As Bitcoin (BTC) continues to stagger around $60,000, MicroStrategy has 7,002 BTC to its stash, bringing its total holdings to 121,044 coins. MicroStrategy CEO Michael Saylor broke the news yesterday, tweeting that:

“Microstrategy has purchased an additional 7,002 bitcoins for ~$414.4 million in cash at an average price of ~$59,187 per bitcoin. As of 11/29/21, we hodl ~121,044 bitcoins acquired for ~$3.57 billion at an average price of ~$29,534 per bitcoin.”

With a current BTC price of $57,000, MicroStrategy’s Bitcoin holding now stands at $6.9 billion.

Meanwhile, Saylor recently talked about the possibility of BTC becoming a $100 trillion asset class at an interview. He added that the benchmark cryptocurrency has recorded steady wins against gold, noting that “digital gold is going to replace gold this decade.”

Additionally, the MicroStrategy executive noted that he is losing no sleep over the ongoing regulation talks on the cryptocurrency industry in Washington. Saylor asserted that it could affect security tokens, decentralized finance (DeFi) exchanges, cryptocurrency exchanges, and other crypto products but not Bitcoin, noting that “Bitcoin is unstoppable as [a] digital property.”

Last Friday, Saylor tweeted that: “Bitcoin offers better inflation protection than gold and is growing faster than big tech.” The billionaire CEO believes that BTC “is the only property you can truly own, as well as the first technology capable of granting property rights to everyone on earth.”

Key Bitcoin Levels to Watch — November 30

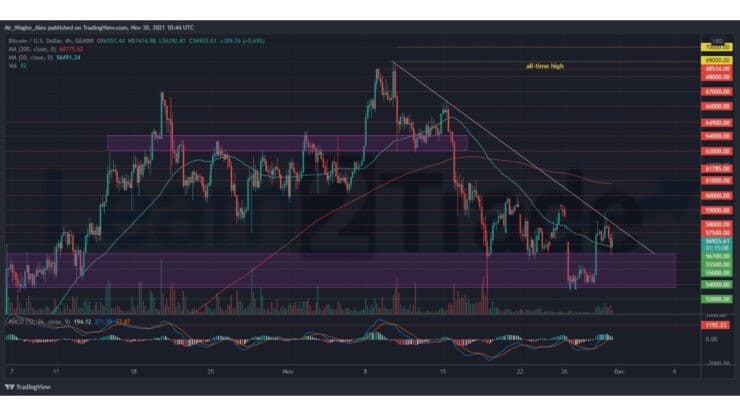

As I projected in the previous analysis, BTC recorded a spike to the upper-$58,000 yesterday but encountered a snag below the $59,000 resistance, which sent the price to the $56,000 pivot top.

That said, the benchmark cryptocurrency has posted a decent rebound to the $57,000 area as the broader market shakes off the previously bearish sentiment. A break above the 57,500 (descending trendline) over the coming hours should secure a bullish foundation for the flagship cryptocurrency as we head into the last month of the year.

As a caveat, any bearish push should get repelled by the $56,000 – $53,755 pivot area.

Meanwhile, my resistance levels are at $57,500, $58,000, and $59,000, and my key support levels are at $56,700, $56,000, and $55,000.

Total Market Capitalization: $2.63 trillion

Bitcoin Market Capitalization: $1.08 trillion

Bitcoin Dominance: 41.4%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.