Bitcoin (BTC) and most of the crypto market breathed a breath of fresh air late yesterday, following a favorable reaction to the recently-concluded US Federal Reserve meeting, as the Fed opted to keep its rates unchanged.

The end-of-year policy focuses on promoting jobs and gaining price stability in the medium term. The official PR of the Fed cited the upbeat evolution of the economy, which inspired optimism in spectators across the financial markets. The PR noted that:

“With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen … Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to US households and businesses.”

The US Fed also revealed its plans to tackle rising inflation, phasing out its bond-buying program, and promote job creation.

Bitcoin reacted positively to the development and rallied by over 6% from its daily low of $46,540 to $49,500 within a few hours. That said, the Fed meeting played a critical role in the fresh BTC leg up.

However, the markets are not out of the woods yet and retain some bearish vestiges. The Bitcoin Fear and Greed Index shows that the benchmark cryptocurrency is in “extreme fear” territory, as traders remain skeptical about placing aggressive longs.

Key Bitcoin Levels to Watch — December 16

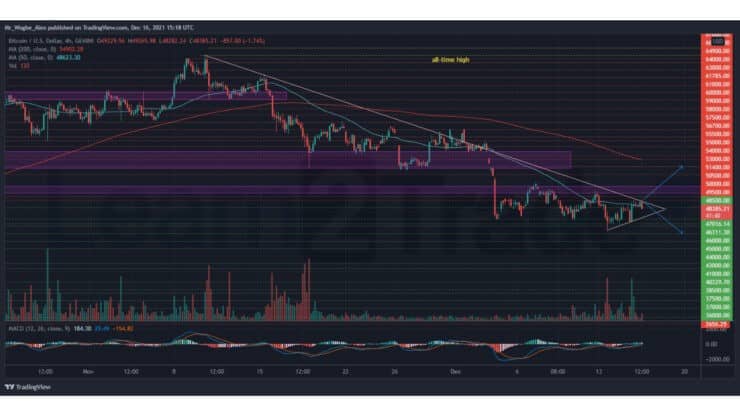

As projected in my last analysis, BTC has regained some bullish traction, which pushed it to the $49,500 top today. In line with the last analysis, the benchmark cryptocurrency recorded a slowdown around that area, given that it coincides with my descending trendline.

That said, the cryptocurrency now faces a critical juncture and should react erratically soon. As illustrated, a rejection from the trendline, the more likely course of action, could open the doors to $45,000 and lower for Bitcoin. However, a bullish candle close above the trendline should extend additional support to bears and set the price on course to the $54,000 pivot zone.

Meanwhile, my resistance levels are at $49,500, $50,000, and $50,500, and my key support levels are at $48,000, $47,000, and $46,000.

Total Market Capitalization: $2.26 trillion

Bitcoin Market Capitalization: $917.5 trillion

Bitcoin Dominance: 40.6%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.