On Thursday, Bitcoin (BTC) recorded its 357th difficulty adjustment, which drove it 9.3% higher than two weeks before. That said, the Bitcoin network mining difficulty tapped a new record high at 26.64 a few hours ago.

Notably, the last record high got recorded on May 15, 2021, when the networks peaked at over 25 trillion. At that time, Bitcoin’s mining difficulty recorded a spike to 21.53% at block height 683,424, making it significantly hard to solve blocks.

However, a massive plunge occurred in summer 2021 due to the China ban on cryptocurrency mining activities across the Asian nation. Following this ban, the BTC network recorded its most significant downward correction in history after it fell by 27.9% at block height 689,472.

The most recent difficulty adjustment occurred on Thursday evening and was the highest on record in the entire 13 years of existence of BTC. At press time and for the next two weeks, Bitcoin’s mining difficulty is exactly at 26,643,185,256,535. Interestingly, the negative adjustment came a few days before the primary cryptocurrency suffered a devastating crash and its global Hashrate slumped.

At press time, the BTC global hashrate stands just above 160 exahash per second (EH/s). Just before the difficulty adjustment, the flagship cryptocurrency’s hashrate coasted along 218 EH/s, 28% higher than the current hashrate.

Key Bitcoin Levels to Watch — January 23

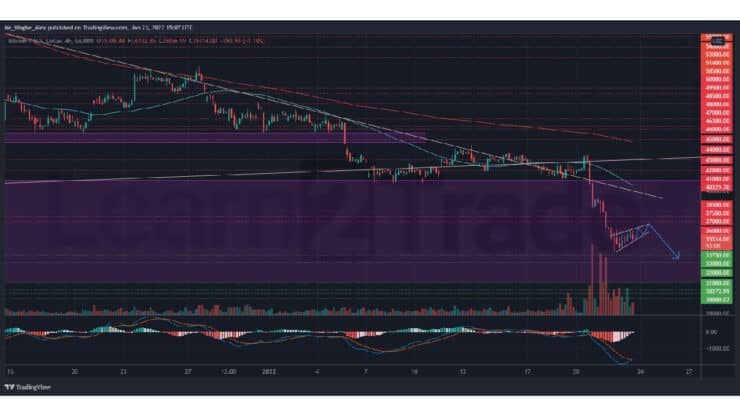

After over two weeks of consolidation between $44,000 and $41,000, BTC finally gave way to bears as the benchmark cryptocurrency lost all composure and slumped by over 20% within 48 hours. The primary cryptocurrency recorded a bottom at $34,000 yesterday before rebounding mildly to the upper-$35,000 region.

That said, this mild rebound appears to be a bull trap as the formation of a bull flag becomes clearer. If the current mild recovery does not get amplified and force a breakout above the upper end of my bull flag, we should see another slump to the $32,000 region this week.

Meanwhile, my resistance levels are at $36,000, $37,000, and $37,500, and my key support levels are at $34,000, $33,000, and $32,000.

Total Market Capitalization: $1.63 trillion

Bitcoin Market Capitalization: $668.3 billion

Bitcoin Dominance: 41%

Market Rank: #1

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.