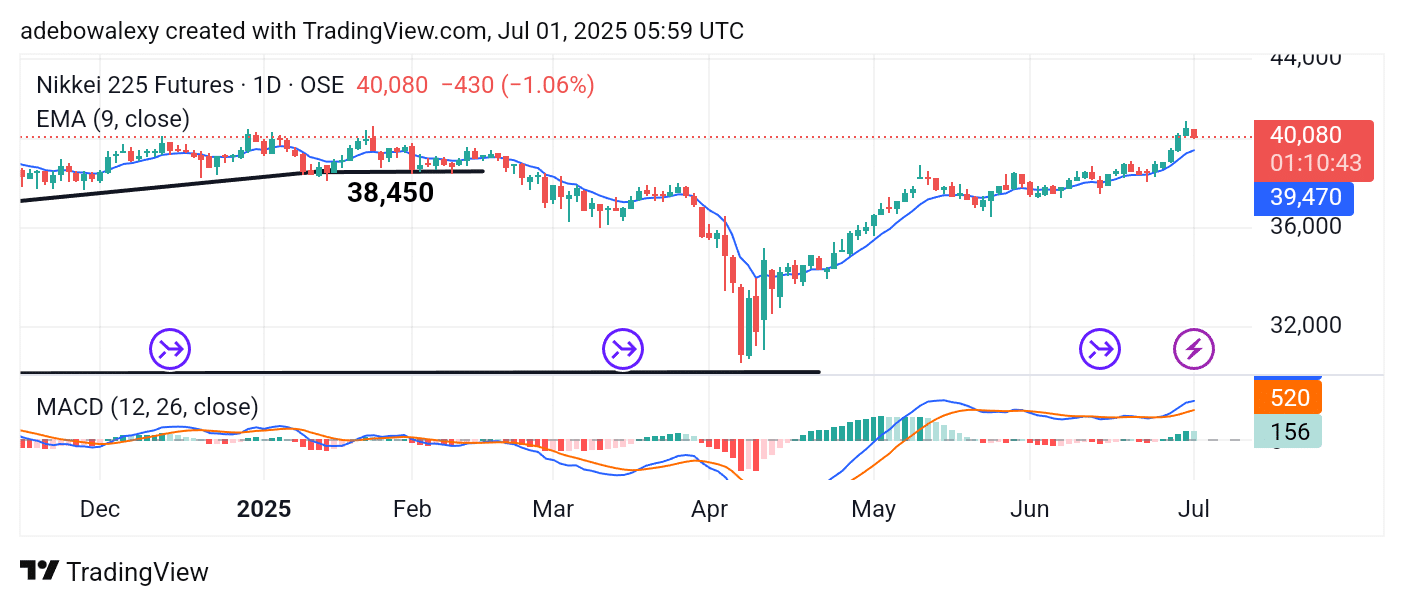

The Japan 225 index has experienced a notable trend continuation since the last update on its futures. This appears to have been fueled by recent global and economic factors. Despite the current pullback, price action can still be considered as maintaining a generally positive outlook.

Key Price Levels

Resistance Levels: 42,500, 45,000, 47,000

Support Levels: 40,000, 37,500, 35,000

NIKKEI 225 Downward Pullback Remains Minimal

While the broader Japan 225 market retains a general upward trend, the ongoing session has produced a mild price pullback. Nevertheless, it seems that the price structure still supports the potential for continued upward movement.

This view is supported by the fact that price action remains above the 9-day Exponential Moving Average (EMA) line. Additionally, the Moving Average Convergence Divergence (MACD) lines remain above the equilibrium level and are maintaining an upward trajectory. Together, these indicators suggest that bullish momentum may persist.

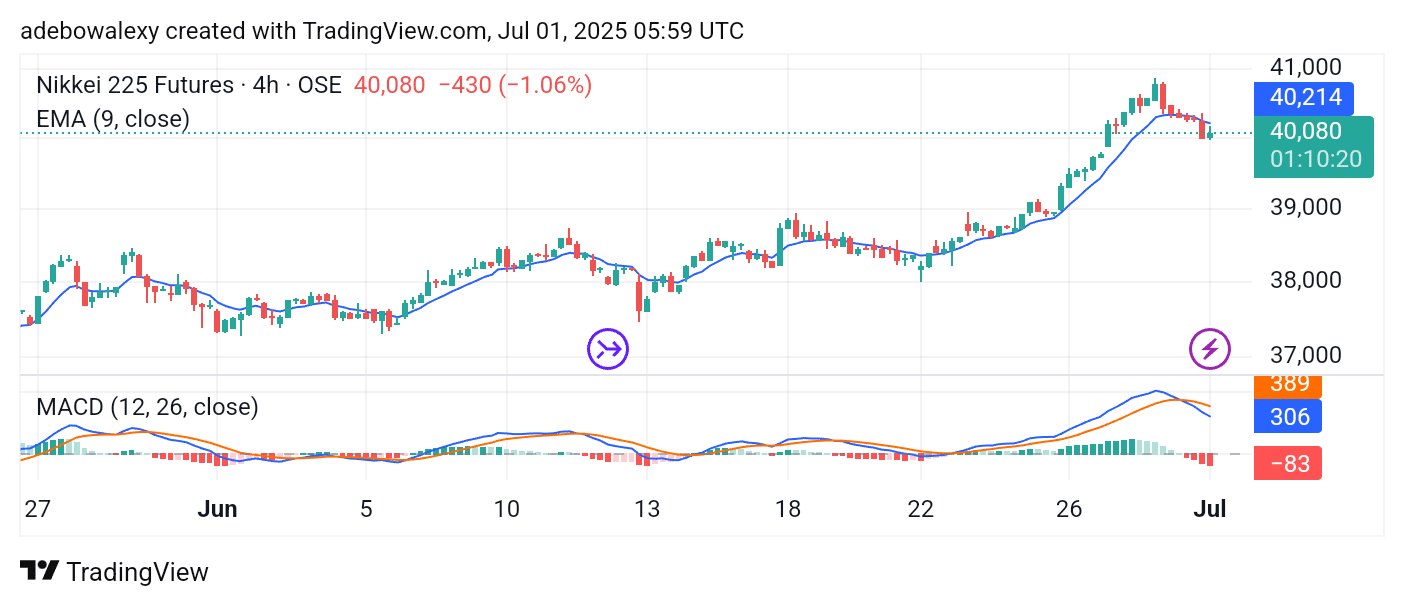

Japan 225 Bulls Are Defending the 40,000 Support

Looking at the Nikkei 225 market on the 4-hour chart reveals that downward pressure may be threatening a deeper pullback. Here, price action has fallen below the 9-day EMA line. However, the ongoing session has managed to keep the index above the key psychological support at the 40,000 level.

The fact that the price is now below the 9-day EMA line gives a slightly bearish impression. Moreover, the MACD lines have completed a bearish crossover above the equilibrium level and continue to trend downward.

Therefore, traders may want to watch closely to see whether the 40,000 support holds. If it does, the market may rebound toward the 42,000 level. If it fails, price action could slide toward the 38,000 level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.