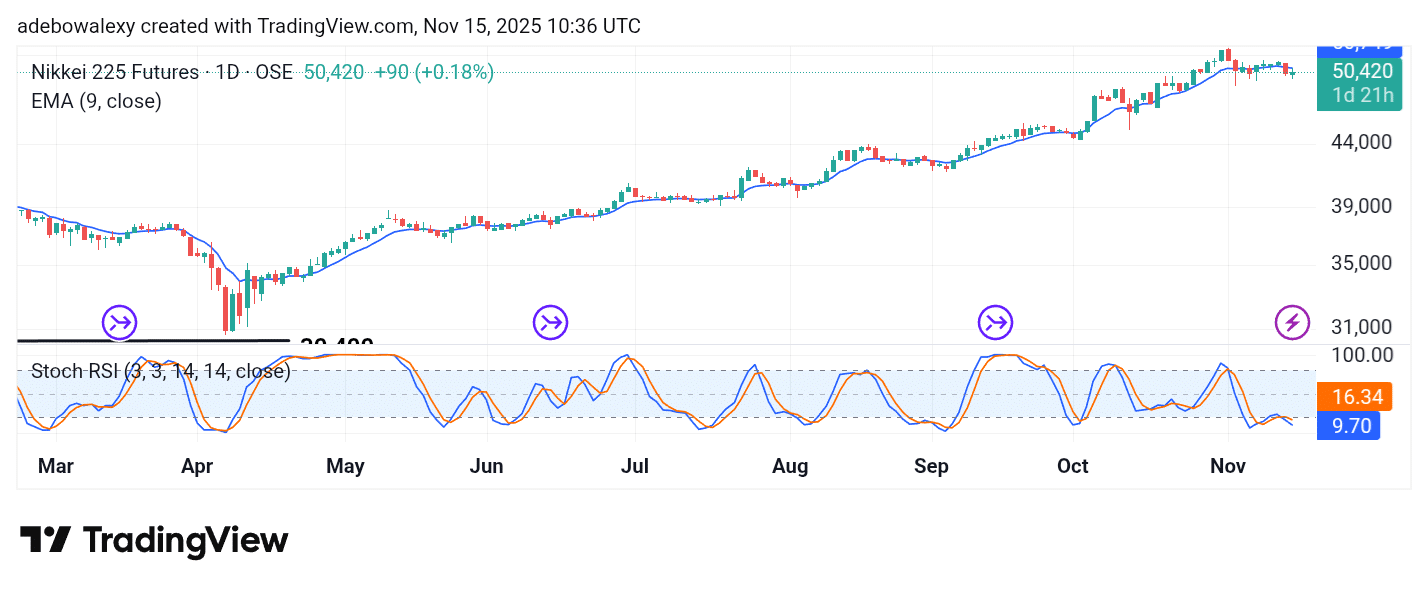

The Japan 225 market saw a sudden regression last Thursday. However, with fading hopes of a Fed rate cut, the market attempted to rebound toward the close of the week. Nevertheless, price activity in this market continues to reflect strong bearish sentiment.

Key Levels

Resistance: 50,000, 52,000, 54,000

Support: 48,000, 46,000, 44,000

NIKKEI Stays Green but Contracts Below Key Levels

Thursday’s trading activity in the Japan 225 market pushed strongly below the 9-day Exponential Moving Average (EMA) line. However, the closing session is represented by a green yet doji-like price candle.

Similarly, the Stochastic Relative Strength Index (SRSI) indicator lines have completed a downward crossover below the 20 threshold of the indicator. The developing lines of the indicator have continued on a bearish path, which sets a clearly bearish tone in this market.

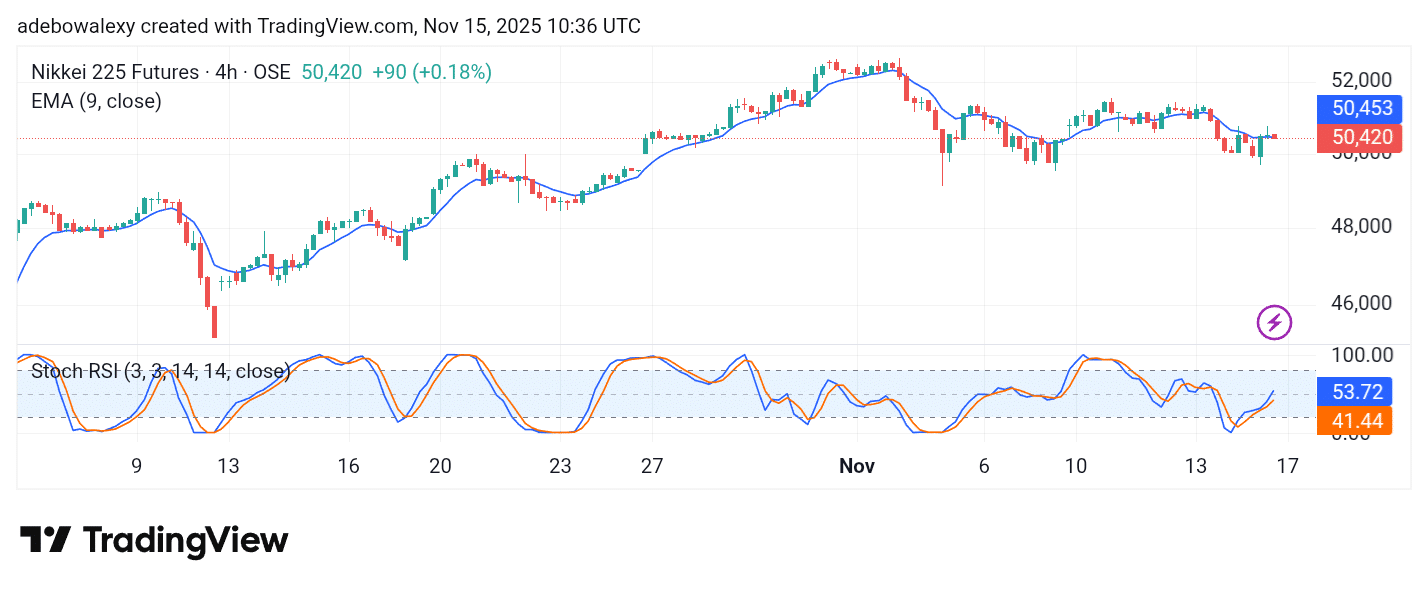

Japan 225 Hugs the 9-day EMA Curve

The last three price candles on the NIKKEI 225 4-hour market are red ones and have edged below the 9-day EMA curve. Meanwhile, the SRSI indicator lines can be seen rising steadily upward from the oversold region.

While this may seem conflicting, the terminal part of the SRSI appears to be diverging as it rises toward the overbought zone of the indicator. Although this could trigger some upward movement, it may still not produce significant progress toward the 52,000 price level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.