Over the weekend, Bitcoin (BTC) slumped to the sub-$20,000 mark as traders took flight from risky assets once again.

Investors responded to warnings made by US Fed Chair Jerome Powell at the recently concluded Jackson Hole symposium, where he said there was a likelihood of a fallout from the bank’s policy plans to curb rising inflation. Crypto investors and traders took the prospect of a significant rate hike as a sign of an end of the free money environment that has supported risky assets for some time now.

Powell snuffed all hopes of a near-term policy reversal by the Fed, hammering in need for a sustained period of below-trend growth coupled with a weaker labor market to get inflation under control.

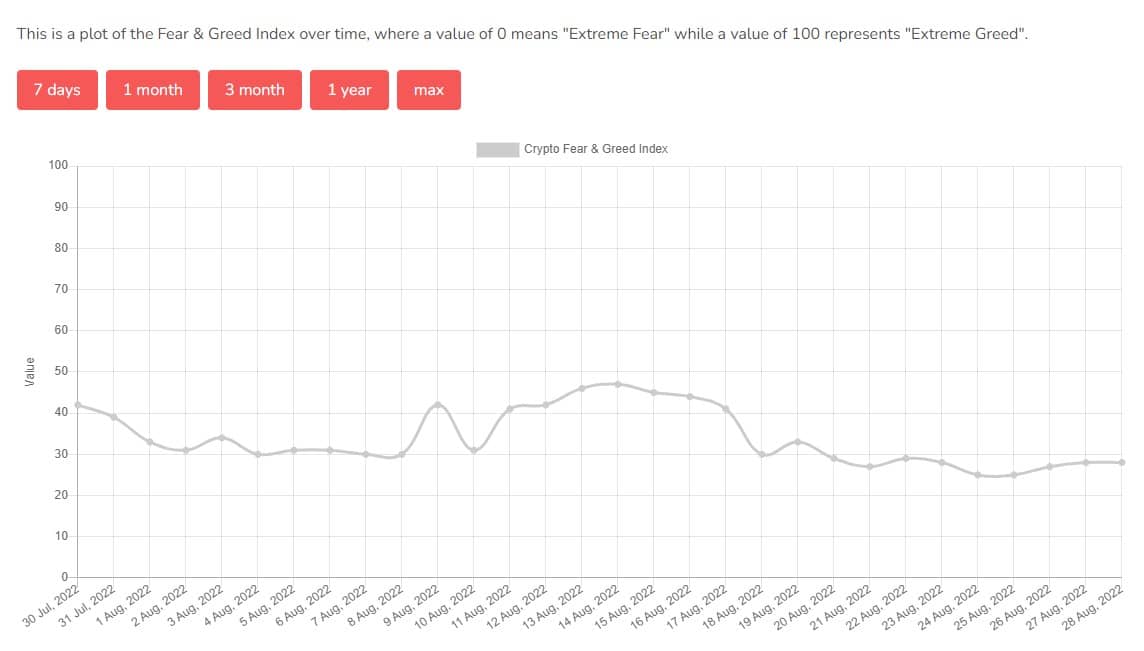

Despite the unfortunate events over the weekend for Bitcoin, the Fear & Greed Index remained unchanged at 28 between Saturday and Sunday. The index managed to keep its head above the 28 mark despite this being the first time BTC would breach the $20,000 mark since mid-July. This sustenance above the “extreme fear” zone is crucial for a comeback for BTC bulls.

That said, analysts believe that a return to the 40 areas would power a recovery above the elusive $25,000 level. Until then, the possibility of a return to 2022 low at $17,580 remains strong.

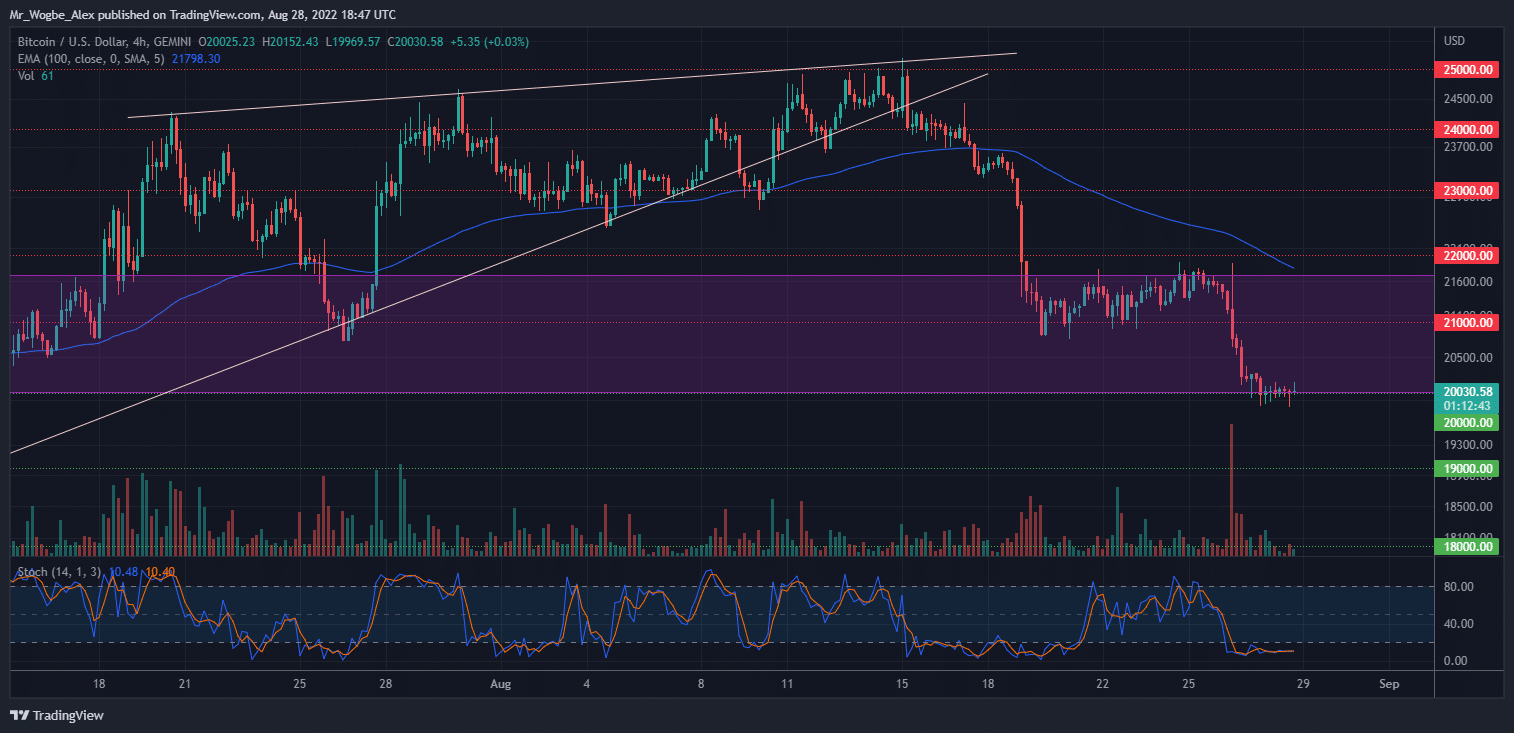

Key Bitcoin Levels to Watch — August 28

After losing the $21,000 handle over the weekend, Bitcoin currently holds the $20,000 mark. The benchmark cryptocurrency needs to maintain this support as it is likely the only line holding it from freefall to the sub-$18,000 mark.

The benchmark cryptocurrency is also coasting in oversold conditions, suggesting that a breach of the $20,000 pivot bottom might be unlikely in the near term.

Meanwhile, my resistance levels are at $21,000, $21,700, and $22,700, and my key support levels are at $20,000, $19,000, and $18,000.

Total Market Capitalization: $968.5 billion

Bitcoin Market Capitalization: $383.2 billion

Bitcoin Dominance: 39.5%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.