Bitcoin (BTC) recorded its worst fall in two months last week, plunging by over 10% after minutes from the July US Fed meeting surfaced.

The recent fall crystallized expectations by many that the benchmark cryptocurrency would extend its decline to the sub-$20,000 region. Some Bitcoin “super-bears,” like Peter Schiff, believe that $10,000 is also on the cards.

As a result, many BTC bulls are slow on placing aggressive bets, especially as the market awaits the Federal Reserve’s 45th annual economic symposium in Jackson Hole, Wyoming on Friday.

Analysts and traders alike are focusing on comments from Fed officials to get clues on what could come next. That said, a dramatic policy change by the central bank is likely to have a lasting effect on Bitcoin and the broader crypto market.

While the Jackson Hole is not a policy-setting event, traders use it as a gauge to see where policymakers’ heads are. The theme for this year’s Fed conference is “Reassessing Constraints on the Economy and Policy.”

US Fed Chair Jerome Powell is expected to talk about the macroeconomic reality facing the Fed and possibly hint at the bank’s next interest rate move. Analysts and traders are curious to know what the Fed’s outlook on inflation is.

Key Bitcoin Levels to Watch — August 25

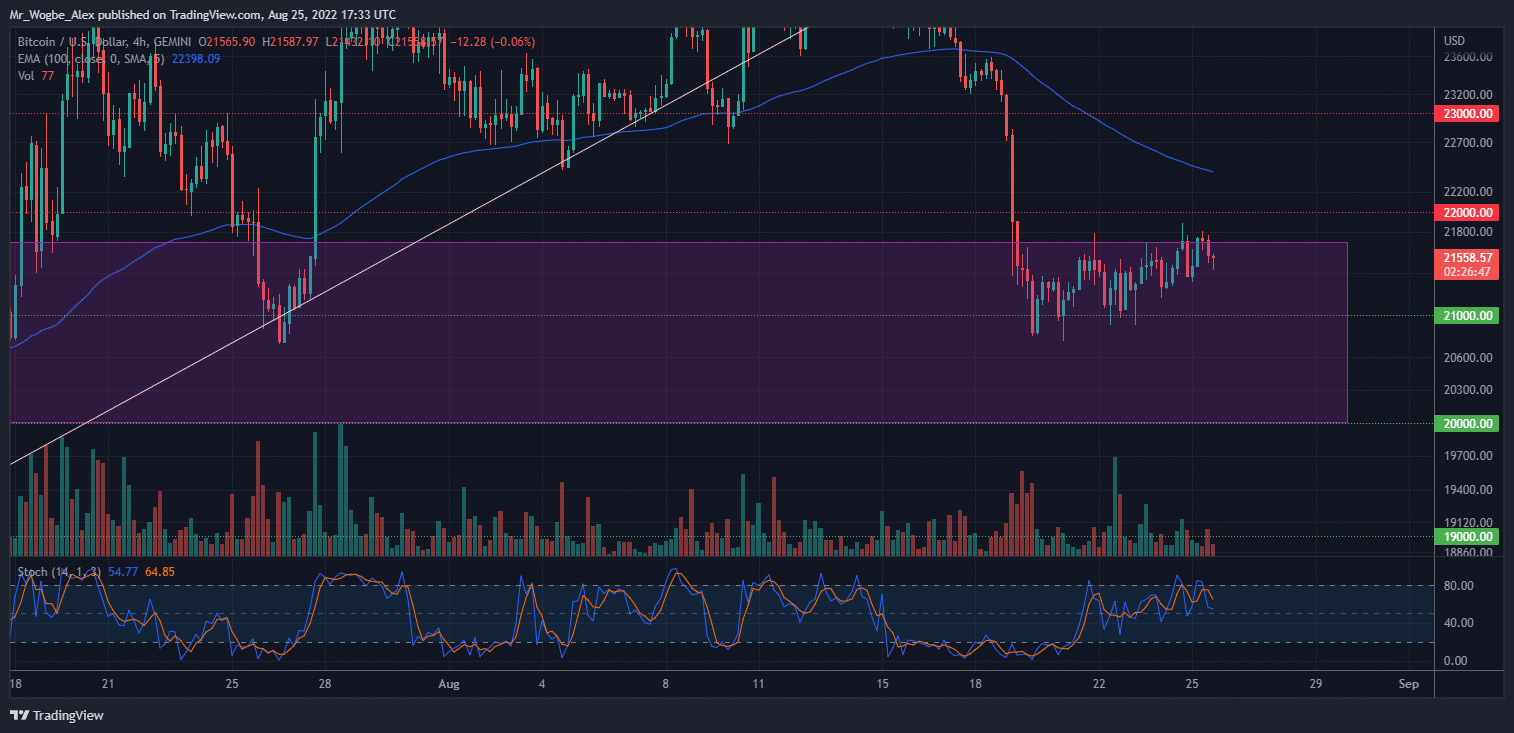

Bitcoin continues to tease along the $21,700 pivot top ahead of the US Fed Jackson Hole symposium tomorrow. That said, I expect to see a continuation in choppiness until the event passes.

A negative reaction to comments from the event would likely trigger a push to the $21,000 support, where bulls would have to fight against a continuation to $20,000 (pivot base). What the price does after that is a different story.

However, a positive reaction to the event would simply expedite a bullish breakout from the pivot zone, setting BTC back into recovery momentum.

Meanwhile, my resistance levels are at $21,700, $22,700, and $23,000, and my key support levels are at $21,000, $20,000, and $19,000.

Total Market Capitalization: $1.04 trillion

Bitcoin Market Capitalization: $411.7 billion

Bitcoin Dominance: 39.5%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.