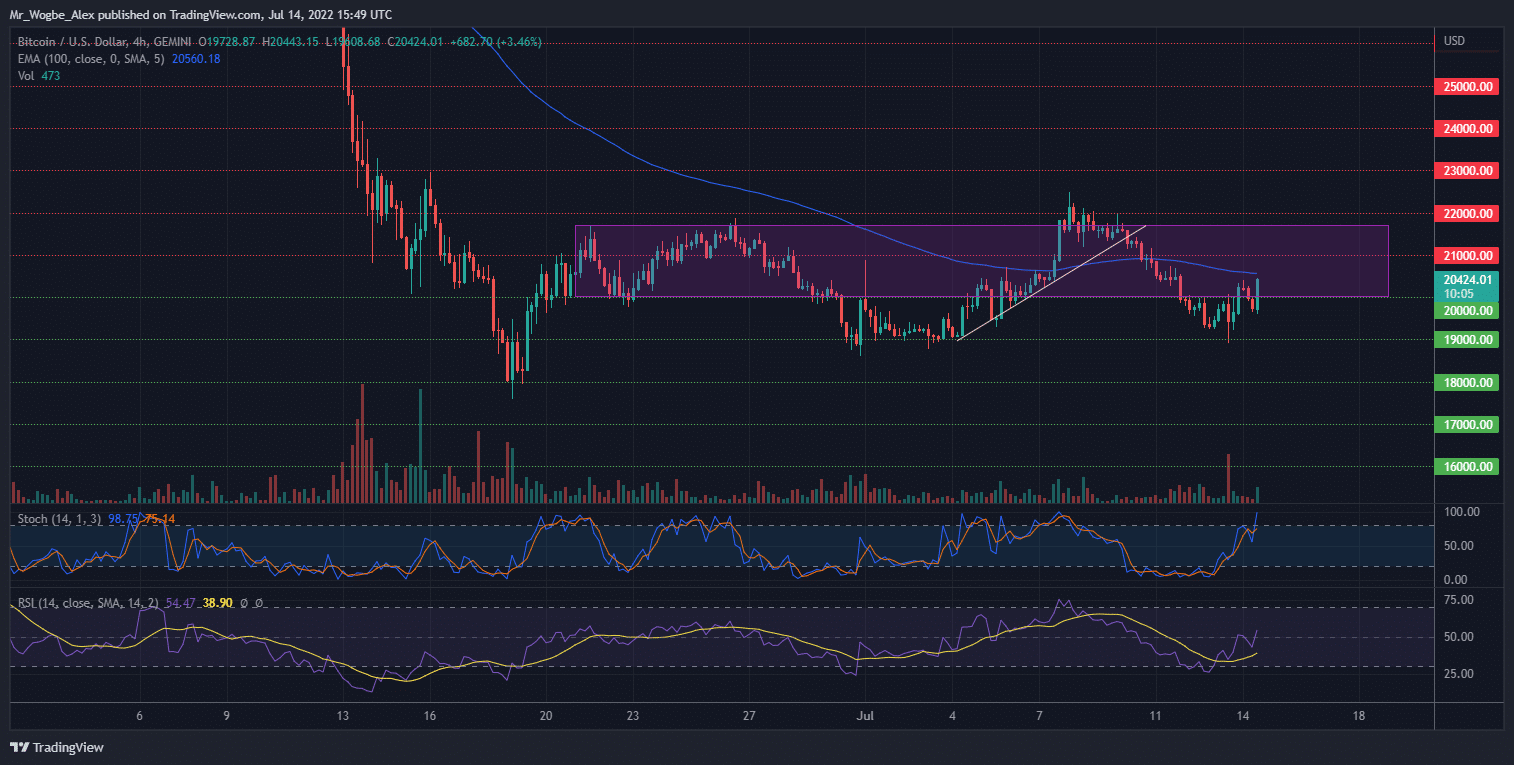

As previously projected, Bitcoin suffered another dip to the $19,000 low after breaching the $20,000 level on Monday. The benchmark cryptocurrency managed to put up a fight, rising on the hot US inflation figures yesterday but could not manage a push above the 100 EMA line around $20,500, prompting another leg down.

That said, I expect to see another retest of the $19,000 base before the weekend, where a possible continuation to the mid-$18,000 area could unfold. Overall, bears have $17,000 in sight and could attempt this level in the coming days.

Meanwhile, my resistance levels are at $20,700, $21,000, and $22,000, and my key support levels are at $19,000, $18,000, and $17,000.

Total Market Capitalization: $897.4 billion

Bitcoin Market Capitalization: $384.5 billion

Bitcoin Dominance: 42.7%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.