Bitcoin (BTC) recorded a shock last week after Jerome Powell indicated that the US Fed was committed to sustaining its monetary tightening campaign to tackle inflation. However, the benchmark cryptocurrency appeared to get its leg under it quickly, a pattern some say indicates that the cryptocurrency has bottomed out.

The flagship cryptocurrency is down by 7% since the Powell-induced crash on August 26, but remains solidly above the $20,000 mark. While a drop is not something bulls like to see, this is a fairly controlled fall for a volatile asset like Bitcoin. Even the Nasdaq 100 index is down by over 5% since the Powell comments, eerily close to what BTC suffers.

Commenting on the strong BTC performance, Ed Moya, Senior Market Analyst at Oanda, wrote in a note: “Bitcoin is showing some resilience here as it has clawed back above the $20,000 level, despite widespread stock market weakness.” He added: “Crypto traders are not used to seeing Bitcoin withstand a rout on Wall Street, so this could be a promising sign.”

While $20,000 is miles away from its all-time high of $69,000, for some market participants, it is a solid performance from the flagship cryptocurrency and serves as a gauge of BTC investors’ confidence.

Key Bitcoin Levels to Watch — August 30

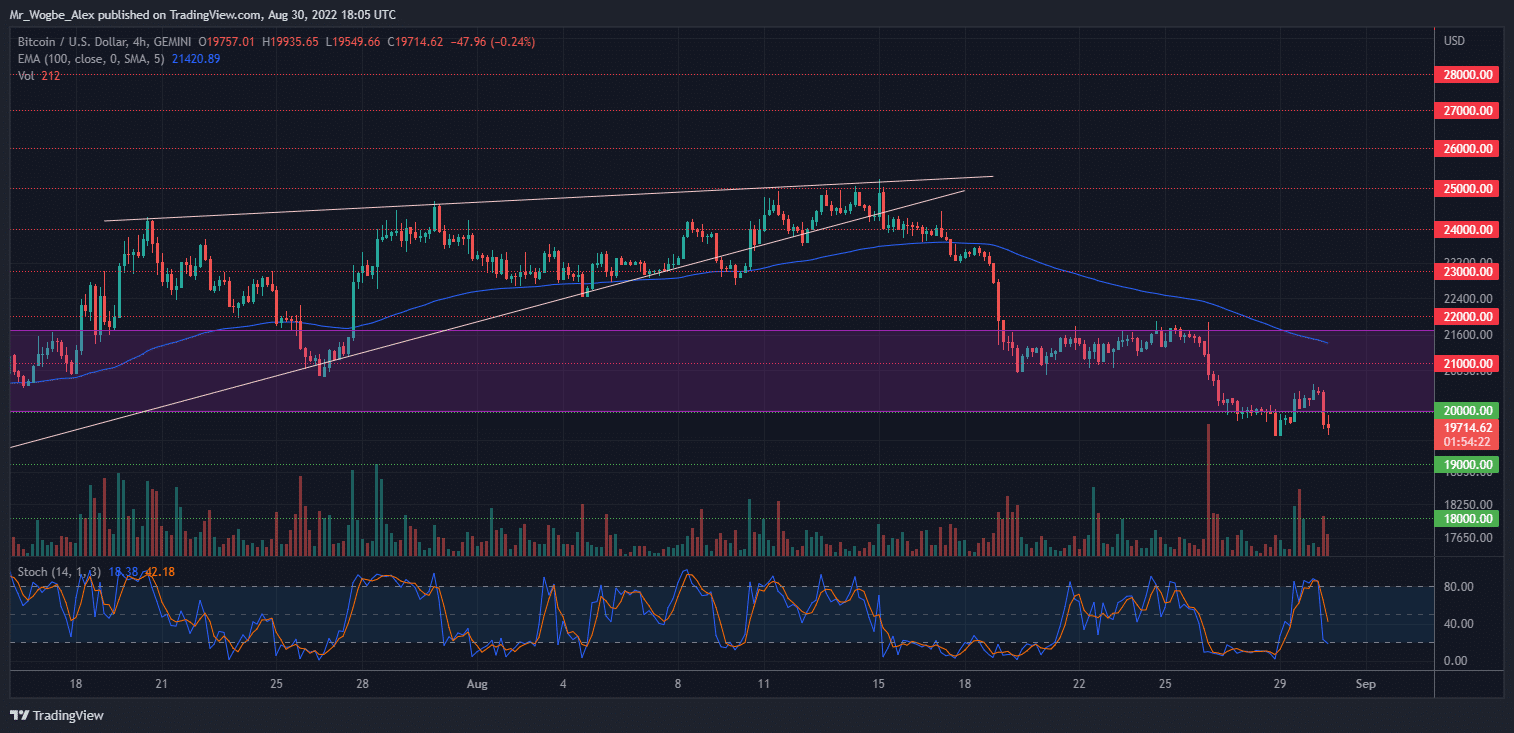

While holding near the $20,000 line, Bitcoin currently trades below that level, as pressure mounts for the crypto giant. The cryptocurrency seems poised to maintain a bearish bias over the coming days, with analysts projecting a return to June lows at $17,580.

With only one day left for the august candle to close, BTC bulls need to fight to secure a close above the $20,000 line. Already, August is primed to end as one of the worst months in 2022. The picture gets even murkier when we factor in the upcoming US Fed rate hike in September.

Meanwhile, my resistance levels are at $20,000, $21,000, and $21,700, and my key support levels are at $19,000, $18,000, and $17,500.

Total Market Capitalization: $954.8 billion

Bitcoin Market Capitalization: $375.5 billion

Bitcoin Dominance: 39.3%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.