Bitcoin (BTC), alongside the global stock markets, continues to suffer FUD amid the emergence of the Omicron COVID-19 variant.

A risk-off sentiment in global financial markets, continued bond tapering efforts by the Federal Reserve, and high leverage on BTC derivatives are all near-term volatility-inducing factors for Bitcoin’s price action.

Despite all these, the on-chain metrics for BTC remain bullish, which could provide investors with more buying opportunities in the event of increased liquidations or stock market volatility. This bullish standing remains as long as HODLers and miners for not dumping their holdings along with the pullback.

HODLers and miners increasingly dumping their holdings are of significant concern to the market, especially bulls. However, the recent price fall, which coincided with a fall of exchange reserves to multi-year lows, makes it increasingly unlikely for the prevailing FUD to trigger a Bear market.

Exchange reserves refer to the number of coins getting transferred from private wallets into exchanges and are typically regarded as a bearish sign. On the other hand, declining exchange reserves indicates a firm accumulation trend and is typically a bullish sign.

Since November 1, all Bitcoin on crypto exchanges has dropped by over 62,500 BTC, putting the total exchange reserve to a record multi-year low of 2.3 million BTC. This means that about 89% of all BTC in circulation is not available for sale.

Key Bitcoin Levels to Watch — December 2

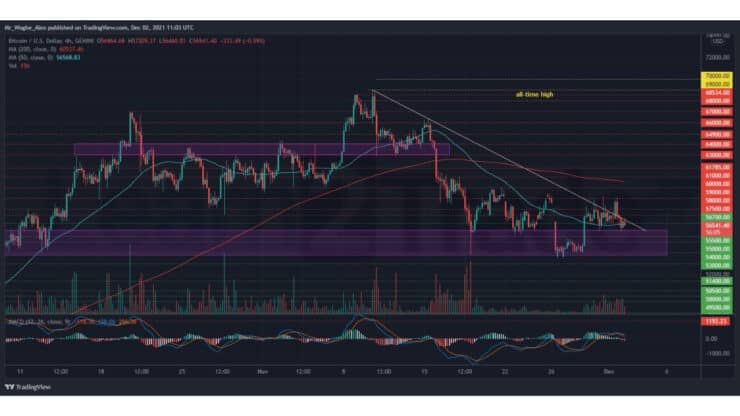

Following a mild bullish move yesterday, BTC touched the $59,000 resistance but failed to break above this crucial line for the third time in three days, indicating that this has become the critical level for bulls to clear to reinstate a bullish sentiment.

The primary cryptocurrency briefly fell below the $56,000 pivot base yesterday but recorded a rebound to the $57,000 mark, just under my descending trendline. Interestingly trading volume appears to have picked up over the last few days, indicating that a bullish breakout might not be far off. The near-term price activity, as we head into the weekend, should determine where BTC goes next amid the prevailing FUD sentiment.

Meanwhile, my resistance levels are at $57,500, $58,000, and $59,000, and my key support levels are at $56,700, $56,000, and $55,000.

Total Market Capitalization: $2.60 trillion

Bitcoin Market Capitalization: $1.06 trillion

Bitcoin Dominance: 41%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.