According to a fund manager survey for July posted by Bank of America (BofA), “long Bitcoin” has dropped to the number three spot as the most crowded trades. The Global Fund Manager Survey is Bank of America Securities’ monthly report is a survey carried out on about 200 institutional, mutual, and hedge fund managers around the world.

The updated ranking now has “long tech stocks” in the number one spot, followed by “long ESG” as number two, “long Bitcoin” at number three, and “long commodities” at number four.

According to the survey, fund managers were less bullish on growth, earnings, and inflation compared to the year before. Overall, 74% of managers expect growth and inflation to remain “above trend.”

In May, “long Bitcoin” was the most crowded trading asset, followed by “long tech stocks” and “long ESG.” By June, “long commodities” overtook “long Bitcoin” as the most crowded trade, pushing it in the number two spot. In that month, “long tech stocks” came third, while “long ESG” moved to number four.

In other news, BofA recently announced that it had assembled a cryptocurrency research team. Last week, the bank noted that:

“We are uniquely positioned to provide thought leadership due to our strong industry research analysis, market-leading global payments platform, and our blockchain expertise.”

Bank of America, ridiculed for being anti-crypto a while back, recently released a report noting that digital currencies “could boost economic growth” in emerging economies.

Key Bitcoin Levels to Watch — July 15

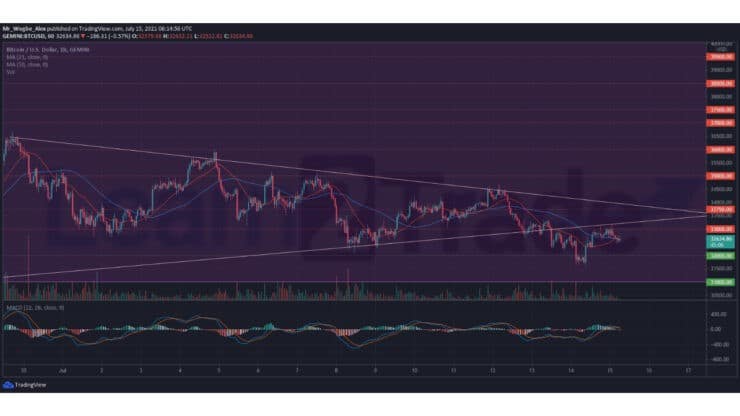

Bitcoin (BTC) bulls put up a good fight at the $31,600 support area yesterday after bears send the price on a steep decline. The benchmark cryptocurrency managed to climb back to the $30,000 region but came across heavy resistance at the psychological level, which prompted a correction to $32,500.

That said, we can see an intersection between the 50 and 21 SMAs, which indicates that a bullish recovery could be underway.

Meanwhile, our resistance levels are at $33,000, $33,750, and $35,000, and our key support levels are at $32,000, $31,600, and $31,000.

Total Market Capitalization: $1.33 trillion

Bitcoin Market Capitalization: $611.1 billion

Bitcoin Dominance: 45.9 %

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.