Bitcoin (BTC) has refreshed its downward trend, as bears snapped the $40,000 support overnight and sent the price to the $38,000 low.

The current bearish sentiment comes amid the growing Russia-Ukraine political tensions, which has prompted investors to dump risky assets like stocks and bonds for less risky ones like gold and safe-haven currencies. That said, with the standoff appearing to have no ease off in sight, the crypto market could record even steeper losses in the medium term.

Commenting on the recent macroeconomic development and its effects on the crypto market in a newsletter last Friday, head of research at Coinbase Institutional David Duong narrated: “Crypto performance in the last week shows us that there’s very little room for complacency regarding any of the major themes impacting this market.” Duong added: “Open conflict could potentially affect bitcoin hash rates, which could exacerbate the knee-jerk market reaction weaker for high-beta risk assets like crypto.”

Also, the ongoing developments have put the broad narrative held by the crypto community that Bitcoin is a hedge against market-moving macroeconomic events. This narrative has failed to hold up since the standoff between Russia and the west over a possible invasion of Ukraine worsened. Instead, BTC has shown a close correlation with risky assets like stocks.

With this, it is increasingly possible that the near-term price action of Bitcoin and the broader crypto market will get dictated by developments from the standoff.

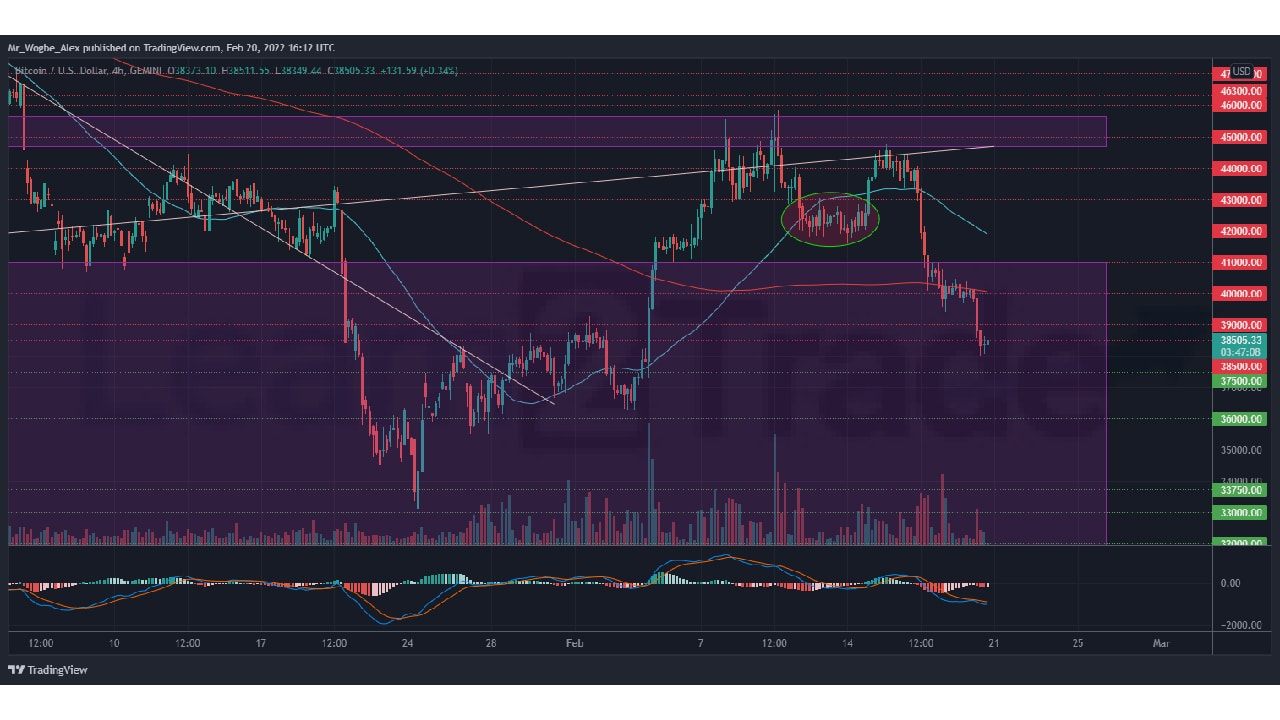

Key Bitcoin Levels to Watch — February 20

After defending the $40,000 support for the past two days, BTC bulls finally gave in to pressure, as the benchmark cryptocurrency tumbled overnight to the $38,000 low. While the bearish trend appeared to ease around the $38,000 psychological support, it remains unlikely that bears have run out of steam.

That said, we could see a bull trap over the coming hours and days, with BTC attempting the $40,000 price point. Currently, I reckon that bears have their eyes on the $36,000 monthly low.

Meanwhile, my resistance levels are at $38,500, $39,000, and $40,000, and my key support levels are at $37,500, $37,000, and $36,000.

Total Market Capitalization: $1.71 trillion

Bitcoin Market Capitalization: $729.4 billion

Bitcoin Dominance: 41.7%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.