With the recent activities in the market, it has become evident that Bitcoin (BTC) and the stock market have begun moving in tandem again.

On Friday, the benchmark cryptocurrency saw over 6% of its value chipped away within a few hours, falling to the $39,200 low, as the stock market exhibited similar momentum.

The S&P 500 (SPX) shed 122 points, or 2.77%, and ended the session at a five-week low of 4,271. Similarly, the Nasdaq Composite (IXIC) dropped by 335 points, or 2.55%, to 12,839. Finally, the Dow Jones lost 981 points, or 2.82%, and fell to a multi-week low of 33,811.

That said, the correlation between Bitcoin and the SPX, US30, and NDX has increased significantly over the past months and would likely continue the trend in the meantime.

The two-month-long correlation coefficient between BTC and SPX tapped a high of 0.53 on Friday, its highest point since January 24. A coefficient at or close to 1 would highlight just how solid the relationship between both assets is.

That said, analysts have asserted that this trend will only continue in the near term as investors look for ways to diversify their portfolios and hedge against downside risks.

Key Bitcoin Levels to Watch — April 24

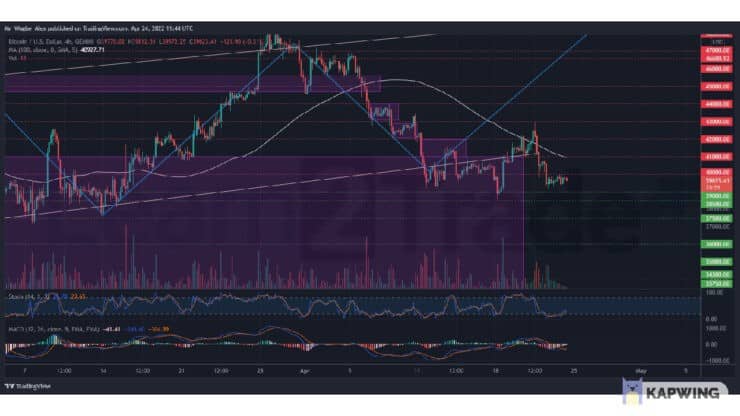

Following its crash from the $43,000 top on Thursday, Bitcoin’s downward spiral has eased off under the $40,000 mark as the benchmark cryptocurrency falls into an aggressive sideways pattern amid minuscule trading volume.

The cryptocurrency has held firmly under the $40,000 mark and above the $39,000 support since Friday despite trading conditions returning to bearish territories. With the prevailing momentum, achieving the $50,000 April target might no longer be possible, considering the number of barriers to scale.

While the bearish momentum might have calmed, BTC could record a leg down to $38,5000 in the near term if the consolidation ensues longer. As such, the flagship cryptocurrency needs a break above the $41,000 level, where the 100 EMA resides, to negate the emerging bear flag.

Meanwhile, my resistance levels are at $40,000, $41,000, and $42,000, and my key support levels are at $39,000, $38,500, and $38,000.

Total Market Capitalization: $1.84 trillion

Bitcoin Market Capitalization: $754.3 billion

Bitcoin Dominance: 40.9%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.