Despite Bitcoin (BTC) currently trading about 36% lower than its November 10 all-time high of $69,000, new on-chain reports show that the number of BTC tokens on crypto exchanges has plummeted to its lowest levels in about ten months.

According to prevailing statistics, the number of all BTC on crypto exchanges at a small 2.363 million coins, worth $103.9 billion at press time. Also, the number of existing coins in the market equates to only 13.7% of the total circulating BTC supply, with a market cap of $836.6 billion.

While 2.363 million BTC might seem like a lot, it is 8.88% lower than the number of Bitcoins held by crypto exchanges in late July last year. Lesser BTC supply on crypto exchanges signifies an overwhelming bullish outlook for the cryptocurrency, as it indicates that investors have no intentions of selling soon.

That said, a combined report from Bituniverse, Peckshield, Etherscan, and Chain.info show that San Francisco-based exchange Coinbase holds the most BTC with 853,530 coins in reserves, roughly 36% of all exchange-based BTC.

Binance comes in second place, with 339,870 BTC in reserves (14.3% of all exchange-based BTC), worth $1.495 billion.

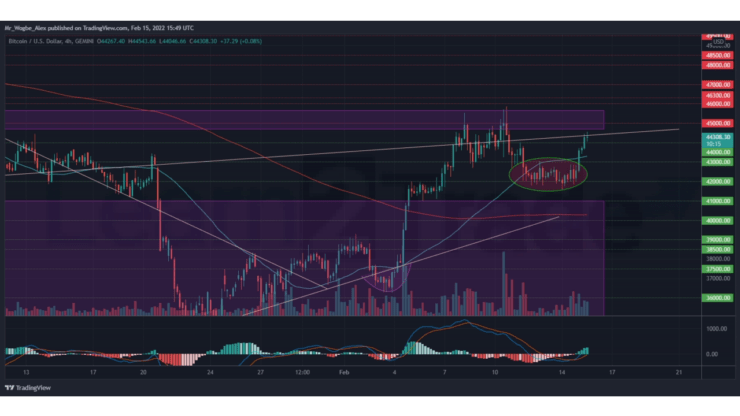

Key Bitcoin Levels to Watch — February 15

Following a three-day sideways retreat after a sharp correction near the $46,000 area, BTC has regained a healthy bullish sentiment, as it snapped the $44,000 resistance and attached itself to my ascending trendline.

That said, the flagship cryptocurrency appears to lack the bullish coordination to reclaim the upper limit of the trendline and continues to stall below the mark. I expect to see a mild correction lower over the coming hours, which should help BTC gather some buyers to facilitate another rebound and a possible breach of the trendline and into the $45,650 – $44,650 pivot area. The coming hours will be critical for the primary cryptocurrency in reclaiming the $46,000 top in the near term.

Meanwhile, my resistance levels are at $44,400, $45,000, and $46,000, and my key support levels are at $44,000, $43,000, and $42,000.

Total Market Capitalization: $1.98 trillion

Bitcoin Market Capitalization: $836.8 billion

Bitcoin Dominance: 42.2%

Market Rank: #1

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.