The Japan 225 index has retreated from its previous lofty targets over the past week. As a result, the futures now trade below key technical levels, which may deter bullish investors in the market.

Key Levels

Resistance: 52,000, 54,000, 56,000

Support: 50,000, 48,000, 46,000

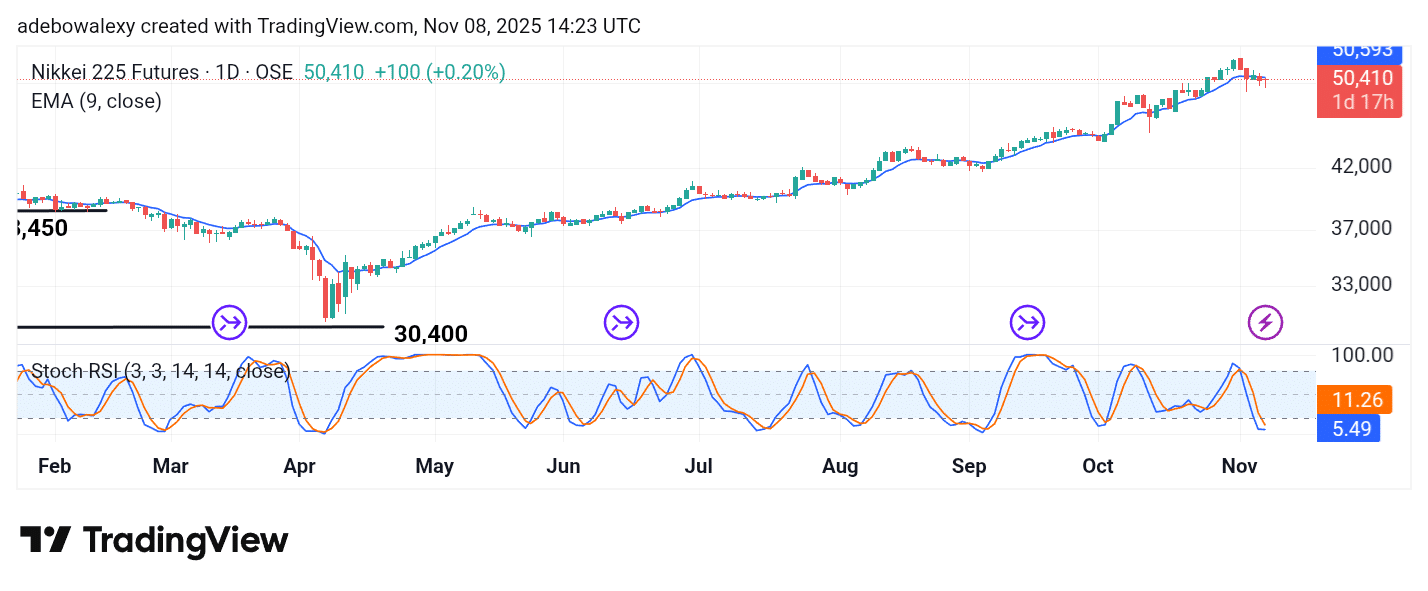

NIKKEI Price Hovers Below the 9-Day EMA

Price activity in the Japan 225 market has clearly experienced a pullback. However, despite the decline, the futures remain only slightly below the 9-day Exponential Moving Average (EMA) line.

The latest price candle on the chart is red, featuring a short upward body with a lower shadow—indicating limited bearish pressure. Meanwhile, the Stochastic Relative Strength Index (SRSI) lines have fallen sharply into the oversold region, even with a modest price decrease. This suggests that downward momentum may soon weaken, and further declines could be limited.

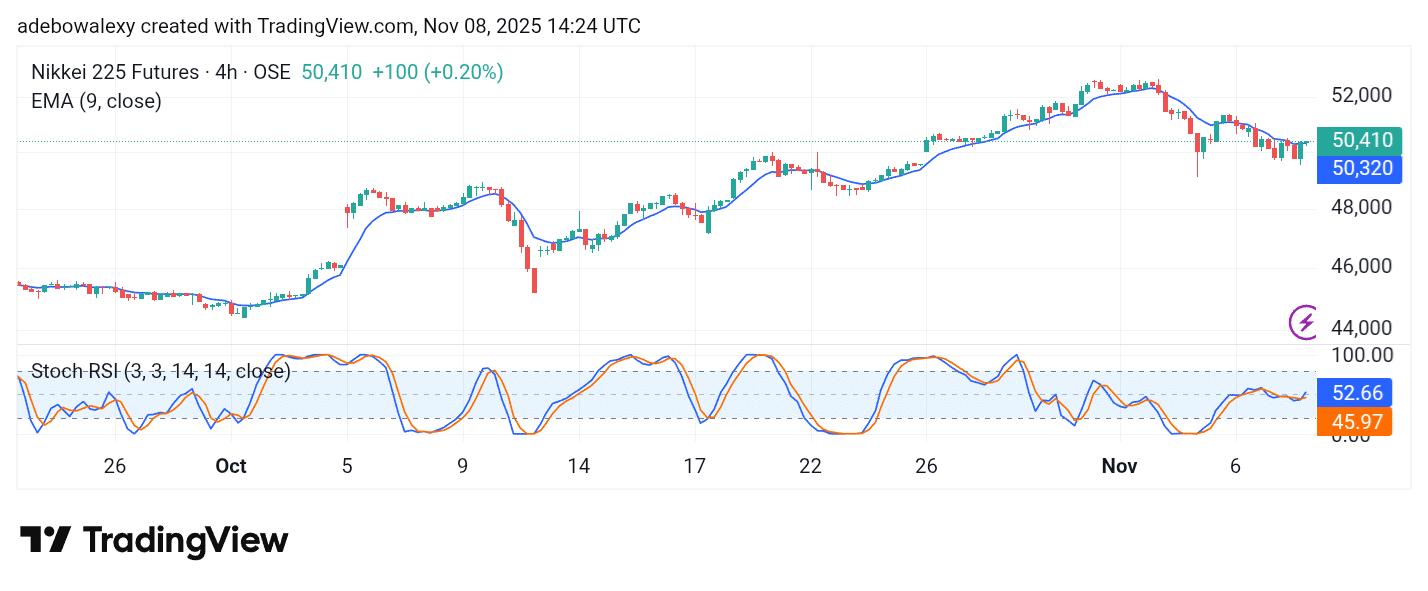

Japan 225 Bulls Launch a Frontal Assault

On the 4-hour chart, price action in the NIKKEI 225 has started to retrace upward. The last two candles on this chart are green, with the most recent one sitting directly on the 9-day EMA curve.

At the same time, the SRSI lines are showing an upward trajectory following a recent bullish crossover. This technical alignment supports the view that price action may soon advance toward the 52,500 level in the near term.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.