Bitcoin (BTC) has recorded yet another negative mining difficulty adjustment after dropping for the fourth consecutive time yesterday by about 5%. The latest adjustment brings the mining difficulty to its lowest point since January 2020.

This drop comes because of the ongoing mining facility clampdown in China over the past few weeks. With fewer computational power mining for Bitcoin, it means that fewer blocks will get added to the blockchain, thus affecting the balance of activities on the network.

Interestingly, the recent drop in BTC mining difficulty means that more rewards are going to miners still online. A Bitcoin mining engineer, Brandon Arvanaghi, explained in an interview with CNBC during the last difficulty adjustment that:

“This will be a revenue party for miners. They suddenly own a meaningfully larger piece of the pie, meaning they earn more bitcoin every day.”

Meanwhile, the BTC hashrate has regained a positive standing after falling below the 90m TH/s mark a few days ago. The BTC hashrate now rests around the 100m TH/s area at press time.

The hashrate jump indicates that many displaced Chinese miners have set up shop in more conducive jurisdictions and are slowly coming online. Already, governments across North America and Europe are working towards attracting miners with eye-popping incentives into their jurisdictions as the mining industry becomes heavily focused on using green and sustainable energy solutions.

Key Bitcoin Levels to Watch — July 18

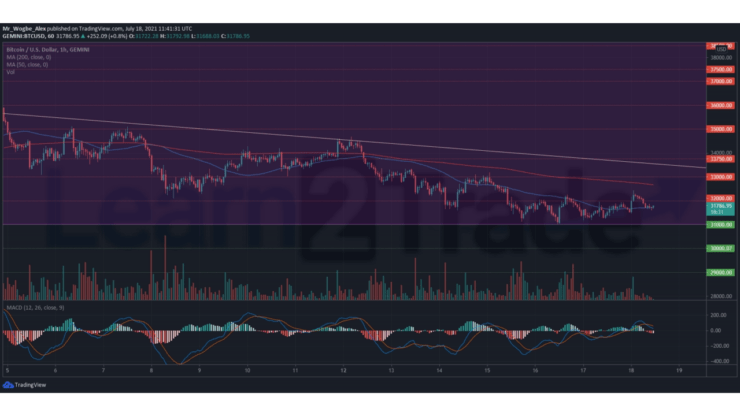

Bitcoin reached a three-week low over the weekend around $31,000 as the crypto market remains under grave uncertainty from regulatory efforts and the GBTC unlocking slated for later today.

Following a goodish bounce to the $32,500 level, the benchmark cryptocurrency suffered another correction. However, the decline got decent support from the hourly 50 SMA at the $31,700 area, where BTC currently trades. That said, bulls need to defend the $31,700 – $31,000 axis over the coming hours and days to prevent a fall to the $30,000 psychological support, as bearish market sentiment persists.

Meanwhile, our resistance levels are at $32,000, $33,000, and $33,750, and our key support levels are at $31,000, $30,000, and $29,000.

Total Market Capitalization: $1.3 trillion

Bitcoin Market Capitalization: $594.8 billion

Bitcoin Dominance: 45.6 %

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.