While most stock markets have experienced some pullback from their previous upward trends, the Japan 225 has also seen its share. However, the downward retracement here appears minimal, as price action lingers around key technical levels. Let’s dive in deeper below.

Key Price Levels

Resistance Levels: 39,000, 40,000, 41,000

Support Levels: 38,000, 37,000, 36,000

NIKKEI 225 Contemplating Further Descent

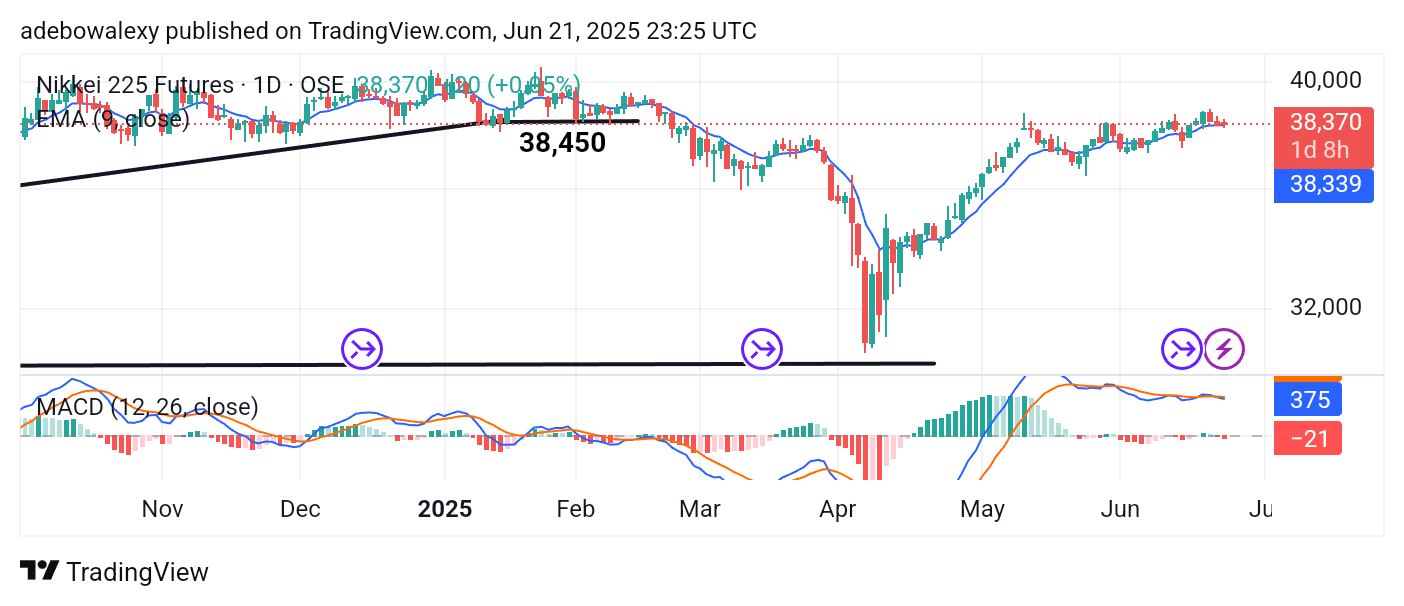

The Japan 225 daily chart shows that price action has gently descended toward the 9-day Exponential Moving Average (EMA) line. However, over the past two sessions, the market has been moving sideways, hovering just above the 9-day EMA.

Similarly, the Moving Average Convergence Divergence (MACD) lines are intertwined and trending sideways, suggesting market indecision. As a result, it’s reasonable to anticipate a potential upward rebound, especially since bears have failed to breach the support at the 9-day EMA.

Japan 225 Edges Slightly Higher

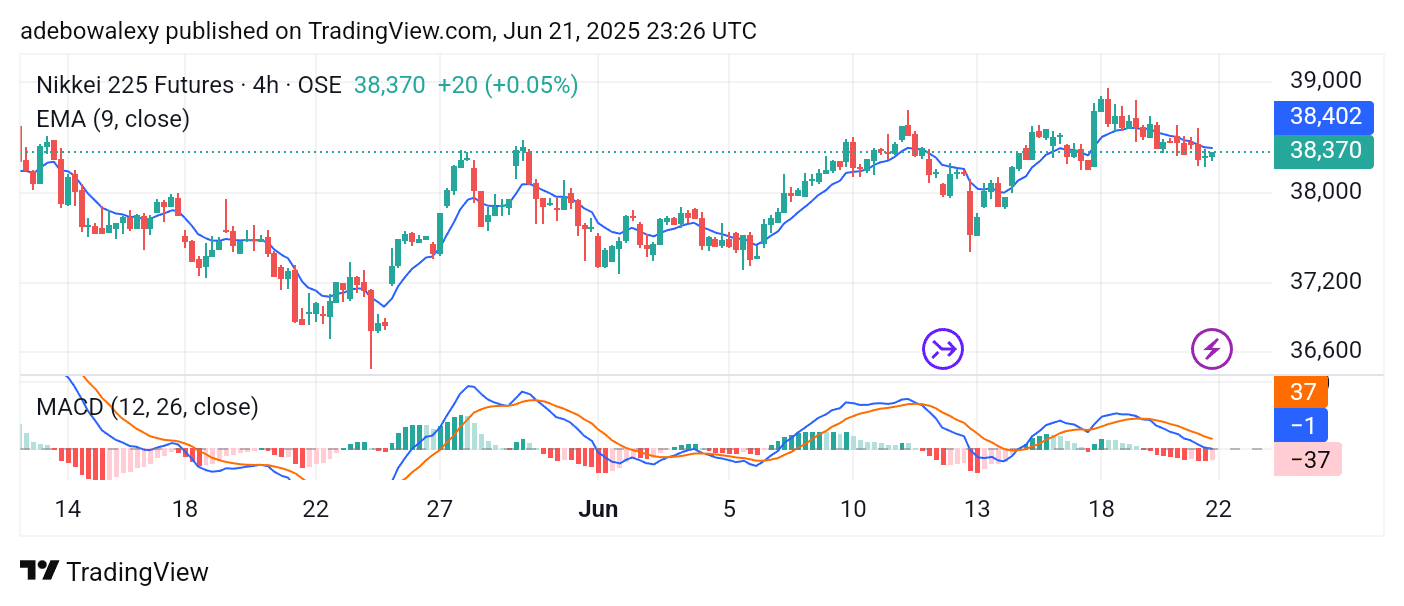

On shorter time frames, the NIKKEI 225 can be seen edging slightly higher toward the end of the week. A closer look at the last two price candles suggests growing bullish momentum, as the most recent candle is higher than the previous one.

However, price action still remains below the 9-day EMA line, but a breakout above it may indicate a further upward retracement. Meanwhile, the MACD lines have descended to the equilibrium level, and the pale red color of the last histogram bar hints at a potential shift in momentum. Still, traders may consider targeting nearby upside levels around the 39,000 mark.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.