On-chain analytics company Glassnode recently reported on the Bitcoin (BTC) network, noting that it is, fundamentally, in a healthy state despite the vacillating price action. The analytics provider revealed that we are in an “impressively quiet week,” as BTC remained range-bound between $34,900 and $32,500. Glassnode noted that:

“It is starting to feel like the calm before the storm as muted and quiet activity appears across both spot, derivative, and on-chain metrics.”

Meanwhile, the company revealed that miner accumulation is on a steady climb as the miner net position change metric flips back to accumulation mode. The on-chain analytics firm noted that:

“This indicates that what sell-side pressure is coming from offline miners is more than offset by accumulation by the operational miners.”

According to Bitinfocharts, Bitcoin’s hash rate recorded a goodish uptick since it fell to a near 2-year low on June 28, when it plunged to 68 EH/s. Currently, BTC’s hash rate has increased by 32% since its June 28 crash to 90 EH/s. This recovery suggests that about a third of hash power has returned online since the dip.

Glassnode asserted that this recovery is a sign that miners in China have successfully migrated to other conducive work environments and have resumed operations.

Key Bitcoin Levels to Watch — July 13

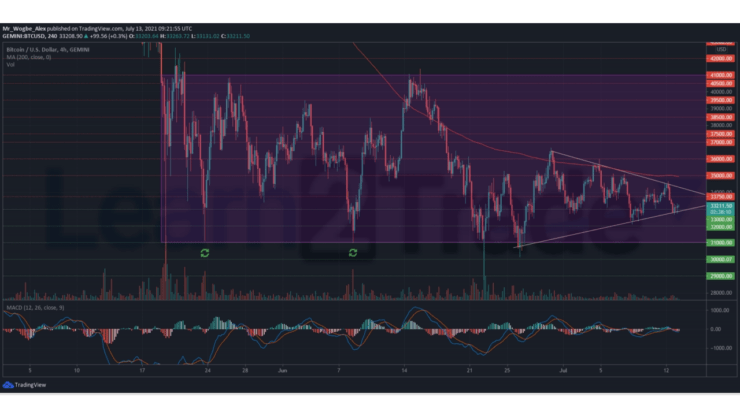

After touching the $34,700 level yesterday, Bitcoin suffered a sharp rejection to the upper-$32k levels. Currently, the primary cryptocurrency has clawed its way back up above the $33k level, as bulls focus on clearing the $33,700 – $34,000 axis.

That said, BTC currently trades within an adjusted wedge with the $34k psychological resistance and $32,700 serving as key target points for bulls and bears. A move through either of these levels could ignite a sustained push in that direction.

Meanwhile, our resistance levels are at $33,700, $34,000, and $35,000, and our key support levels are at $33,000, $32,700, and $32,000.

Total Market Capitalization: $1.37 trillion

Bitcoin Market Capitalization: $622.7 billion

Bitcoin Dominance: 45.5 %

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.