In recent days, the Japan 225 has continued to slide lower. It appears that the mixed fundamentals surrounding this market have contributed to its ongoing decline. Currently, price action has fallen below key technical levels, indicating increasing bearish potential.

Key Price Levels

Resistance: 39,000, 39,500, 40,000

Support: 38,000, 37,500, 37,000

Nikkei 225 at Risk of Further Decline

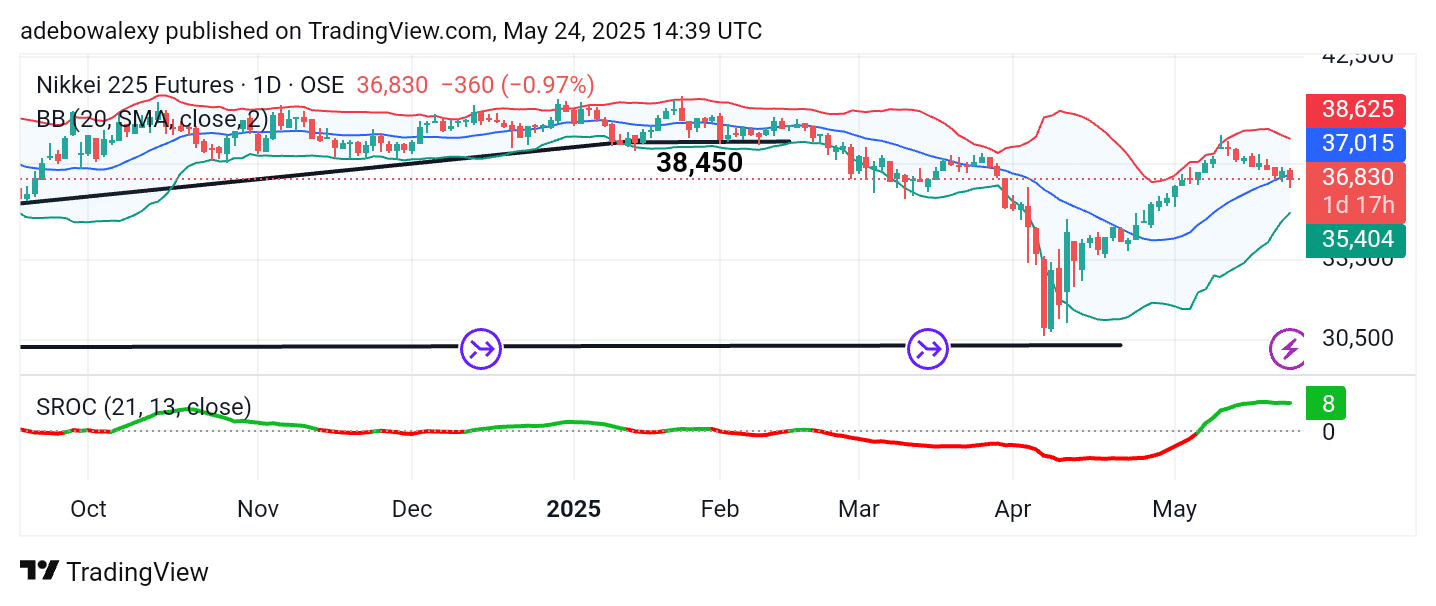

The latest price candle on the Japan 225 chart has slid below the middle Bollinger Band, a technical signal that price action is becoming more vulnerable. Despite this, momentum has remained relatively steady. However, the price candles appear to be contracting further as price action continues to regress.

As a result, the lines of the Smoothed Rate of Change (SROC) indicator remain above the equilibrium level but are moving sideways, suggesting uncertainty. Overall, the position of the last price candle suggests that further downside movement is likely.

Japan 225 Remains Vulnerable

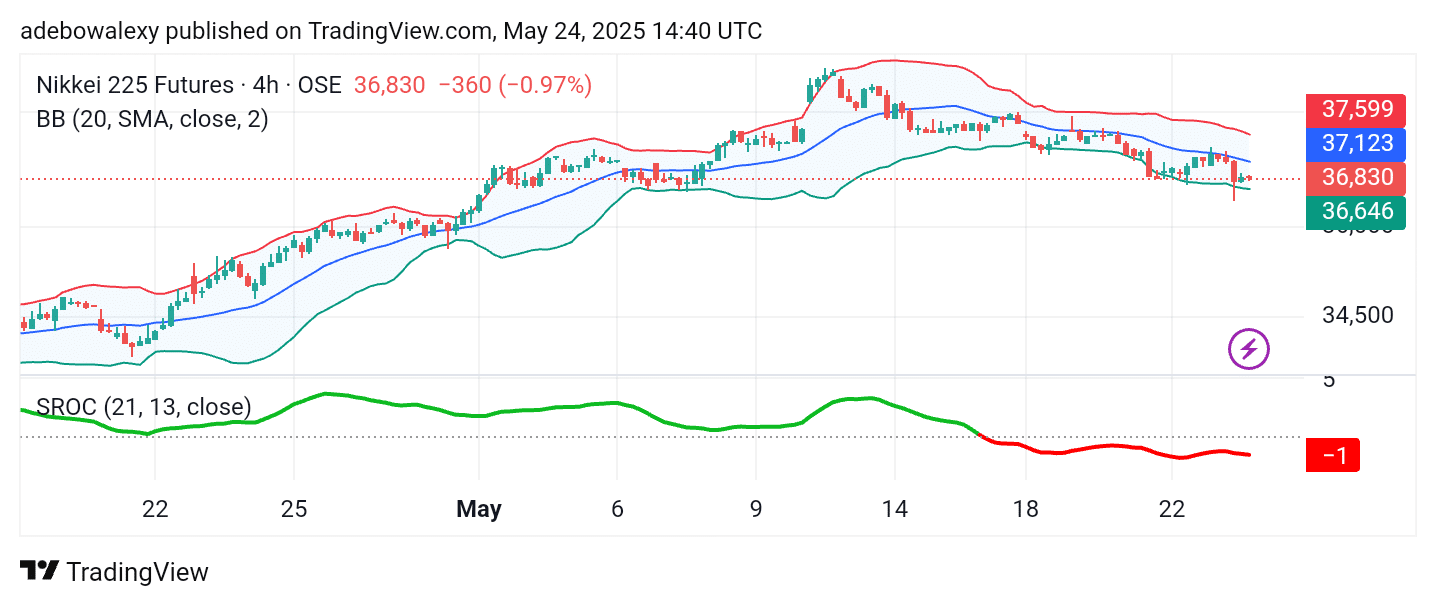

On the 4-hour chart, price activity continues to face downward pressure. The most recent candle is red, indicating a sustained retracement. Price action is positioned below the middle Bollinger Band, while the bands themselves have narrowed, pointing to reduced volatility.

The SROC indicator lines are now below the equilibrium level, with its terminal turning red—signaling a persistence of bearish sentiment in both the short and long term. Nonetheless, traders should remain attentive to upcoming economic data releases that may influence market direction.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.