According to new research reports, only a minority group of wallets hold the lion’s share of Bitcoin (BTC). The report revealed that the top 1% of wallets control more wealth than most affluent households in the US.

More surprisingly, the top 0.01% of Bitcoin holders control 27% of all BTC in circulation. The details emerged from a Wall Street Journal report on December 20, explaining the dynamics of Bitcoin supply and its concentration regions.

Meanwhile, a study released by the National Bureau of Economic Research showed that the top 10,000 BTC addresses held over 5 million coins, worth roughly $242.5 billion at press time. The report described this as having a higher market valuation than the 46th-largest company in the world, ICBC.

The research also noted that with an estimated 114 million BTC wallets globally, this small group (10,000 wallets) controls 27% of the 18.9 million coins currently in circulation. However, the report failed to specify if these addresses belonged to exchanges or custodians.

Furthermore, the Bitinfocharts BTC rich list shows that the Binance cold wallets, Binance’s offline storage wallets, are the top two wallets among the 10,000, holding a combined 433,490 BTC currently worth over $21 billion.

The crypto figures reflect the growing problem of wealth inequality in the US—where the top 1% of households control about 75% of all wealth based on a report by the Federal Reserve.

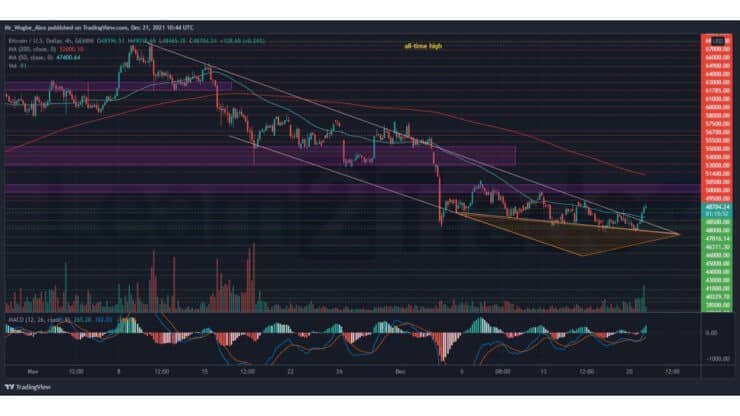

Key Bitcoin Levels to Watch — December 21

BTC recently recorded a 7.5% overnight spike, following a bullish comeback in the Turkish lira (TRY). The benchmark cryptocurrency touched the $49,000 top a few hours ago and currently shows no sign of slowdown.

This bullish breakout comes following a steady decline within a bearish wedge. That said, bulls will likely capitalize on this leg up and push the benchmark cryptocurrency into the $51,500 – $50,500 pivot zone in the coming days, where they can break the current bearish hold on the market.

However, a fall below the $47,000 – $46,000 range could perpetuate the bearish bias longer and open the doors to $43,000.

Meanwhile, my resistance levels are at $49,500, $50,000, and $50,500, and my key support levels are at $48,000, $47,000, and $46,000.

Total Market Capitalization: $2.26 trillion

Bitcoin Market Capitalization: $921.1 trillion

Bitcoin Dominance: 40.8%

Market Rank: #1

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.