Bitcoin (BTC) suffered another debilitating blow on Tuesday as it fell to the lower $36,000 end amid the worsening geopolitical tensions between Russia and Ukraine. That said, many analysts now opine that $30,000 could come into view again.

Today’s drop to the $36,370 low makes it the third consecutive daily decline for the benchmark cryptocurrency after Russian President Vladimir Putin recognized two self-proclaimed separatists in Eastern Ukraine and ordered troops to secure the area.

While Bitcoin plummeted near its monthly low at $36,270, a decline that began on February 16, gold has performed remarkably better over the same period, reaching its highest point since June.

Commenting on the ongoing development, John Roque of 22V Research noted on Monday:

“In the globe’s latest maelstrom — U.S./Russia/Ukraine — Bitcoin, the asset purported to be the answer to every question, has quietly weakened and is notably underperforming its arch-enemy, gold.”

Roque forecasted that BTC could fall to $30,000, a low not seen since July 2021, due to the temporal migration of investors from BTC to safer assets like gold.

Also, co-founder and managing partner of Nexo, Antoni Trenchev, noted: “Bitcoin’s inability to hold $40,000 amid heightened Ukraine tensions means $30,000 is back in play,” adding “Geopolitics has, for now, replaced inflation as the primary driver of both traditional and crypto markets.”

Key Bitcoin Levels to Watch — February 22

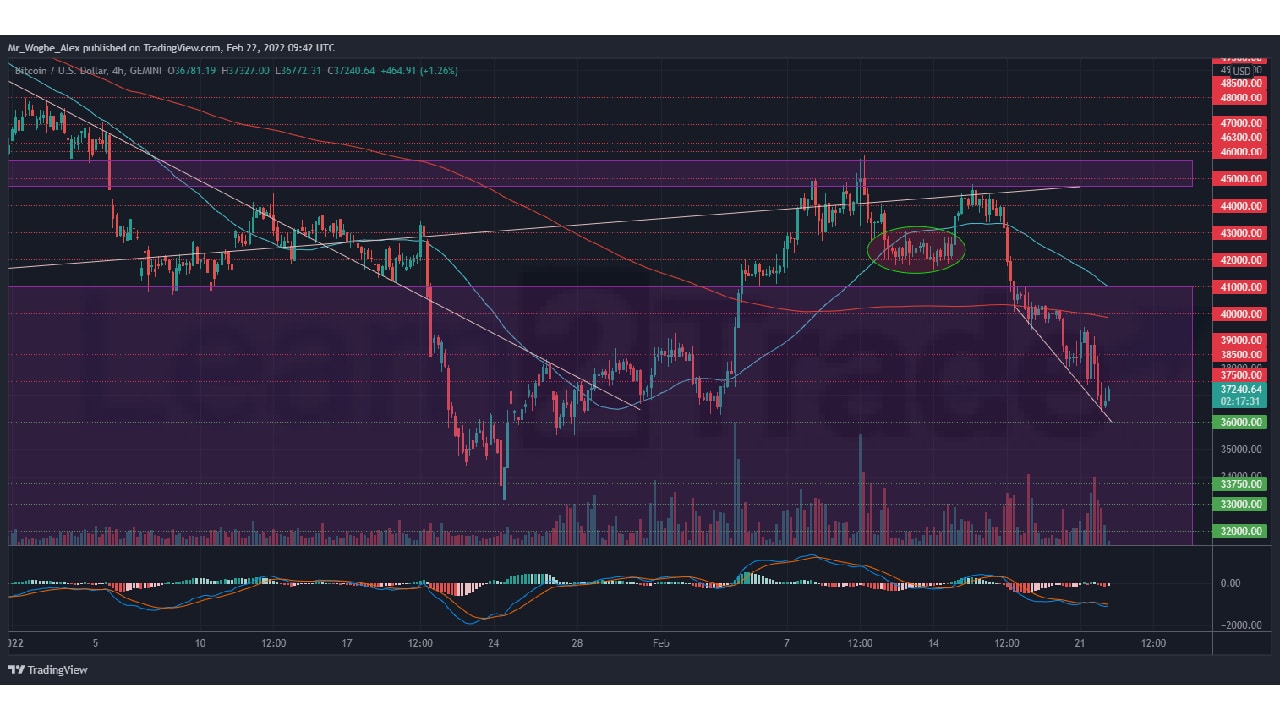

After barreling to a multi-week low at $36,370 earlier today, BTC appears to have entered a minor bullish correction before a possible continuation lower. The rebound comes after the benchmark cryptocurrency hit my mini descending trendline on the 4-hour chart, which has repelled the price on contact for the past week.

That said, BTC needs to secure a break above the critical $39,000 level in the near term to negate the current bearish sentiment. Considering the prevailing conditions in the global macroeconomic space, a bullish push above the previously mentioned critical level seems unattainable.

Meanwhile, my resistance levels are at $38,500, $39,000, and $40,000, and my key support levels are at $36,320, $36,000, and $35,000.

Total Market Capitalization: $1.67 trillion

Bitcoin Market Capitalization: $707.4 billion

Bitcoin Dominance: 42.2%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.