Researchers at American investment firm ARK Invest have promulgated a significantly bullish future for Bitcoin (BTC). The research team asserted that the benchmark cryptocurrency could exceed $1 million, with a market cap of $28.5 trillion, by 2030.

ARK Invest, chaired by Catherine Wood, has remained steadfast in its support for Bitcoin for a while. Last July, the firm acquired an additional 450,000 additional shares of the Grayscale Bitcoin Trust (GBTC) within two days. Currently, the company has more than 6.5 million GBTC shares on its balance sheet.

Cathie Wood has also expressed her bullish BTC projections severally in the past. In late December 2021, Wood asserted that the flagship cryptocurrency could hit the $500,000 price tag in five years.

Following its latest research, ARK Invest has put forward an even ambitious projection for BTC—$1.36 million per coin by 2030. The research team noted:

“According to our research, Bitcoin’s market capitalization could scale more than 25-fold in the next decade, with each exceeding $1 million in value.”

ARK Invest also highlighted several milestones the benchmark cryptocurrency had scaled in the past few months, including surpassing the $1 trillion valuation mark for the first time in February 2021, the approval of spot BTC ETFs by Canadian regulators, and the approval of Bitcoin Futures ETF by the SEC last October.

Key Bitcoin Levels to Watch — January 27

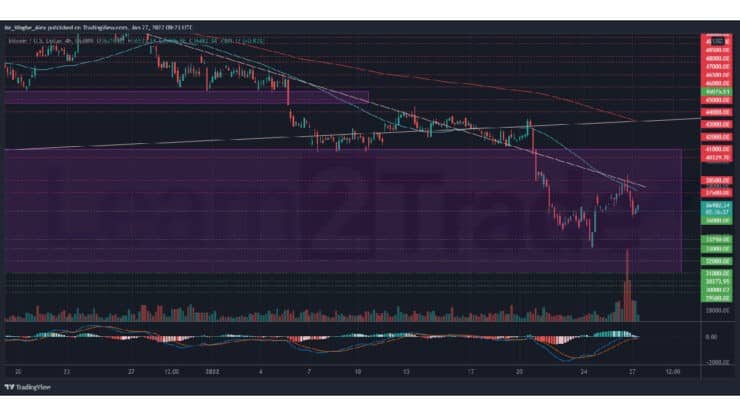

Following a strong recovery from its recent crash, BTC’s bullish momentum hit a snag yesterday, falling back to the $36,000 support, on some hawkish comments from the recently-concluded FOMC meeting. At press time, the benchmark cryptocurrency has neatly bounced off the support, building a good case for sustained bullish momentum.

The immediate barrier for bulls is the $38,500 line, which would put BTC back above the long-prevailing bearish trendline, possibly lending it some support to breach the $41,000 pivot barrier.

Meanwhile, my resistance levels are at $37,500, $38,500, and $40,000, and my key support levels are at $36,000, $35,000, and $33,750.

Total Market Capitalization: $1.65 trillion

Bitcoin Market Capitalization: $691.4 billion

Bitcoin Dominance: 41.8%

Market Rank: #1

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.