Bitcoin (BTC) suffered another wave of sell-off in the Asian session on Thursday, as it fell to the $34,337 low. The rest of the cryptocurrency industry suffered the same fate, as the total market capitalization fell to the $1.5 trillion mark again.

Many analysts argued that the $35,000 level was a critical level for the benchmark cryptocurrency and that a sustained breach below this level could spur additional sell-offs. That said, speculation over the next support level and whether a near-term recovery was possible flooded the crypto space on Thursday.

Notably, the refreshed bearish momentum came due to the risk flight by investors across the financial markets after Russian forces invaded Ukraine on Thursday after Russian President Vladimir Putin said that the country would carry out a “special” military operation in Ukraine and called for Kyiv to surrender.

The broadcast triggered a widespread crash across the equities and crypto market this morning, highlighting the tight correlation between both markets.

Meanwhile, stablecoins recorded the highest overnight trading volume amid the frenzied flight to safe-haven assets. Tether (USDT) recorded a 24-hour trading volume surge of over $50 billion, while Binance USD (BUSD) and USD Coin (USDC) trading volumes spiked by about $8 billion collectively.

With reports of bombing and aggressive military operations in Ukraine, investors remain on edge over a possible retaliation from western powers. Already, the US has imposed some sanctions against Russia and has promised to impose even stricter sanctions. Also, the EU is set to impose “the harshest sanctions ever” on Russia, according to the EU foreign policy chief.

Key Bitcoin Levels to Watch — February 24

As mentioned earlier, BTC continues to suffer intense bearish pressure amid the prevailing risk-off mood in the market, as the benchmark cryptocurrency inches closer to its 2022 low of $33,150.

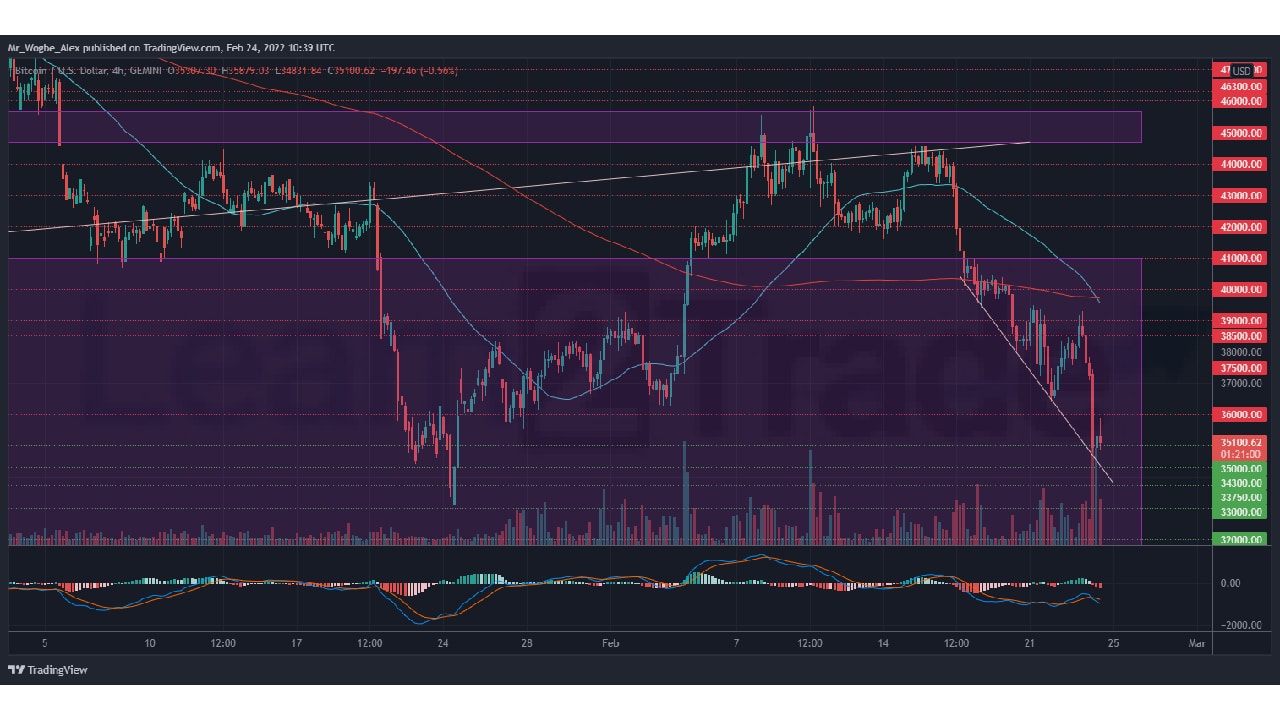

Notably, we can see the completion of a bearish golden cross pattern on the 4-hour chart, indicating that the bearish trend could persist longer. That said, I expect a sighting of the $33,000 low this week as the market fall to bearish forces.

Meanwhile, my resistance levels are at $36,000, $37,500, and $38,500, and my key support levels are at $36,320, $36,000, and $35,000.

Total Market Capitalization: $1.57 trillion

Bitcoin Market Capitalization: $666.9 billion

Bitcoin Dominance: 42.4%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.