The Japan 225 ended the week on a negative note, weighed down by a combination of mixed fundamentals. Uncertainty surrounding the U.S. trade landscape, declining oil prices, and weakening U.S. consumer sentiment contributed to the bearish sentiment in the Japanese equity market. Let’s delve deeper into the market conditions and technical outlook below.

Key Price Levels

Resistance: 38,000, 39,000, 40,000

Support: 37,000, 36,000, 35,000

Nikkei 225 Faces Resistance Despite Limited Downside Movement

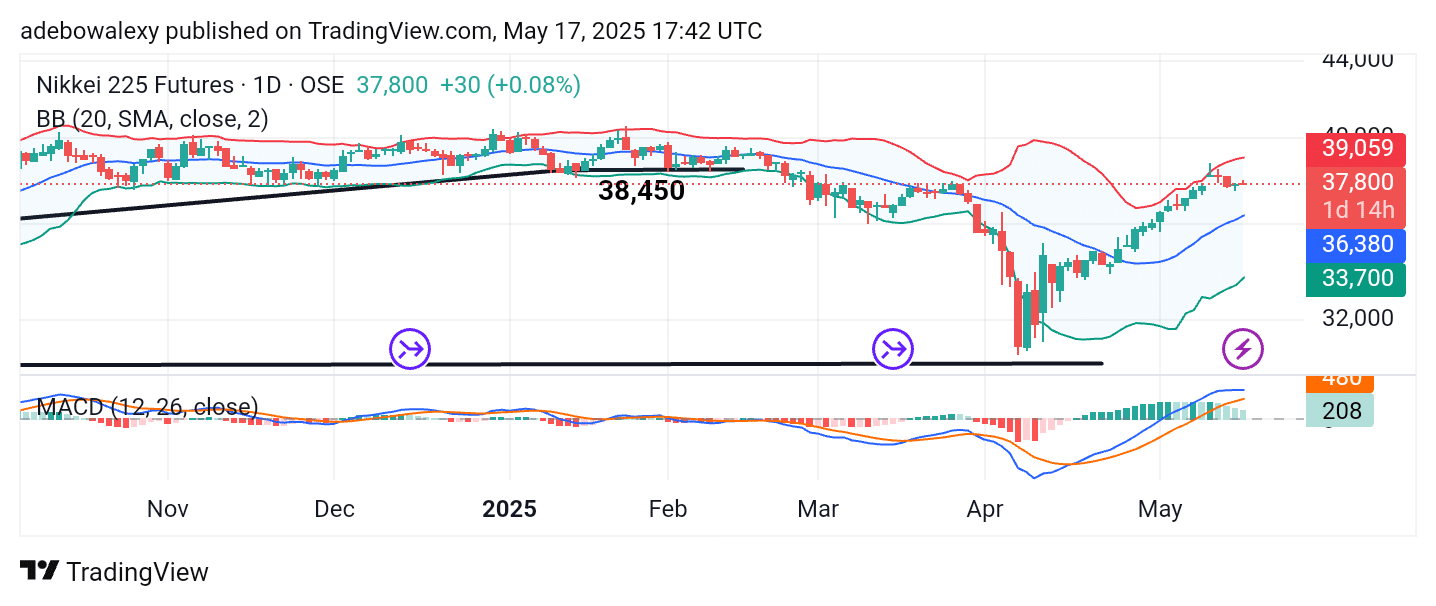

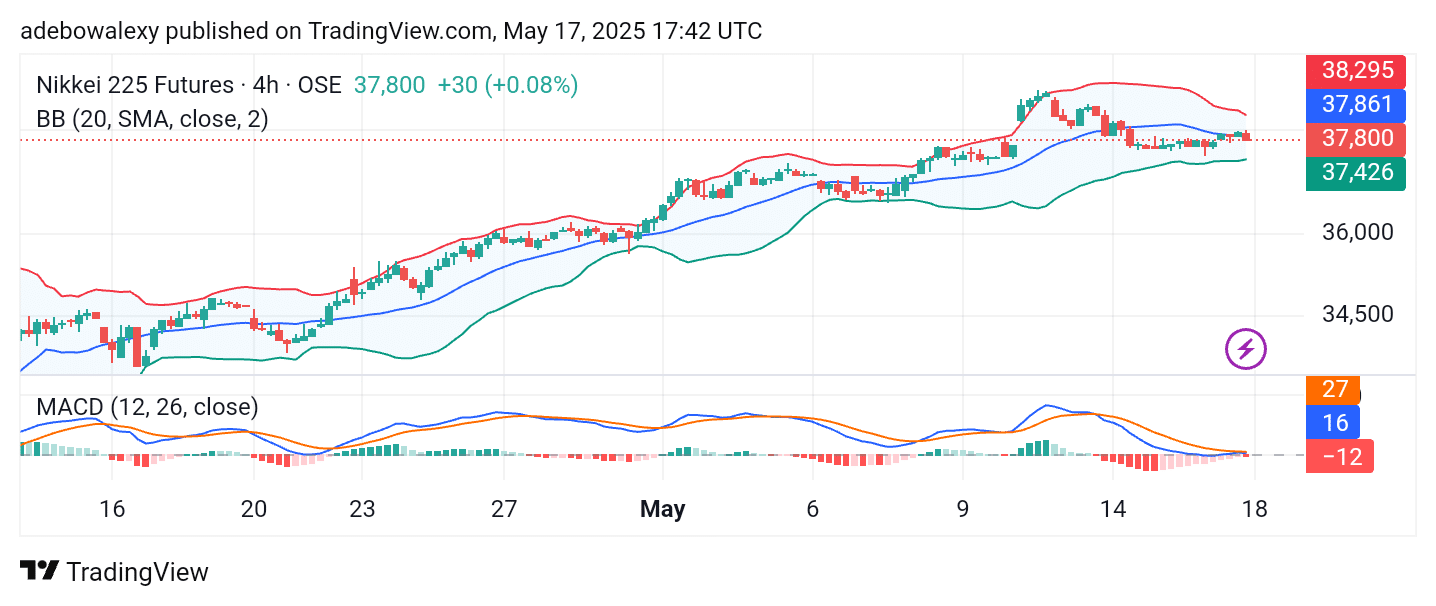

Throughout the week, the Nikkei 225 remained under pressure, but the downward retracement has been modest, as reflected in recent candlestick formations. Price action continues to hover near the upper band of the Bollinger Bands indicator, suggesting low volatility and limited momentum.

The MACD (Moving Average Convergence Divergence) lines remain above the equilibrium (zero) level, and the Bollinger Bands still indicate a general upward slope. This suggests that the market may be consolidating, potentially awaiting a catalyst to break through key resistance levels.

Japan 225 Short-Term Outlook: Market Lacks Clear Direction

On the daily chart, the Nikkei 225 appears to be ranging near the middle Bollinger Band, reinforcing the view of a market in a holding pattern. However, the latest candlestick has closed below the midline of the Bollinger Bands, hinting at emerging bearish pressure.

Although the MACD lines are still positioned above the zero line, they are starting to flatten, showing signs of waning bullish momentum. The latest MACD histogram bar has turned red, indicating early bearish sentiment, even as the indicator lines remain slightly positive.

Traders should closely monitor upcoming economic data releases or geopolitical developments, as these could provide the necessary momentum to push the index toward the 38,500 resistance zone.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.