As Bitcoin (BTC) struggles to keep bears at bay, the United States Securities and Exchange Commission (SEC) has announced the postponement of its decision on the Bitwise Bitcoin ETP Trust and Grayscale Bitcoin Trust applications.

The regulatory authority issues two separate extension dates for both applications to decide whether to approve, reject, or “institute proceedings to determine whether to disapprove” the applications. The SEC noted in its memo sent to both firms that:

“The Commission finds that it is appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the comments received.”

That said, analysts expect the watchdog to decide on the Bitwise Bitcoin ETP Trust Grayscale Bitcoin Trust on February 1 and February 6, 2022, respectively.

In early October, Bitwise Asset Management sent an application to the NYSE Arca for a BTC ETF. With the ETF, the firm plans to give its clients exposure to “actual BTC” rather than derivatives like Bitcoin futures contracts.

Meanwhile, Grayscale Investments—the world’s largest digital currency asset manager—submitted a filing around the same time as Bitwise to the SEC to convert its Grayscale Bitcoin Trust (GBTC) into a BTC Spot ETF.

Key Bitcoin Levels to Watch — December 19

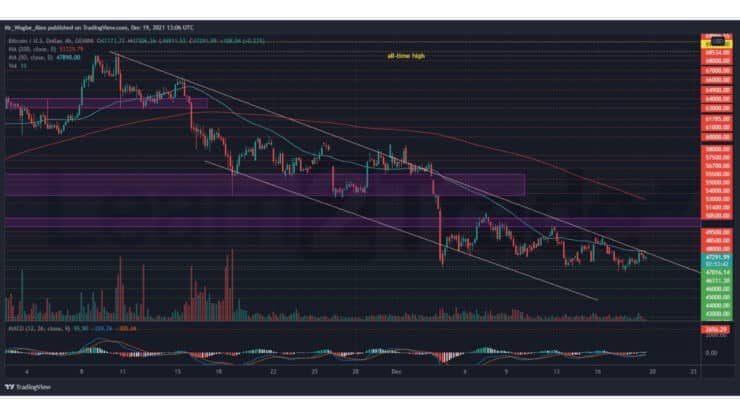

BTC continues to toe a bearish path as it records bullish exhaustion at the $48,000 top from yesterday’s rebound from the $45,700 low. This rejection comes due to the string of resistance properties at the $48,000 line, considering the confluence of technical levels, including the 50 SMA line, descending trendline top, and the resistance line.

That said, failure to break this resistance in the near term could confirm another leg down for BTC, as the $45,000 support comes into view for the primary cryptocurrency.

Meanwhile, my resistance levels are at $48,000, $48,500, and $49,500, and my key support levels are at $46,300, $46,000, and $45,000.

Total Market Capitalization: $2.21 trillion

Bitcoin Market Capitalization: $893 trillion

Bitcoin Dominance: 40.3%

Market Rank: #1

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.