El Salvador has gone half a year since it initiated its Bitcoin (BTC) experiment. So far, things do not look so giddy for the Central American nation following the recent market crash.

President of El Salvador, Nayib Bukele, shocked the world in 2021 when he announced the country’s plans to adopt Bitcoin as a legal tender and hold it in its balance sheet. Spending over $85 million within six months on a volatile asset like BTC is a risk on its own. Since BTC suffered a 50% retracement after hitting a new record high at $69,000, Bukele’s administration has come under criticism.

The benchmark cryptocurrency touched the all-time high in November and has been on a downward slide ever since. The most recent retracement came over the past few days, with the cryptocurrency shedding over $10,000 to touch its lowest point since before El Salvador’s Bitcoin venture.

At press time, BTC trades at $36,650, following a $3,500 surge in the last 24 hours. This means that El Salvador’s entire BTC holding is down by over 23%. The country holds a total of 1,801 BTC, presently valued at $66 million from the over $85 million investment.

Regardless, Bukele remains unfazed by the recent market dump, even taking to Twitter to make jokes about a new position in McDonald’s.

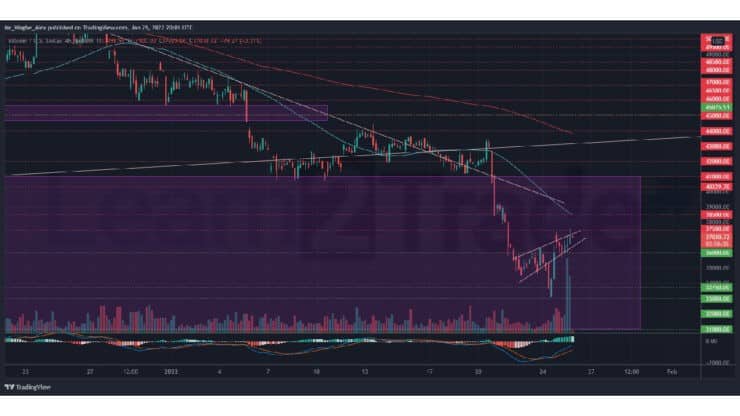

Key Bitcoin Levels to Watch — January 25

After suffering its worst sell-off in months, BTC finally caught a break at the $33,000 support yesterday, a six-month low. The benchmark cryptocurrency appears to have attracted numerous buyers at that support level but lacks the coordination to breach the $37,500 barrier. BTC has now recorded two rejections from that resistance, suggesting that a bearish charge could ensue in the coming days due to the formation of a double-top pattern.

While a sustained break above the $37,500 barrier could stall the bearish continuation, BTC is more likely to fall again to the $35,000 zone in the near term.

Meanwhile, my resistance levels are at $37,500, $38,500, and $40,000, and my key support levels are at $36,000, $35,000, and $33,750.

Total Market Capitalization: $1.66 trillion

Bitcoin Market Capitalization: $697.4 billion

Bitcoin Dominance: 41.9%

Market Rank: #1

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.